Special Report

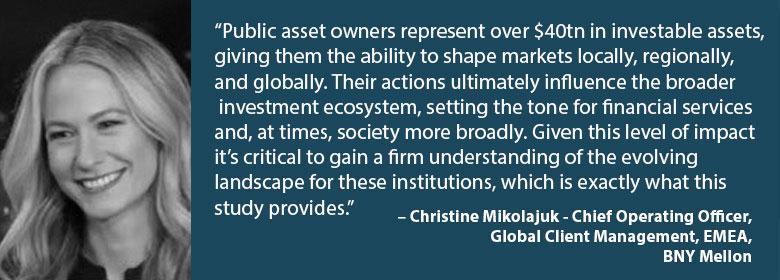

Public asset owners, including sovereign wealth funds, public pension funds, and central banks, collectively hold over US$40 trillion in investable assets.1 Scale gives them the power to move and shape markets locally, regionally, and globally – but today the public asset owner landscape is in flux.

The structural evolution of capital markets is compelling public asset owners to reassess their roles, objectives, investment strategies, and operating models. While recent geopolitical and macroeconomic turbulence has accelerated this evolution, it is likely to continue over the medium to long term. The ways in which public asset owners adapt will ultimately influence the broader investment ecosystem, with leaders in the sector setting the tone for financial services and, at times, society.

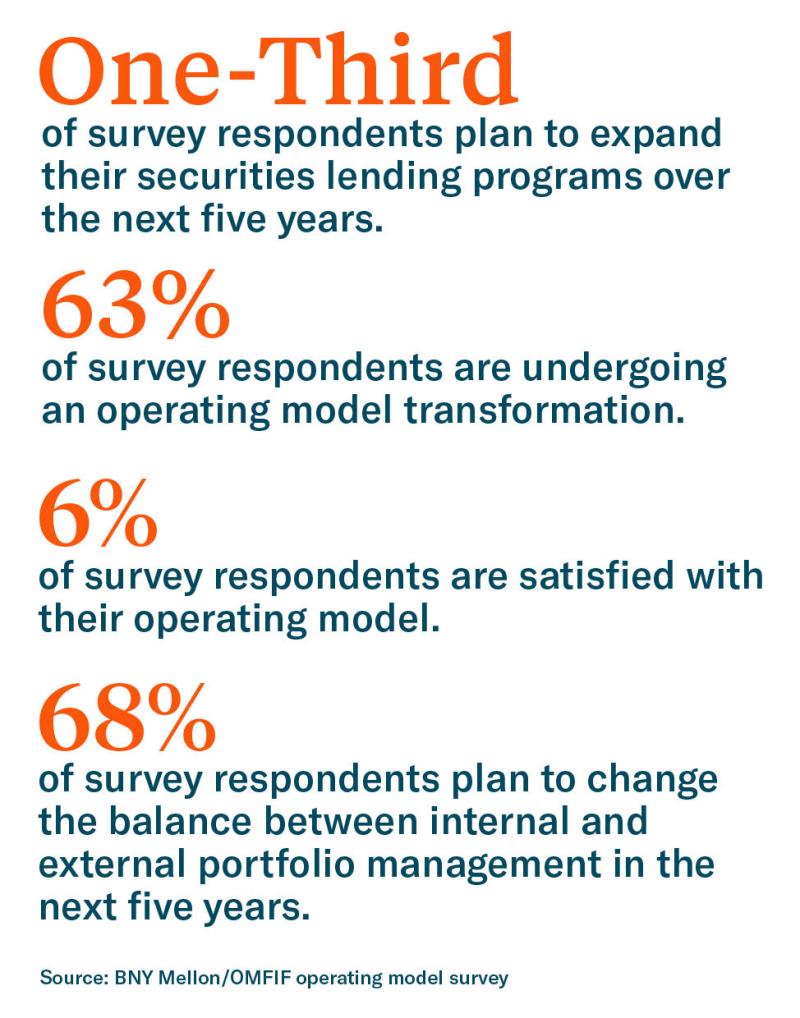

This brief report focuses on strategies that can help public asset owners successfully adapt to their changing environment. It is based interviews conducted by BNY Mellon with more than 90 senior leaders from almost 50 global public asset owners, representing nearly US$9 trillion in assets. In addition, an anonymous survey of public asset owners conducted in collaboration with the Official Monetary and Financial Institutions Forum (OMFIF), focused on their operating models.

