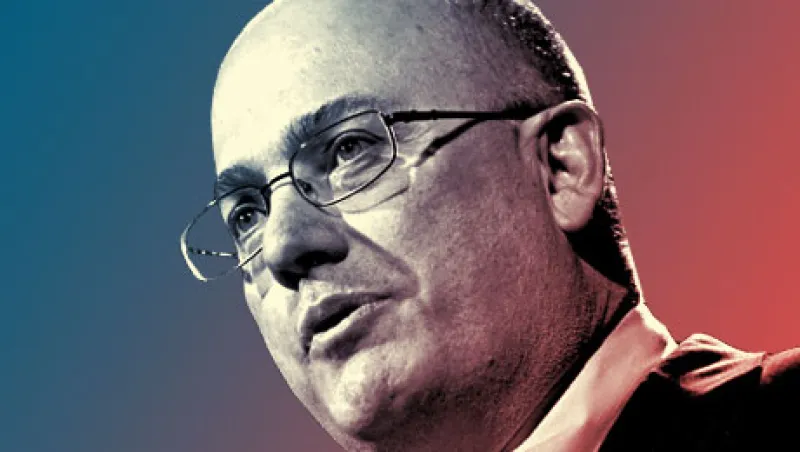

The landmark $1.2 billion settlement between Stamford, Connecticut–based SAC Capital Advisors and the U.S. government has bought SAC founder Steven Cohen only a short reprieve. The plea bargain, negotiated with the Department of Justice’s U.S. Attorney’s Office for the Southern District of New York (SDNY), concluded criminal charges against four SAC companies. The settlement has been heralded as a rare instance in which a firm has been charged with corporate criminal liability. Cohen was not charged directly and continues to deny any wrongdoing.

“This is an example of the government establishing corporate vicarious liability,” says former associate deputy attorney general Jonathan Feld, a lawyer in Dykema’s Chicago office. “Cohen, even though he is CEO, may not be personally liable unless he is proved to have done something affirmative, as in, instructing someone. The prosecutors will have to establish what he knew and his role, if any, in each of the insider trading cases by former employees.”

What the guilty plea agreement did not provide for Cohen is the end to the government’s assault. While resolving criminal charges against SAC companies, the DoJ did not grant immunity from prosecution to any individual from an SAC company. The DoJ also underscored that it can continue to pursue the maximum term of imprisonment applicable to any such violation of criminal law. The parallel civil case being pursued by the Securities and Exchange Commission, which is charging Cohen with failure to supervise and is seeking to ban him from ever managing outside money, remains outstanding.

The upcoming trials of two former SAC employees, Mathew Martoma and Michael Steinberg, have taken on an even more pivotal role in both the criminal and civil cases. For SDNY, any evidence derived from either man’s testimony could lead to a determination that Cohen should be held responsible for insider trading and could be used to prove that a crime has been committed. In the SEC’s case, a conviction of Martoma or Steinberg — or both — strengthens the agency’s charge of supervisory negligence.

Both SDNY and the SEC are focusing on trades done by Martoma and Steinberg in 2008. In Martoma’s case, SAC affiliate CR Intrinsic Investors liquidated its positions in drugmakers Elan and Wyeth ahead of the negative results of clinical trials based on nonpublic information allegedly obtained by Martoma. CR Intrinsic then shorted shares of Elan and Wyeth, generating illegal profits of $276 million. (In March SAC and CR Intrinsic agreed to pay $616 million to settle SEC insider trading charges based on the Elan and Wyeth trades, without admitting or denying guilt.)

Around the same time, analysts at the firm warned Cohen of suspicious e-mails to Steinberg on nonpublic information about computer maker Dell. Despite these warnings, Cohen dumped his Dell shares while Steinberg began shorting the stock in his Sigma Capital account, according to the charges. Dell shares took a nosedive shortly thereafter, earning huge profits for SAC and affiliate Sigma Capital.

Convictions are much more difficult to obtain in criminal cases than in civil ones. The prosecution must prove to a jury beyond a reasonable doubt the direct link between Cohen’s trading activities and Martoma’s and Steinberg’s use of nonpublic information. Evidence establishing that link has not surfaced to date. SDNY is leaving its options open to continue its investigations by not granting criminal immunity to Cohen.

A lot will also depend on the government’s ability to solicit cooperating witnesses from among former employees or by turning Martoma or Steinberg. There’s no indication pretrial of any willingness to cooperate with prosecutors from either defendant. Both have pleaded not guilty and are fighting the charges vigorously. Steinberg’s lawyers have already requested a change in venue to outside New York. With the trial set for November 18, his lawyers cite the difficulty in selecting an unbiased jury, given all the publicity surrounding SAC.

But all is subject to change, as the trials unfold. Negotiations throughout any trial are fluid. Prosecutors will weigh the value of the defendants’ testimony in determining any offerings for a nonprosecution deal or shortened jail time. Defendants, on the other hand, will continually assess the strength of their defense and the risks of conviction in deciding to cooperate and accept a deal for immunity.

“A conviction of either would materially assist in proving the civil administrative claim that Steve Cohen failed to supervise Martoma and Steinberg,” says Stephen Crimmins, a partner with KL Gates in Washington and New York. “But even if both are acquitted, the SEC can still proceed, because its civil proceeding is subject to a lower standard of proof.”

In the event of a conviction, the SEC can not only slap an industry ban but also impose additional civil monetary fines. Although criminal liabilities have been capped based on the recent SDNY settlement, new fines can still be imposed on SAC Capital and Cohen under the SEC’s civil suit.

Neither SDNY nor the SEC appears to be slowing down on its insider trading offensive. “No institution should rest easy that it is too big to jail,” said Preet Bharara, U.S. Attorney for the Southern District of New York, following the recent SAC settlement. “That is the moral hazard that a just society can ill afford.”

SEC chairwoman Mary Jo White is not backing down either. She spoke at the Securities Enforcement Forum in Washington in October, and the message was clear. She explained how the agency has a renewed focus on fixing “broken windows,” referring to the relentless pursuit and punishment of law infractions, no matter how small, during the 1990s by then New York City mayor Rudolph Giuliani and police commissioner William Bratton. “The theory is that when a window is broken and someone fixes it, it is a sign that disorder will not be tolerated,” she said. “But when a broken window is not fixed, it is a signal that no one cares, and so breaking more windows costs nothing.”

With heightened government oversight, a new order is emerging for hedge fund participants, placing compliance and corporate governance front and center. The advent of harvest technology brings the game of trading surveillance to the next level. Increased use of new data analytical tools — “force multipliers,” as White described them in her speech last month — and whistle-blowers is expected. Court-approved wiretaps will likewise continue to be part of the DoJ’s powerful surveillance arsenal.

The final chapter — at least for now — to the SAC Capital saga is the government’s most concerted attempt to fix one big broken window.

Amy Poster is director for risk and regulatory advisory services at New York–based C&A Consulting (amy.poster@caconsultingllc.com). Previously, she worked for the U.S. Treasury Department, in the Office of the Special Inspector General for the Troubled Asset Relief Program, as senior adviser for financial markets; she also served in federal interagency enforcement initiatives. Before that she was global risk controller for credit products at Credit Suisse Group. The views and opinions stated in this article are those of the author and do not necessarily represent the views or opinions of C&A Consulting, its management or its affiliates.

Read more: "Wall Street: No Firm Is Above the Law"