Paul Wightman, CME Group

AT A GLANCE:

- Naphtha futures trade volumes rebounded by 40% in 2023, and into 2024, after commercial firms turned to the futures markets to manage risk amidst heightened price outlook uncertainty

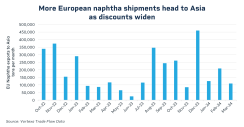

- European naphtha prices have fallen sharply compared to Asia, resulting in more European naphtha cargoes being shipped eastwards

Total trading volumes of naphtha, which competes with propane as petrochemical feedstock, surged by 40% across several markets in 2023, exchange data showed. Hedging by commercial-based firms entering into the market to manage price risk led the surge. Futures volumes have also started 2024 strongly, based on the latest exchange data.

China a Key Driver of Demand

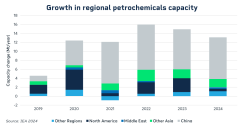

The Asian petrochemical sector is likely to continue drawing higher volumes of naphtha even though there’s an overall slowing in the rate of demand. A recent report from the International Energy Agency (IEA) noted that China would remain a key driver for the naphtha market in the years ahead given its strong position in the global trade for petrochemicals.The IEA estimates that China will add as much production capacity for ethylene and propylene – which have industrial, automotive and construction uses – as what currently exists in Europe, Japan, and South Korea. When this capacity comes onstream, China will require larger imports of products like naphtha and propane.

Trading activity in some of the price spreads linked to naphtha, such as propane, has increased on a year-on-year basis despite a small decline in U.S. propane exports to Europe in 2023. Part of the reason for this could be the widening of the spread, which brought more commercial paper into the market to hedge.

Weakness in the European Market

European naphtha prices have fallen sharply compared to those in Asia, and this has led to higher volumes of European naphtha cargoes shipped eastward. At the same time, imports of naphtha and LPG cargoes from the Middle East and Russia have fallen sharply, partly on the declining demand situation across Asia.The latest trade flow data from Vortexa shows that while exports from Europe have been volatile on a month-on-month basis, the overall volumes have been increasing. Exports to Asia reached around 230,000 tons per month between August 2023 and March 2024. In the eight months up to and including July 2023, total exports to Asia from European ports were around 110,000 tons per month.

The spread between European naphtha and Japanese naphtha is a keenly watched factor and a barometer for trade flows between the Atlantic basin and Asia. With European prices trading at a discount to naphtha in Asia, refiners have an incentive to export in a bid to remove some of the excess supply in the market.

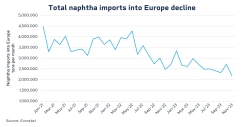

European demand for products like polymers, a key product used in the construction industry, will likely fall further on the back of expected slower economic growth following a series of interest rate hikes from the European Central Bank and the Bank of England to beat back inflation. Argus Media suggests that European petrochemical demand is unlikely to show any considerable growth in 2024.

European naphtha prices have typically traded at a discount to Japanese naphtha prices, and this has been particularly evident since the second half of 2023. Part of the reason for this is the relative strength of petrochemical demand in the Asian markets. CME Group data shows that the price of Asia naphtha was trading at over a $25 per metric ton premium to the European market, the highest level in around 15 months.

Asia Poised for Higher Naphtha and LPG Demand

The latest IEA report estimates that demand for naphtha and other petrochemical feedstocks such as liquefied petroleum gas (LPG) and ethane will reach 1.7 million barrels per day more in 2024, than levels seen in 2019. The changes in Asia are expected to boost trading in the light-ends markets such as propane, naphtha, and gasoline elsewhere such as Europe to ensure sufficient supplies are exported to the region.

Demand Turns South in Europe

The latest data from Eurostat shows a decline in the volume of European naphtha imports. Total naphtha imports into the EU-27 member states fell to 2.1 million tons per month which represents a significant decline compared to the 4.2 million tons imported in May 2022. The weaker demand situation in Europe was one factor behind the strengthening East-West futures naphtha spread since the end of the second quarter 2023.

Analysis from S&P Global Platts shows that Asian naphtha demand is expected to rise from 2024 and beyond and in some cases exceed total production volumes. This implies that the supply/demand situation could tighten further in the months ahead and may prompt further hedging of the underlying commodity price volatility. Traders are turning to the futures markets to manage risk on a growing volume of export flows. Trading relationships to other products such as propane have also been more volatile, drawing market participants to the futures markets to manage risk on products linked to these alternative feedstock markets.