Japanese corporate pension funds that seek greater returns and diversity are turning increasingly to private assets, according to a survey of 102 asset owners by AL-IN, a magazine for institutional investors.

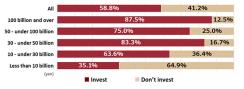

Most notable among the survey results is that more than half of Japanese corporate pension funds (58.8%) have invested in private assets (PAs) versus 43.9% in a 2019 survey. Generally speaking, the larger the fund, the larger the allocation to PAs.

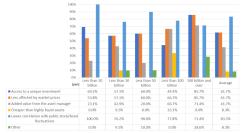

Among the funds that have invested in PAs, the most common expectation is a “lower degree of correlation with movements of publicly traded securities,” although investors do not believe that PAs are cheaper than high liquidity assets.

Investment in private assets by fund size

What do investors expect from private assets?

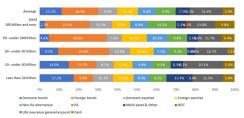

Among funds already invested in PAs, portfolio diversification through active use of alternative assets is common, and the larger the fund the lower the ratio of investment in domestic bonds. On average among all funds, PAs allocation ratios are higher (at 9.9%) than traditional non-PA alternatives, such as hedge funds (9.0%).

Average portfolio by fund size

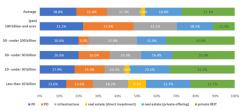

Real estate assets preferred

What types of PAs do Japanese corporate pension funds prefer? Real estate assets, especially privately offered closed-end real estate funds and private REITs. While private equities are probably the most popular PA category abroad, domestic investors seeking income gains prefer PAs the lower risk-return ratio of core real estate assets.

Which private assets do you invest in?

Future issues and directions of Japanese PA investments

The survey asked respondents who don’t invest in private assets why they don’t, and the most common answer was limitations on liquidity and “expensive unit price.” Other obstacles to investing in PAs reported include difficulty in getting “assent from a sponsor company, board of directors, or a representative meeting” and “unable to deal with current administrative capacity.” These issues are not insurmountable. Fund managers can reduce the “expensive unit price” by devising ways to offer smaller units. To overcome the greater issue of improving PA liquidity, secondary markets need to be developed and expanded.

Although it will take time and effort to solve these and other problems, Japanese corporate pension funds will continue to grow their investment in private assets. In December, AL-IN held a PA investment seminar and took a quick survey of participants’ plans to increase/decrease their PA investment ratios in the future. Forty percent of respondents said they would increase their allocation to PAs, 47% would maintain the status quo – none said they would decrease investment in PAs.