Equities have long been an essential source of long-term return in diversified portfolios. But do stocks also deserve their reputation as investments that can potentially hedge inflation? Not necessarily. To maximize equity return potential, we believe active management — in particular, stock selection that is informed by a view on inflation and how it affects specific companies — is imperative.

As with most asset classes, the potential of equities to hedge inflation depends more on changes in the rate of inflation than on its absolute level. If inflation is high but stable, equity prices would likely embody current inflation expectations. But a jump in inflation, often accompanied by escalating interest rates, is more likely to be detrimental to equity returns. It can put pressure on price-to-earnings multiples through several channels, including:

• Higher capital costs

• Higher discount rates applied to future earnings or dividends (which lower net present values)

• Higher input costs

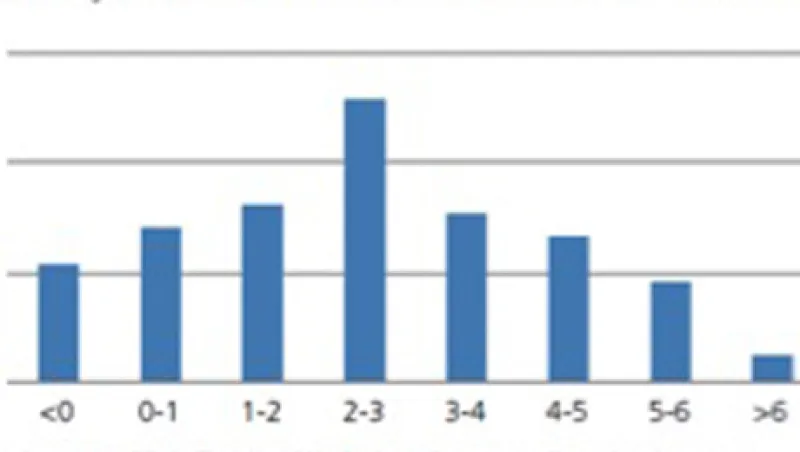

Our analysis of historical data shows that low levels of inflation have been supportive of P/E multiples, with the highest levels occurring when inflation ranged from 2 to 3 percent. P/E multiples declined steadily as inflation accelerated above this level. They also fell when inflation was negative or close to zero, most likely because extremely low inflation resulted from economic weakness (see Chart).

Despite these patterns, the relationship between inflation and individual equities remains complex and idiosyncratic. Fortunately, we were able to tease out these dynamics by analyzing more than a half century of data. We found that broad equity returns have not intrinsically provided a good hedge against inflation. Thus, selecting stocks for their inflation-hedging potential requires that an equity portfolio manager not only be unusually vigilant about the risk of approaching inflation, but also exceptionally well-informed about how a company will likely perform in varying inflationary environments.

Some investors have sought to hedge inflation risks by investing in natural resource stocks. Regrettably, however, these stocks have not always been a satisfactory safe haven. Our analysis, as well as academic research (see Gary Gorton and K. Geert Rouwenhorst, “Facts and Fantasies about Commodity Futures,” February 28, 2005. Yale ICF Working Paper No. 04-20.) indicates that equity risk factors drive returns of natural resource stocks more than inflation risk factors. Reasons for this loose connection between natural resource equities and inflation include:

• Commodity producers, for good reason (such as promotion of stable earnings), may hedge their production. In return, they do not get the full benefit of rising prices.

• Commodity producers may be hurt by factors that actually increase commodity prices. For instance, a strike at a copper mine might lead to higher prices, but it can also limit production.

• Natural resource companies may include debt in their capital structure, leading to higher costs of capital if interest rates rise.

The bottom line: Natural resource equities have the potential to hedge inflation only in diluted form. Without doubt, broad commodities futures indexes offer a more direct and concentrated vehicle for capturing inflation risk (more inflation beta per dollar invested). Unfortunately, however, not all equity investors have the knowledge, experience or flexibility to make such an allocation.

What attributes can cause a stock to provide a potential hedge against inflation? Our analysis identified three key attributes that may help companies and their investors withstand, or even benefit from, inflation.

Pricing power is critical to a company’s ability to pass along high input costs. It can be exerted by companies with a brand name or dominant market share. A brand-name consumer staples company with pricing power, for example, could pass rising wage or commodity costs onto customers without losing market share, unlike generic providers. This has the benefit of generating wider profit margins. For example, a hypothetical brand-name company with 40 percent margins that experiences 10 percent input cost inflation can either flex its pricing power by passing on higher costs via a 6 percent price increase, or maintain its prices and experience a 15 percent margin compression. In contrast, a generic competitor with only 20 percent margins and no pricing power in the same inflationary environment will either have to raise prices by 8 percent to pass along higher costs or maintain its prices but see margins compress by 40 percent.

Supply-side advantages can also give firms a way to defend against rising costs. Structural advantages include characteristics such as location or access to raw materials that competitors cannot duplicate. For example, in an environment characterized by commodity inflation, an oil and gas company with access to low-cost oil and gas from non-traditional reserves could allow some participants in the supply chain to generate higher profits. On the other hand, an oil and gas producer may be subject to a royalty agreement whereby it pays a higher percentage of revenue to the host country as prices increase, which could prevent it from taking full advantage of inflation.

Finally, income is a key objective of many equity investors in today’s low-yield environment. Inflation has the potential to erode the value of dividend income. For this reason, equity investors should focus on companies that have a potential willingness and ability to boost their dividends over time at a rate that exceeds inflation. Sustainability is critical, so the expansion of dividends ought to be funded by mounting free cash flow as opposed to rising debt, falling cash on the balance sheet or an increasing payout ratio.

Even though not all equities may hedge inflation equally, stocks will likely continue to be a core component of most diversified portfolios over a full range of economic scenarios. For equities to realize their long-term potential as a key source of portfolio returns, however, it’s critical that managers seek to anticipate inflation and actively identify the securities that are less likely to be hurt by — or more likely to benefit from — inflation.

Bob Greer is an executive vice president and real return product manager in Pimco’s Newport Beach office. Prior to joining the company in 2002, he was with JPMorgan Chase and Daiwa Securities as a developer and product manager of commodity indexes. He is the author of "The Handbook of Inflation Hedging Investments," published in 2005. He also co-authored "Intelligent Commodity Indexing," published by McGraw Hill in 2012. He has over 30 years of investment experience and holds an MBA from the Stanford University Graduate School of Business and an undergraduate degree from Southern Methodist University.

Raji O. Manasseh is a senior vice president and dividend strategies product manager in the Newport Beach office. Prior to joining Pimco in 2012, he was a vice president and client portfolio manager on the growth equity team at Goldman Sachs Asset Management. He has 13 years of investment experience and holds an undergraduate degree from Wheaton College in Illinois. He is a member of the New York Society of Security Analysts.