Among institutions already engaged in securities lending, some plan to liberalize lending guidelines and review existing lending agreements. These shifts counter the retreat from securities lending programs following the 2008 financial crisis, when a lack of transparency, concerns about short selling and perceived links to market volatility steered many public asset owners away.

Securities lending is moving beyond these concerns. Growing regulatory support, front-office control and governance, flexible platforms and technology, and alignment to broader principles and mandates may create a supportive backdrop and foster a more positive attitude.

Growing Regulatory Support

Recent initiatives focusing on transparency and reporting seem to have reinforced institutional confidence. For example, the European Union’s Securities Financing Transactions Regulation (SFTR) introduced granular transparency for securities lending transactions.4 In November 2021, the U.S. Securities and Exchange Commission (SEC) proposed similar reporting rules for securities lending participants.5 Regulators are also considering mandatory clearing to strengthen securities lending.6 Central clearing could increase utilization and revenue for public asset owners while potentially reducing risk.Front-Office Control and Governance

Based on interviews, institutions increasingly see securities lending as part of front-office investment activity rather than merely an offset for administration and custody costs. One official in the survey who relies heavily on external managers explained, “The most sophisticated investors see securities lending as a component of a total portfolio approach alongside their investments.”Flexible Platforms and Technology

Interviews revealed that public asset owners have more flexibility in securities lending than previously. For example, they can tailor lending for a given spread or focus only on a limited set of high-value securities. The industry is also increasing its flexibility by extending the range of acceptable collateral. Ultimately, however, it’s the overall features of a collateral set, such as concentration limits, minimum capital requirements and minimum share price levels, that are recognized as more important than the inclusion or exclusion of a specific security. Additionally, fintechs are also offering so-called “fully paid” securities lending, allowing intermediary banks or brokers to act as a counterparty for higher value/spread trades. Finally, securities lending platforms can increasingly integrate with institutions’ operations for better visibility alongside other portfolio data, using APIs, for instance.Alignment to Broader Principles and Mandates

Interviews showed that sustainability considerations can raise concerns about conflicts with an institution’s mandate and objectives. Further, public asset owners in the Middle East and parts of Asia want to ensure that securities lending counterparties are Shariah-compliant. Malaysia became the first market to adopt a Shariah-compliant securities lending framework in 2017.7 Still, others interviewed struggle with the ethical implications of perceived downward pressures on markets. As a result, securities lending platforms are evolving to accommodate a broader set of principles, affording public asset owners better tools to understand the implications of their securities lending programs. Emerging solutions are also allowing clients to see the ESG implications of their collateral and to control prohibited short-selling.Is there a “one size” approach to transforming operating models?

Diversification, the growth of securities lending, the integration of ESG factors, and shifts to internal or external portfolio management have downstream implications for public asset owners’ operating models. Strategy changes in these areas require corresponding adjustments to operating models, processes, providers, and technology – with a foundation of data that enables future scale and flexibility. Public asset owners concur that current operating models are not adequately meeting their evolving needs. They face operational challenges that result in significant end-to-end inefficiencies and friction. Interviewees cited numerous situations, such as:

- Performing reconciliation only once per month because the process is understaffed and overwhelmingly manual.

- Responding to cybersecurity issues by turning off internet connections during a crisis.

- Keeping records on paper in offsite storage facilities they rarely access.

- Coping with siloed systems, unresponsive vendors and expensive legacy, technology that is impossible to upgrade.

As public asset owners manage the shift in their investment strategies and the transformation of their operating models, data is the foundation of their future. There are a number of challenges to overcome and best practices to consider as institutions seek to build a data-centric organization.

Survey respondents cited data integration and analytics as by far the greatest operating model challenges across all public asset owner types, sizes, and geographies. Optimal data integration allows data to move seamlessly from the portfolio manager to the front and middle office and then to the custodian and back office, informing decision-making throughout the process.

