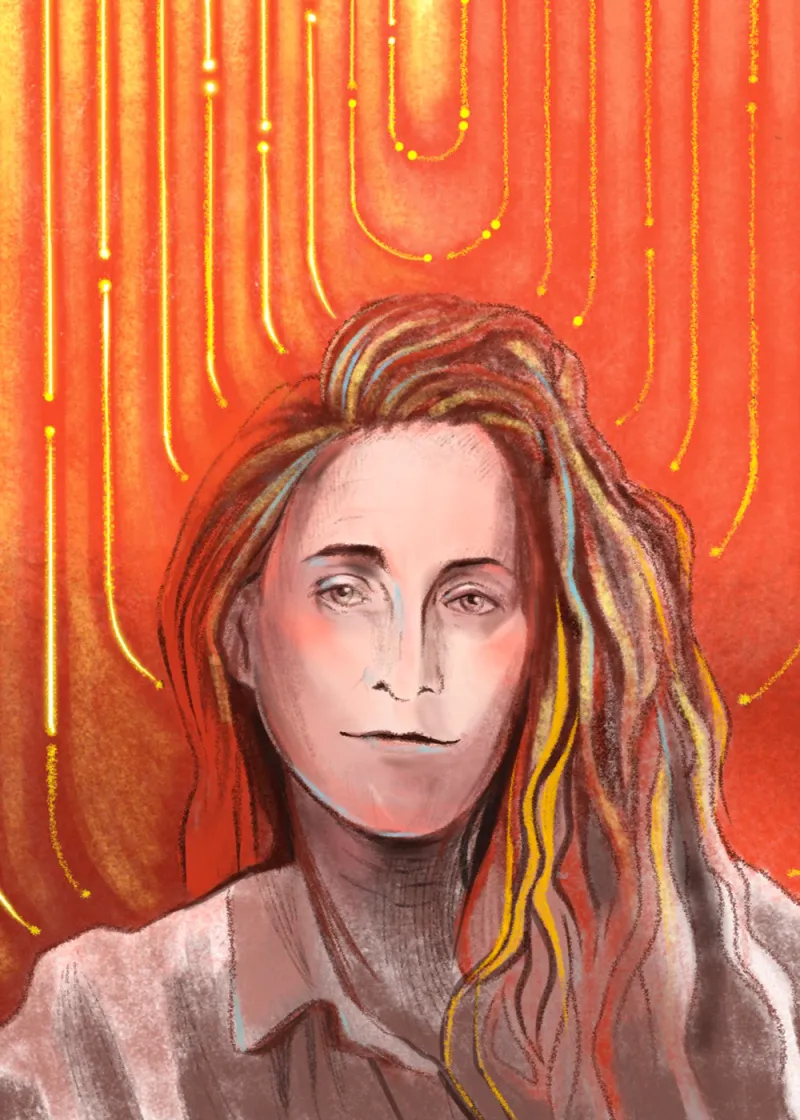

Nicole Buffett

(Illustration by II)

The first time is awkward, clunky, and discomfiting, but then you get better at it, says Nicole Buffett, the 45-year-old granddaughter of Warren Buffett.

She still remembers her trepidations when trying to create a nonfungible token, popularly known as an NFT. “I was definitely like the annoying person who doesn’t get it, asking a bunch of questions,” says the abstract painter and mixed-media artist. But she also felt like she was stepping into a fascinating new world. “It was wild, it was very exciting,” Buffett says. “I was like, ‘Oh no, I have to do all this technological stuff.’ It felt uncomfortable. It was like learning a new language.”

Regarded by much of Wall Street as a curious extravagance, NFTs are digital assets encoded in an online ledger or blockchain as part of a “minting” process, which certifies them as unique and noninterchangeable. This, as with much crypto, creates their authenticity and scarcity. For artists like Buffett, it also establishes an NFT’s provenance and chain of ownership so sales can be tracked in real time.

As a result, the assortment of items now being tokenized and tossed onto the blockchain is near-bottomless: photos, paintings, collages, musical compositions, and virtually every type of art imaginable; game, video, and audio files; celebrity tweets, texts, memes, and selfies. Charmin even began selling toilet-paper-themed NFT art this past spring, smirkingly dubbing it “NFT(P),” nonfungible toilet paper.

NFTs were quietly introduced several years ago but only this year crossed the line from quirky collectibles to serious bank. Marketplace data show sales of NFTs topped $2.5 billion during the first half of the year, dwarfing the prior-year period of $13.7 million. In August alone, the $2.5 billion figure was eclipsed by NFT platform OpenSea, which reported more than $3 billion in sales on 2 million transactions. Even with crypto hitting September speedbumps, OpenSea’s 30-day trailing sales came in at $3.2 billion as of this week, with 2.4 million transactions.

This year, trophy sales of NFTs by Sotheby’s and Christie’s — which fetched $69 million for an NFT in March, while accepting payment in either cash or cryptocurrency — have forced even the most passionate NFT naysayers to consider the gold mine they may be shirking if they ignore the crush of crypto-rich millennials pouring bids into the market.

