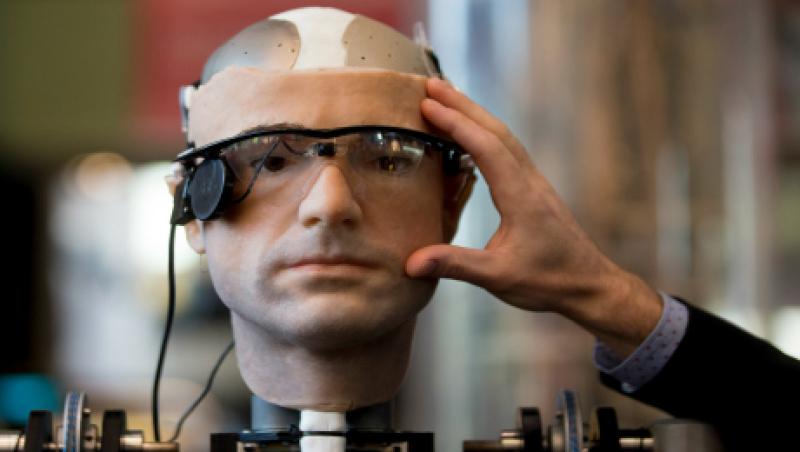

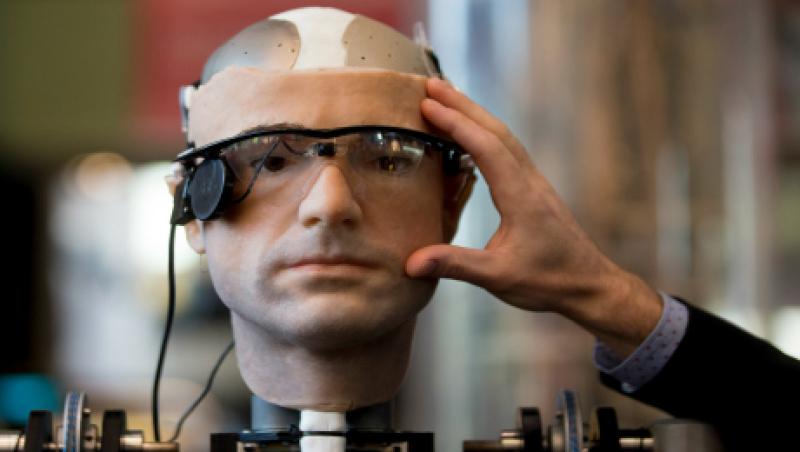

Wage Against the Machine: Compensation Does Not Compute

Automation threatens to slow wage growth in the U.S., which as been sluggish since the late-2000s recession.

Erik Weisman

May 12, 2016