< The 2016 All-Asia Research Team

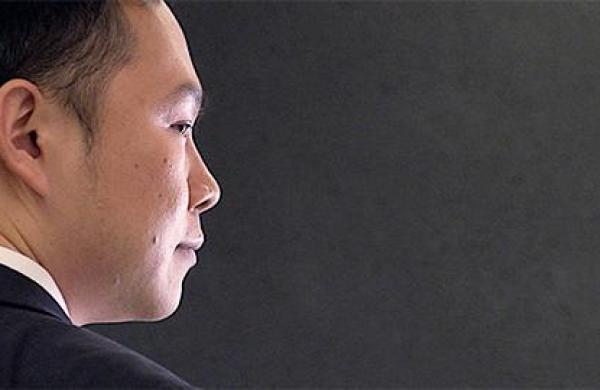

Stephen Hagger, Ting Min Tan & team

Credit Suisse

First-Place Appearances: 12

Total Appearances: 18

Team Debut: 1994

Under the guidance of Ting Min Tan, 47, and Stephen Hagger, 52, Credit Suisse’s Malaysia equity research group wins top honors for a sixth year in a row. The leaders and four colleagues are based in Kuala Lumpur, and one teammate each works out of Singapore and Thailand. Together they report on 38 companies, providing “insights from angles not typically covered by other analysts,” one fund manager observes. Despite the team’s ongoing bearishness on the local market, largely owing to continued weakness in the ringgit and suppressed consumer sentiment, the researchers foresee a positive rerating for upstream plantation companies as a result of the drought induced by the El Niño weather pattern. On this theme they are sticking with their long-standing outperform rating on Kuala Lumpur’s Genting Plantations. The palm oil producer and fruit processor should benefit from rising prices as yields decline, they predict. The stock rose 7.3 percent during the 12 months through late April, to 10.64 ringgit, compared with the domestic market’s decline of 7.2 percent. Credit Suisse’s analysts assign it a price objective of 11.50 ringgit. “They are highly regarded locally, which translates to a unique ability to meet with top managements instead of just corporate investor relations people — and hence garner better insights,” avers another fan.