I can’t recall ever seeing an institutional investor with a group focused exclusively on the research and development of innovative investment tools, methodologies or even technologies. There are, to be sure, “special opportunities” groups and “special situations” teams, and most investment organizations will usually have a strategy team that can do some applied research and development work. But none of these groups can be accurately characterized as “R&D,” as they don’t really foster and exploit learning about innovation from a holistic perspective.

I find this odd. In fact, I’d like to suggest here that we need public pensions and sovereign funds to add R&D to their organizational toolkits. It seems like a good idea to me that an industry, which is utterly reliant on informational advantages and knowledge, would institutionalize and formalize processes for creativity. Today, however, most institutional investors are allergic to innovation. In fact I’d argue that most prioritize efficiency (and expediency) at the expense of innovation, which is bad. Being a successful investor requires creativity and innovation.

The job of an institutional investor is to take money and turn it into more money. To achieve this, investors apply human resources and decision-making procedures to information with the hope of generating knowledge that can drive returns. That’s all institutional investors really do. Seriously, that’s it. Now, great investors combine talented people with effective procedures and unique information in order to create proprietary knowledge and, thus, persistent outperformance. Indeed, research shows quite clearly that knowledge is a resource as valuable as any other form of capital. And Eduard van Gelderen, one of my co-authors and friends, recently reminded me that we often judge investors according to their “information ratio,” as the secret sauce to successful institutional investment is in the development of knowledge and its management.

But “knowledge” doesn’t just happen. It’s not something that can be outsourced (to, for example, pension consultants) because the best R&D and knowledge will be inevitably tailored to the specific circumstances of the investment organization. If I’m a Giant looking for alpha, I’ll have to think hard about the kind of knowledge that I have the capacity to develop that others do not. I’d need to think about opportunities that don’t fit in silos or boxes and look for markets that are complex, inefficient, and opaque.

I’d also focus on a subset of those markets in which I have an understanding advantage that I could use to identify endemic inefficiencies (perhaps thanks to my network or unique access). If I were a university endowment, I’d be thinking about my own campus and alumni. If I were a sovereign fund, I’d be looking for opportunities emerging locally. If I were a family office, I’d look for family assets and networks.

But to all of this unique knowledge, which I believe can be a source of persistent and structural alpha to institutional investors, one must apply innovation and creativity. And that, in turn, requires investors to develop mechanisms to “think different.” While this mechanism has not been formalized organizationally in R&D groups, some investors are moving in the right direction by focusing on the potential for collaboration and cooperation to facilitate knowledge creation and transfer. Indeed, research importantly shows that cross-department or asset class collaboration and interaction is critically important to organizational success.

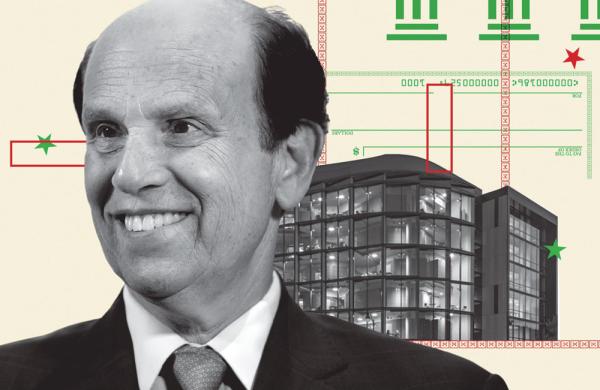

As an example of how institutional investors might start thinking about institutionalizing R&D, take the example of Jagdeep Singh Bachher and the University of California’s Office of the CIO. The UC just published its annual report (which, caveat lector, I assisted in writing, so discount and disapprove what follows accordingly). What I think is unique about this report and the CIO’s office is the way in which it positions collaboration as a key component in its long-term strategy for developing new investment opportunities. Specifically, the UC talks in the report about harnessing collaboration in four distinct networks:

- Internal: The UC is trying to work as a single team, aiming for a coherent portfolio that achieves all its objectives. It is trying to cut across silos and simple asset-class designations in order to avoid missing investment opportunities that might fall through the cracks.

- Sponsors: The UC is aiming to leverage the unique resources it has within the University of California by collaborating with the wider academic community. For example, the University has three national labs, five massive medical centers, ten campuses, and something on the order of $5 billion in research funds deployed every year. The amount of knowledge created in this one university ecosystem rivals entire countries. Heretofore, the CIO will attempt to take advantage of this wealth of knowledge through discussions and engagement, as well as find investment opportunities within the UC ecosystem.

- Peers: The UC is looking to collaborate and, where possible, invest with like-minded peers. Peer networks can be invaluable for investment innovation, as peers can pool capital, scale costs, and share risks across a range of opportunities. Peer-to-peer platforms can also help connect investors around particular opportunities or themes.

- Professionals: The UC is prioritizing knowledge sharing between its external managers. It is seeking relationships that are truly collaborative, where the UC can actually add value to the managers.

The UC is focused on these four layers of collaboration because it recognizes the need to be more rigorous about the ways in which it develops, manages and deploys knowledge. And the UC isn’t the only fund to encourage collaboration and cooperation as deliberate R&D mechanisms; Adrian Orr and the New Zealand Super Fund — their “Three Cs” — is another example that readily jumps to mind.

Unfortunately, this isn’t the norm within institutional investment. The majority of Giants should be trying to develop formal organizational structures for managing innovation, but they’re not. As I’ve said before, I think the best investors are those that accept financial markets as constantly changing ecosystems and, as a result, are trying to evolve dynamically through innovation to be able to reap returns. Good investment ideas don’t last forever, which means there are significant rewards for spotting new opportunities early and acting in an entrepreneurial manner quickly. Why don’t the biggest investors in the world recognize this?

I would advocate for R&D groups in all pension funds. This is not an excuse to create yet another silo within an already bureaucratic organization. Rather, an R&D group situated in a pension fund would have the mission to work cross functionally and spread innovative ideas and practices around the organization in a coherent and structured manner. Knowledge does not transfer or flow without encouragement. Moreover, there is too much knowledge today for any single person to be able to adequately deploy it all. So, we have to foster discipline around how we use it.

Analogous to the way that we need pension funds to build risk-taking cultures, we also need pension funds to develop cultures that can stomach and manage innovation. Long-term out-performance relies on this.