Institutional Investor in early December hosted a webcast with investment management firm Invesco and North Carolina State University titled “Unlocking Potential: The Expanding Role of ETFs for Institutions.”

Invesco’s Garrett Glawe, Head of Asset Owner ETF Specialists, and Chris Dahlin, Factor & Core Equity Strategist, were joined by North Carolina State University Chief Investment Officer Chris Ip, to discuss recent trends in the ETF industry and three specific ETF use cases for the endowment fund.

Fast facts

North Carolina State University (NCSU) Investment Fund:

- $2.8 billion portfolio with three pools of capital: a $2.3 billion long-term pool (a diversified pool endowment model that targets 5.5% real return), a $400 million intermediate-term fund (with a shorter duration of one to two years with a 2% distribution rate goal), and a $100 million Socially Responsible Investing (SRI) pool

- Investment team: Two investment analysts, one investment reporting specialist, and CIO Chris Ip

- Consultants: Graystone for public markets and Hamilton Lane for private markets

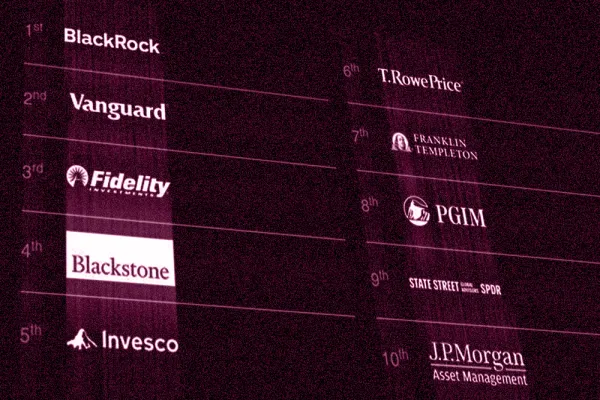

Invesco:

- $2.1 trillion global asset manager1

- Recently hit a milestone with $1 trillion AUM in ETF and indexed strategies2

The rise of the ETF industry

- “Capital will flow where it’s treated best. It’s clear that investors think the ETF wrapper is treating their capital pretty well.” – Chris Dahlin, Factor & Core Equity Strategist

Since Covid, the size of the ETF industry has grown rapidly, Chris Dahlin said, “What I think might be more surprising is the sheer magnitude of the growth and progression of capital from inception in 1993 to about 2019; from COVID on, that flow has accelerated from $4 trillion to almost $12 trillion as of today.” Equities were clearly the early winner in the AUM migration into the ETF wrapper and still make up 80% or so of total ETF assets, however fixed income flow has begun accelerating3.

ETFs have slowly taken market share from mutual funds. Today, there is about $22 trillion in mutual fund trillion has left active mutual funds and about $1.5 trillion has moved into either index mutual funds or ETFs4. “Although the assets and flow into active ETFs are still dwarfed by passive flows, active is certainly starting to pick up steam and gain market share and flow,” Dahlin said.

Why ETFs?

- “It's efficient, it's cost effective, there's good liquidity, and implementation can be done quickly.” – Garrett Glawe, Head of Asset Owner ETF Specialists, Invesco

The panel agreed that the potential benefits of ETFs include their cost effectiveness, liquidity, and operational efficiency, helping asset allocators to avoid the lengthy process of hiring a new active manager.

To date, North Carolina State University currently invests in five ETFs:

- Invesco S&P 500 Equal Weight ETF (RSP)

- Invesco Nasdaq 100 ETF (QQQM)

- Invesco Senior Loan ETF (BKLN)

- Two active ETFs focused on domestic and international small-cap value

“We generally try to look for active managers, and we're generally structurally indifferent,” CIO Chris Ip said. “When we weren't able to find an active manager, we gravitated more towards the Invesco RSP ETF product, which is the equal weight product: The thesis was that typically outperforms and will catch up with the large cap.”

ETF use cases

Here are some observations from recent ETF investments by Chris Ip, Chief Investment Officer, North Carolina State University.

Invesco S&P 500 Equal Weight ETF (RSP) to help mitigate concentration risk in large-cap equities:

- “Although RSP has seen net outflows this year across all investor types, among institutional investors or asset allocators, it's actually attracted positive flows still, because I think there is concerns about concentration in the US equity market.”

Invesco NASDAQ 100 ETF (QQQM) to provide exposure to innovative technology companies and balance RSP:

- “We studied research that showed that the potential benefits of blending RSP with QQQ, because QQQ is the proxy for the large tech, and while it should broaden, we also wanted to make sure we were protected and had enough exposure to the large cap, and so far, it's been accretive.”

Invesco Senior Loan ETF (BKLN) to serve as a public proxy for private credit prior to managers calling capital:

- “We made a $10 million investment to a private credit fund, we would invest $10 million in BKLN, and when that private fund makes a $5 million capital call, we would sell the $5 million of BKLN and fund it to that capital call. If it's doing well, we can have it for the long-term pool and put it in our intermediate term fund.”

ETF future interest and product development

Chris Ip noted that NCSU is likely to use more ETFs over time.

- “As long as it's to the earlier point, efficient cost, liquid and cost efficient as well, then we see no reason why we wouldn't continue to broaden our use of ETFs.” – Chris Ip, Chief Investment Officer, North Carolina State University

Invesco’s Chris Dahlin answered an audience question about ETF product development. “It’s at the intersection of where we see client demand, flows, gaps in the lineup, and portfolio construction,” he said. “There's a little bit of art and a little bit of science to this.”

