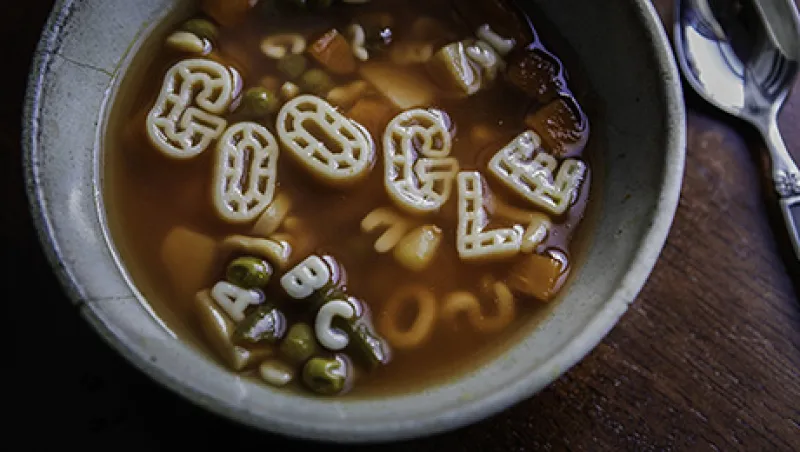

Campbell Soup Co. letters spell out the word "Google" in a bowl in this arranged photograph taken in New York U.S., on Wednesday, Aug. 12, 2015. Google Inc. rose as much as 6.5 percent after reorganizing into a holding company called Alphabet Inc., breaking out its main Web operations from ambitious new endeavors such as research lab Google X and Calico, which seeks to extend human lives. The structure, announced Monday, will give greater clarity into how Google invests in various ventures, including driverless cars, high-speed Internet service and health-related technologies. Photographer: Chris Goodney/Bloomberg

Chris Goodney/Bloomberg