Global vs. Local Cloud Architecture & Cybersecurity Concerns

Cloud was the hot topic among public asset owner interviewees. It offers significant benefits in terms of flexibility, scalability and resilience. But it is also controversial: Some institutions are worried about security and privacy. The independence of major providers (which are typically U.S. private-sector firms) raises concerns. While some public asset owners have embraced mainstream cloud solutions and providers, others retain specific data types in-country or on-premises and only store less sensitive data on the cloud. Alternatively, some institutions continue to store all data on-premises or with local cloud providers.Closely tied to the growth in cloud storage is the urgent challenge of cybersecurity. Public ownership exposes these institutions to heightened risk of cyberattacks as part of warfare or covert destabilization strategies, in addition to asset theft, making security the second-most cited technological challenge. The broader ecosystem of external actors, from custodians to consultants, must also be considered part of cybersecurity initiatives. Reassuringly, from our conversations with public asset owners, there is evidence that institutions are integrating external parties into their cybersecurity initiatives. Cybersecurity is now a critical component of vendor RFPs for responsibilities such as custody mandates or data provision.

Other Asset Owners show a more tentative or preliminary approach to ESG. Those interviewed indicated common tactics include applying exclusion lists, investing in specific green instruments and strategies (e.g., green bonds) or starting to incorporate ESG principles into selected areas of investment, such as energy efficiency requirements for real estate.

However, from those interviewed across the board, the most significant ESG challenge for public asset owners is the availability of reliable, transparent and comparable data and metrics to measure performance. ESG data lacks standardization, even in asset classes where data is relatively advanced, such as equities. Public asset owners participating in the BNY Mellon interviews find it challenging to measure ESG performance in each function and are actively looking for providers to help them understand and improve their ESG frameworks and decision-making.

Various supranational and regulatory bodies are making progress in overcoming data challenges. For example, the EU taxonomy for sustainable activities offers standardized data structures. Notably, interviewees outside the EU said they are adopting the EU taxonomy, often alongside existing approaches to ESG data. Other popular sources include MSCI and the UN PRI. Some banks also offer applications that enable public asset owners to manage, monitor and analyze ESG factors across portfolios, scoring them against customizable ESG and sustainability metrics based on multiple vendor outputs and even crowdsourced data.

Over time, greater regulatory harmonization, taxonomies and technology should address the challenge of standardization. However, public asset owners ultimately need robust data-management systems and processes that deliver a total portfolio view to apply an ESG framework fully. Such a dashboard requires an operating model with data at its core and the requisite skill set for using it effectively.

To do so successfully, public asset owners must future-proof their operating models and put data at their core. Some institutions deploy a single system across their organization, with an aim to reduce complexity. Others implement specific improvements to the front, middle and back office and then integrate, relying on emerging custodian or fintech platforms to ensure that data flows seamlessly across their organizations.

In the future, rapid change, growing complexity and demand for impact and success compel public asset owners to increasingly collaborate with world-class peers, providers and other stakeholders. It is through these collaborations that public asset owners unlock opportunities, strengthen their operating models, and deliver on their promise to the people, communities, and countries that they represent and serve. BNY Mellon looks forward to continuing this collaboration as we jointly power individuals and institutions to succeed in the financial world.

For more, download the full BNY Mellon Report, The Evolution of Public Asset Owners.

1 OMFIF Global Public Investor (GPI) 2021 Survey

2 McKinsey & Company: Putting carbon markets to work on the path to net zero, October 2021

3 McKinsey & Company: Putting carbon markets to work on the path to net zero, October 2021

4 https://ec.europa.eu/info/business-economy-euro/banking-and-finance/financial-markets/post-trade-services/securities-financing-transactions-sfts_en

5 The Securities and Exchange Commission: Proposed rule - Reporting of Securities Loans, November 2021

6 Group of Thirty: U.S. Treasury Markets: Steps Toward Increased Resilience, July 2021

7 “Malaysia begins Islamic stock lending,” Securities Finance Times, December 13, 2017

BNY Mellon is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY Mellon of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY Mellon. BNY Mellon has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material.

The Bank of New York Mellon, a banking corporation organized pursuant to the laws of the State of New York, whose registered office is at 240 Greenwich St, NY, NY 10286, USA. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and is authorized by the Prudential Regulation Authority (PRA).

