Recent extreme market volatility has created sizable asset class exposure shifts in many institutional portfolios. Invesco portfolio managers Scott Wolle, Chief Investment Officer, Global Asset Allocation, and David Millar, Head of Multi-Asset, discuss the current risk climate and offer insights into multi-asset risk mitigation strategies to help optimize potential investment outcomes.

What trends are you seeing as institutional investors respond to the current market landscape?

David Millar: Some investors are expecting a relatively quick V-shaped recovery from the current economic displacement. This is in sharp contrast to the general reaction in 2008, when investors’ comfort around taking on risk was a much slower, painful process. Unfortunately, investors’ memories can be notoriously short. However, investors today have an incredibly diverse selection of strategies to help better manage and fine-tune portfolio volatility exposures, and that allows a broader introduction of lower- and non-correlated assets to more traditional asset class allocations. This approach can help strengthen overall defensive and upside characteristics.

Scott Wolle: One common theme has been around the importance of liquidity – and the challenges of finding it during major market disruptions. Similar to 2008, risk assets of all types experienced a sharp global sell-off as the potential human and economic toll of the COVID-19 pandemic became increasingly apparent. While markets appear to have stabilized to a degree, the crisis has been a reminder that investors should always know where they can turn to for liquidity in their portfolios when everything seems to be falling.

We believe, highly liquid multi-asset strategies can help provide a compelling choice in this type of uncertain climate by offering the potential to pursue steadier return streams with an attractive upside beyond that offered by most typical traditional fixed income securities – and without the drawdown exposures of equity markets. This can help provide an expanded range of investment levers to help optimize expected return consistency through all types of markets, which in turn could strengthen longer-term portfolio outcome potential.

How can multi-asset strategies work for risk mitigation?

Millar: Multi-asset strategies are designed to offer flexibility that allows for a shift away from specific market-driven performance to more absolute return and other outcome-oriented solutions that strive for greater control over risk exposures. A major advantage of these strategies is that they seek to offer a way to increase potential portfolio risk efficiency with greater liquidity, transparency, and cost efficiency compared to strategies such as hedge fund, private equity, and venture capital investments.

What are some of the different ways these strategies attempt to shape risk exposures?

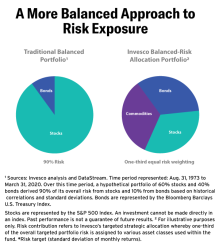

Wolle: In terms of risk mitigation, let’s start with risk parity, where allocations are based on volatility contribution rather than capital exposures. In a traditional 60/40 portfolio, history shows up to 90% of risk is generated by the equity allocation, which isn’t balanced at all. By contrast, our Balanced-Risk Allocation strategy optimizes allocations across equity, fixed income, and commodity market exposures. It does so through up to 30+ sub-asset classes, and is based on each asset class contributing an equal amount to overall risk. A slight tactical overlay then seeks to help take advantage of current market conditions. The goal is to deliver more consistent returns across the full economic cycle, with less risk than a traditional 60/40 allocation. While returns will still be linked to these underlying markets, the strategy’s balanced risk approach has generated lower correlations of 0.73 and 0.491 to global equities and U.S. fixed income markets, respectively, since its inception2.

How can absolute return strategies work in today’s market environment?

Wolle: Absolute return approaches can vary widely in terms of philosophy and execution, offering investors a broad selection to help meet their specific needs and goals. For example, the Invesco Macro Allocation strategy is differentiated by its systematic use of risk premia exposures rather than alpha potential for allocation decisions. It utilizes some of the same tools as our Balanced-Risk Allocation strategy, starting with a risk-balanced core, but significantly dials up the tactical overlay to be the primary return driver by using directional and relative volatility trends. It also invests in long and short positions, which provides greater flexibility to pursue absolute returns independent from broader capital market indices. The result has been a unique risk/reward profile that historically has delivered consistently positive returns over longer timeframes, largely uncorrelated with assets traditionally associated with attractive defensive attributes in difficult markets.

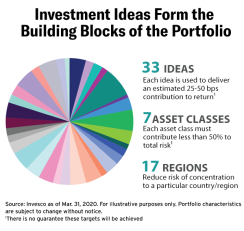

Millar: Our Global Targeted Returns strategy takes a different approach, breaking from traditional asset allocation models through an idea-driven portfolio. The strategy combines extensive research with risk modeling to blend together up to 30 investment ideas identified by searching across global assets, geographies, sectors, and currencies. These ideas can be expressed using credit and government securities, equities, commodities, and currencies, as well as other exposures such as inflation, interest rates, volatility, and relative value pairs trading.

One idea paired a long Russian ruble position with a short Chilean peso position. The portfolio has benefited as the cheaper, higher-carry ruble has strengthened against the peso, as the twin-surplus Russian economy has been better positioned than the twin-deficit Chilean economy. This type of drilldown to find compelling ideas can pursue gains from within an asset class – in this case emerging markets – without being dependent on the overall direction of the broader market itself.

Each idea is selected based on its potential to add independent, positive returns over a two- to three-year time horizon. Relative size is based on return potential and expected volatility under various economic scenarios, both in isolation and in relation to other ideas. The goal is to deliver a consistent, positive hit ratio across the majority of ideas, with no single idea or risk exposure dominating performance. Achievement of that goal is seen in broadly diversifying return streams that positively skew monthly returns while significantly lowering equity beta exposure and avoiding extreme drawdowns.

How are institutional investors incorporating these types of strategies into their portfolios?

Wolle: It depends on the strategy and its characteristics, and the investor’s goals and investment guidelines. The Balanced Risk Allocation strategy is often used as a more risk-efficient option for, or complement to, a traditional 60/40 portfolio allocation. Macro Allocation is usually placed within multi-asset or liquid alternatives sleeves or as a hedge fund complement or replacement, due to its excess return focus, relatively low fees, daily liquidity, daily pricing, and absence of lockups.

Millar: Global Targeted Returns is frequently placed in a global tactical asset allocation or opportunistic sleeve, typically with other liquid alternatives or hedge fund investments. One of the unique characteristics within the multi-asset space is that in addition to having lower correlations to traditional assets, these strategies also often exhibit lower correlations to one another due to the relatively wide range of investment styles. Because of this, investor allocations can include complementary strategies to further optimize portfolio risk/reward exposures.

Key Takeaways: We expect the multi-asset segment will continue to experience growing demand. Investors are naturally interested in solutions less dependent on broader market returns. The recent volatility highlighted that investors need to carefully think through potential equity risk exposures. Multi-asset solutions offer a way to round out allocations from an outcome-oriented perspective that can help provide more resilient portfolio positioning through all types of markets.

Start a conversation about risk mitigation strategies. Learn more.

1 As of April 30, 2020.

2 June 2, 2009.

This document is intended only for institutional investors in the U.S. It is not intended for and should not be distributed to, or relied upon, by the public. This is for informational purposes only, is not to be construed as an offer to buy or sell any financial instruments and should not be relied upon as the sole factor in an investment-making decision. This document contains general information only and does not take into account individual objectives, taxation position or financial needs. This does not constitute a recommendation of any investment strategy for a particular investor. As with all investments, there are associated inherent risks. Investors should consult a financial professional before making any investment decisions if they are uncertain whether an investment is suitable for them. The opinions expressed herein are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. All data as of April 30, 2020, unless stated otherwise.

Invesco Advisers, Inc. is an investment adviser that provides investment advisory services and does not sell securities. NA7062