For Nicole Buffett, creating NFTs of her paintings, especially during the pandemic, when in-person art shows and gallery openings have been a near impossibility, allowed her to expand her circle of buyers globally — a large proportion of them young, entrepreneurial, and tech-savvy. “NFTs are really art as money, art as currency, which means there’s more accessibility for artists and for people who want to buy art,” she tells Institutional Investor. “It’s great just to have more eyeballs on the work.”

But how does one make an NFT, exactly? “A nonfungible token is basically a JPEG. It’s digital; it’s art that is looked at on a screen,” Buffett says. “For artists, the screen really is the new wall.” Buffett creates high-resolution images of her paintings, Photoshops them to “make them perfect and extra-digitized,” then saves them and loads them onto an NFT platform like OpenSea, “which is basically how you mint it.” The platform, which she links to her digital wallet, charges her for the minting process and also allows her to sell her work. “The original painting is called the ‘physical,’ but some people don’t even want the physical when you offer it alongside the NFT,” Buffett says. “Maybe they don’t have the space for it, or they’re traveling. Some feel that committed to the value of the NFT.” Since offering her first NFTs several months ago, Buffett has nearly sold out of her collections. Most NFTs are sold for Ethereum, the primary currency of the NFT market, valued for its liquidity. “I am not taking dollars for NFTs,” Buffett says. “I will help people get set up so they can buy art on the blockchain, but the currency of the NFT space is Ethereum. I do still take dollars for physicals.”

Buffett’s enthusiasm stands in stark contrast to the feelings of her billionaire grandfather, Warren Buffett, who is famously known to be a crypto crank. Since the rise of cryptocurrencies like Bitcoin in 2008, the nonagenarian has denounced them as “rat poison squared,” proclaiming he will never own any. At this year’s Berkshire Hathaway annual shareholder meeting, when asked about his latest views on the trillion-dollar crypto market, Buffett appeared visibly agitated. He said he detested seeing politicians dodge questions, but, “I’m going to dodge that question.” His business partner, Charlie Munger, was less verklempt. “Of course I hate the Bitcoin success,” he said. “And I don’t welcome a currency that’s so useful to kidnappers and extortionists and so forth, nor do I like just shuffling out a few extra billions and billions and billions of dollars to somebody who just invented a new financial product out of thin air. So I think I should say modestly that the whole damn development is disgusting and contrary to the interests of civilization.” To this, Buffett jammed his finger at the audience and exclaimed, “I’m all right on that one!”

Yet Buffett has been far more sanguine on the blockchain, the decentralized, secure ledger technology that underpins crypto, which he has grudgingly called “ingenious” and “important.” In June, days after the shareholder meeting, Berkshire Hathaway showed it was not above making a major fintech play, investing $500 million in closely held Nubank, a crypto-friendly financial institution based in São Paulo, which tracks NFT trends on its website and offers Bitcoin ETFs through a $5 billion digital investment platform. To many watching on Wall Street, the move made it patently clear that while Buffett may never publicly back crypto, he is edging into the realm of decentralized finance.

The last time I interviewed Nicole Buffett, she had taken some flak for speaking candidly — and very publicly — about what it was like to be a Buffett and a member of one of the world’s richest families. This was in 2008, when Warren Buffett was bailing out Goldman Sachs with a $5 billion check during the global financial crisis. At the time, Nicole Buffett was living in a cabin on a 100-acre forest preserve in the hills of Inverness, California, working on her paintings in an artist residency. Her remarks about her family’s largesse and the global wealth gap were not well received by her grandfather, but she says the two have since reconciled. “We are a family of really strong individuals, really different people,” she says.

Her foray into the realm of decentralized finance has in many ways been shaped by her grandfather’s approach to value investing. “It’s not just about the money, or about scoring the points and winning the game,” she says. “It’s about what’s behind it. How does this serve the world in general, beyond a financial game that is being played? I think there is a responsibility and a moral perspective there, and that is very much a Buffett thing.”

The methodology that goes into investing in NFTs or art isn’t all that different from the methodology that goes into investing in stocks, bonds, or any other asset class, she notes. “My grandfather will look at something and ask, ‘Does it have integrity? Does it have sustaining value? What are the components; can you break them down? What’s the concept behind it? Has it ever been in the marketplace before, and has anyone ever bought it or sold it?’ Art is very much like that.”

Since offering her first NFTs several months ago, Buffett has released four collections. Her most popular collection so far is her first, “Spirit Coins.” Simple and brightly hued, they’re paintings that seek to evoke “the way the spirit sits when you are in a circle,” she says. “They are about bringing clarity and light to these technology spaces. It’s really an ode to ancient practices. They are small and meditative.”

The immediacy of the NFT medium is a major part of its appeal, both for artists and investors, Buffett says, as an NFT can be sold the same day it is minted. “I am able to connect through OpenSea and Twitter to buyers around the world,” she says. “I am not just sitting here, making all this art for my art vault.” During the pandemic, Buffett has sold NFTs of approximately 40 paintings she exhibited in China in 2012 that are now part of a private collection. “I am the creator, so I own the image and the copyright,” she says. “It’s a lot like how it works for a photographer: The buyer owns the digital token or JPEG that lives and is tracked on the blockchain, so if you buy the NFT, or the physical painting, you can sell it to someone else, but that does not give you the right to make prints.”