This material, which may be considered advertising, is for general information purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional advice on any matter. This material does not constitute a recommendation or advice by BNY Mellon of any kind. Use of our products and services is subject to various regulations and regulatory oversight. You should discuss this material with appropriate advisors in the context of your circumstances before acting in any manner on this material or agreeing to use any of the referenced products or services and make your own independent assessment (based on such advice) as to whether the referenced products or services are appropriate or suitable for you. This material may not be comprehensive or up to date and there is no undertaking as to the accuracy, timeliness, completeness or fitness for a particular purpose of information given.

BNY Mellon will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. BNY Mellon assumes no direct or consequential liability for any errors in or reliance upon this material. This material may not be distributed or used for the purpose of providing any referenced products or services or making any offers or solicitations in any jurisdiction or in any circumstances in which such products, services, offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements.

© 2022 The Bank of New York Mellon Corporation. All rights reserved

Both interviews and the survey show approaches vary depending on the asset class and instrument, with some institutions internalizing some asset classes while concurrently externalizing others. For example, one public pension fund surveyed said that it seeks to further in-house alts and specific equities, while externalizing others.

Cost and the ability to build up national capabilities were cited as the top rationales for internalizing portfolio management. Improved performance and better control and oversight are a close second. Examples include several institutions currently establishing internal trading teams and a pooled pension fund, which in the past had moved asset management toward external managers, rebuilding its internal desk.

Public asset owners noted that they typically externalize strategically for specific geographies or asset classes where they can learn from external managers’ expertise. Some more sophisticated institutions go as far as running a concurrent external and internal strategy to explore new asset classes. One sovereign wealth fund professional said that it employs both internal and external desks and “plays them off each other.”

In alternatives, public asset owners’ first forays are often through direct investments and acquisitions of real estate. As they gain sophistication and confidence, many co-invest with external third-party institutions, while others add private equity, hedge funds and hedge funds of funds to their portfolios. At their most sophisticated, public asset owners can act as quasi-private equity shops themselves, leading sourcing, due diligence and strategic investments.

Public asset owners also seek out external managers to achieve improved performance and benefit from additional services, such as market insights or reporting. Only a small minority say cost benefits are a primary driver when hiring external managers.

Not only are there a variety of approaches taken to internalization and externalization, but the the balance between internal and external management is highly dynamic. The BNY Mellon survey showed that two-thirds of institutions are planning to change their strategy over the next five years.

Yet these changes also represent an opportunity. Public institutions that succeed in breaking out of old patterns will play a new role in financial ecosystems and amplify the impact they can have on society more broadly.

In the search for yield, public asset owners are exploring new asset classes. Their approach ranges along a continuum of bold to conservative, with sovereign wealth funds (SWFs) expressing the greatest interest in entering new sectors, asset classes, and markets early.

Digital assets are one area of interest, but none of the interviewees featured as part of BNY Mellon’s recent report “The Evolution of Public Asset Owners” seek to invest in cryptocurrencies directly, given the current lack of regulatory certainty and investment security. Instead, public asset owners look to indirect investments in the digital currency space. According to the public asset owners interviewed, digital assets and tokenization attract more interest. Many see tokenized assets as a powerful way to increase market liquidity, especially in alternative asset classes such as real estate. In particular, SWFs foresee an opportunity to shape the market. One fund official said: “We want to be leaders in this space – market makers who play a role in creating liquidity.”

Based on BNY Mellon interviews, the space economy is also generating excitement. Institutions with equity investments are familiar with companies such as SpaceX and their ecosystems. The majority of BNY Mellon survey participants from the Middle East in particular, are interested in the broader sector, such as satellite telecommunications, where the prospect of returns is distant. One public institution, for example, has a joint venture with a satellite company and plans to invest significantly in building capacity for its country and region.

Several institutions in APAC also recognize carbon as an emerging asset class, with one suggesting it could become a core part of its portfolio. Carbon allowances or credits are a small and fluctuating market, currently worth around US$100 billion with an estimated US$250 billion in annual turnover2 and growing 20% annually as emissions trading systems and regulatory regimes mature.3 Moreover, BNY Mellon has found that investors look to carbon and its derivatives (futures and options) as a tool to hedge the climate risk in their portfolios.