In other words, even after Buffett has created and sold her physical paintings, she can continue to capitalize on them as NFTs — in some cases, in perpetuity. For instance, each time an NFT she has sold is relisted and sold on the secondary market, she receives a 10 percent royalty — not once, but every time it changes hands. So depending on how many times it resells, she can capitalize on it continuously. In addition, because it’s on the blockchain, she can also see the full record of sales, prices, buyers, and sellers. “I have probably quadrupled my income selling NFTs of my work,” she estimates. “It’s just another way to share globally and allow the art to continue fulfilling its purpose and connecting with people.”

Buffett says she tries to price her NFTs affordably, usually in the hundreds of dollars, so that any art lover can buy it. “I want it to be accessible,” she says. “I like to see myself as an everyday artist. I want people to be able to easily buy it and enjoy it.” Her clients are primarily “very smart, mostly younger people; some finance-driven, some tech-driven, some more art-driven, like me.” The space tends to be “extremely male-dominated,” but she expects it to change over time. “Instead of dudes with cars, it’s dudes with digital stocks in the form of art,” she says. “It’s a whole culture of collectibles, tokens, and NFTs.” Her buyers have most recently come from the U.S., Canada, Brazil, Thailand, and China.

Considering her stance on accessibility, what are investors to make of the NFTs that are selling for millions — or tens of millions — of dollars? So long as there is a willing buyer and seller, pushing the boundaries will always be a part of art, Buffett says. “Fundamentally, it’s an agreement between people that this item really is worth the millions of dollars. It’s a function of how money and culture coexist. It’s putting a flag in the ground — it’s very Christopher Columbus. And of course, someone has to pay for that. It’s clubby and much of it is very hype-driven. But these big sales mean we get to decide the value of our art and prove that the belief is real.”

Does the Buffett name bring clients in? Yes, but most of the time, she says, millennials only learn of the connection to Warren Buffett after buying her work. Dan Sickles, a 33-year-old New York-based filmmaker who purchased an NFT of Buffett’s painting Opal Moon No. 6, has never met her in person and didn’t know anything about her family history. They connected through the CryptoPunks community, an early NFT art project that recently surpassed $1 billion in all-time sales. (Visa splashed out nearly $150,000 in Ethereum for a CryptoPunk NFT in late August, stating its belief that “NFTs will play an important role in the future of retail, social media, entertainment, and commerce.”)

Sickles says he has been acquiring NFTs since late last year for a variety of reasons — to invest, to display, to support other artists and their work, and to gift. “For a primarily virtual medium, it was obvious to me that [Buffett] was working in a way that spoke directly to the physical, but also the ephemeral: the moon, the elements, energies. And I appreciate the tension between the medium and the work itself.”

While many mobile-minded collectors keep their NFTs solely on their computers or phones, as NFTs take off, they are increasingly being displayed in homes and on walls in attractive digital art frames, which can run from the low hundreds to thousands of dollars. At the same time, says Buffett, NFTs themselves are becoming more nuanced, taking on a variety of additional dimensions. “I am working on making more NFTs with musical compositions, and I recently did one for a charity that’s the first-ever NFT hologram,” she says. The hologram, which depicts dolphins swimming in the ocean, will be auctioned off in December in support of the Open Earth Foundation, which is funding the protection of dolphins in the Cocos Island National Park off Costa Rica.

There is, indeed, an unmistakable, youthful virility to the NFT landscape, but Warren Buffett — his disdain for crypto notwithstanding — is still revered in the space. “A lot of people in the crypto world are huge fans of my grandfather,” Buffett says. “It’s funny he’s not really into it, because he’s very much celebrated. His credo of creating value, of creating growth, it’s such a big part of his legacy.”

With billions of dollars sluicing into crypto and questions arising over the concerning amount of fossil fuels it burns, many investors are asking, reasonably, is it all worth it? The answer may not be arriving anytime soon, as the intensifying financialization of NFTs appears to be inevitable. This summer, financial engineers were marching into the market, suggesting futures contracts on NFTs; launching NFT investment funds; tapping NFTs to collateralize loans; and creating exchanges to fractionalize the priciest of NFTs, so more people can participate in the pricey end of the market.

Buffett says the space will need to evolve to remain accessible and to reduce or eliminate the impact on the environment, which is why she is working with a number of eco-friendly charities and nonprofits, like the Open Earth Foundation. “You can offset it with positive impacts, but there has got to be an offset,” she says.

Buffett is looking into reforestation projects and other ways of ensuring her work can be carbon-neutral or -negative. She does not speak idly; the granddaughter of the world’s sixth-richest person lives in a tiny house on a small farm in Ojai, California. “The goal is to bring more generosity to this space, make it more inclusive and innovative, and that includes charitable causes,” she says.

“How you approach external challenges is what makes you who you are. It’s a lesson I’ve taken from my grandpa,” she adds. “The externalities are always around you. It’s about how you apply your perspective to those things. It’s completely unique. And that’s what makes him great.”