Many of Invesco’s early factor-based ETFs were focused on a single factor, like quality or low volatility. These can be important portfolio building blocks but can have a higher tracking error to the broad market. More recently, Invesco worked with a public pension plan to launch multi-factor ETFs that seek to harness the factor premium but are designed to keep tracking error relatively low.

If you’re interested in watching a replay of the webcast Unlocking Potential: The Expanding Role of ETFs for Institutions, click here

1Invesco Ltd. AUM of $2,124.8 billion as of September 30, 2025.

2Morningstar Direct, as of 11/30/25

3Ibid.

4Ibid.

There are risks involved with investing in ETFs, including possible loss of money. Index-based ETFs are not actively managed. Actively managed ETFs do not necessarily seek to replicate the performance of a specified index. Both index-based and actively managed ETFs are subject to risks similar to stocks, including those related to short selling and margin maintenance. Ordinary brokerage commissions apply. The Fund's return may not match the return of the Index. The Funds are subject to certain other risks. Please see the current prospectus for more information regarding the risk associated with an investment in the Funds.

This does not constitute a recommendation of any investment strategy or product for a particular investor. Investors should consult a financial professional before making any investment decisions.

Factor investing (as known as smart beta or active quant) is an investment strategy in which securities are chosen based on certain characteristics and attributes that may explain differences in returns. Factor investing represents an alternative and selection index based methodology that seeks to outperform a benchmark or reduce portfolio risk, both in active or passive vehicles. There can be no assurance that performance will be enhanced or risk will be reduced for strategies that seek to provide exposure to certain factors. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Factor investing may underperform cap-weighted benchmarks and increase portfolio risk.

Invesco does not offer tax advice. Please consult your tax adviser for information regarding your own personal tax situation. Investors should be aware of the material differences between mutual funds and ETFs. ETFs generally have lower expenses than actively managed mutual funds due to their different management styles. Most ETFs are passively managed and are structured to track an index, whereas many mutual funds are actively managed and thus have higher management fees. Unlike ETFs, actively managed mutual funds have the ability react to market changes and the potential to outperform a stated benchmark. Since ordinary brokerage commissions apply for each ETF buy and sell transaction, frequent trading activity may increase the cost of ETFs. ETFs can be traded throughout the day, whereas, mutual funds are traded only once a day. While extreme market conditions could result in illiquidity for ETFs. Typically they are still more liquid than most traditional mutual funds because they trade on exchanges. Investors should talk with their financial professional regarding their situation before investing.

These are the personal views of the panelists and do not constitute investment advice or a recommendation to buy or sell any investment security, and they are not necessarily the views of Invesco. The referenced use cases may not be the experience of others and are no guarantee of future performance or success.

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions, there can be no assurance that actual results will not differ materially from expectations.

The opinions expressed are those of the speakers, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals. These comments should not be construed as recommendations, but as an illustration of broader themes.

Factor investing is an investment strategy in which securities are chosen based on attributes that have been associated with higher returns.

Factor investing may underperform cap-weighted benchmarks and increase portfolio risk.

Since ordinary brokerage commissions apply for each ETF buy and sell transaction, frequent trading activity may increase the cost of ETFs.

Low Volatility: Describes investments that have demonstrated the lowest volatile securities in the same asset class.

Quality: Characterizes companies with strong measures of financial health, including a strong balance sheet.

Socially responsible investing: The use of environmental and social factors to exclude certain investments for non-financial reasons may limit market opportunities available to funds not using these criteria. Further, information used to evaluate environmental and social factors may not be readily available, complete or accurate, which could negatively impact the ability to apply environmental and social standards.

Investments focused in a particular sector, such as basic materials, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

QQQM

The risks of investing in securities of foreign issuers can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The Fund is non-diversified and may experience greater volatility than a more diversified investment.

RSP

Stocks of medium-sized companies tend to be more vulnerable to adverse developments, may be more volatile, and may be illiquid or restricted as to resale

BKLN

Most senior loans are made to corporations with below investment-grade credit ratings and are subject to significant credit, valuation and liquidity risk. The value of the collateral securing a loan may not be sufficient to cover the amount owed, may be found invalid or may be used to pay other outstanding obligations of the borrower under applicable law. There is also the risk that the collateral may be difficult to liquidate, or that a majority of the collateral may be illiquid.

An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa.

Investments focused in a particular industry or sector, such as financials, are subject to greater risk, and are more greatly impacted by market volatility, than more diversified investments.

Non-investment grade securities may be subject to greater price volatility due to specific corporate developments, interest-rate sensitivity, negative perceptions of the market, adverse economic and competitive industry conditions and decreased market liquidity.

The risks of investing in securities of foreign issuers can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The Fund is non-diversified and may experience greater volatility than a more diversified investment

Reinvestment risk is the risk that a bond’s cash flows (coupon income and principal repayment) will be reinvested at an interest rate below that on the original bond.

The Fund may engage in frequent trading of its portfolio securities in connection with the rebalancing or adjustment of the Underlying Index.

The Fund’s use of a representative sampling approach will result in its holding a smaller number of securities than are in the underlying Index, and may be subject to greater volatility.

The Fund may hold illiquid securities that it may be unable to sell at the preferred time or price and could lose its entire investment in such securities.

Under a participation in senior loans, the fund generally will have rights that are more limited than those of lenders or of persons who acquire a senior loan by assignment. In a participation, the fund assumes the credit risk of the lender selling the participation in addition to the credit risk of the borrower. In the event of the insolvency of the lender selling the participation, the fund may be treated as a general creditor of the lender and may not have a senior claim to the lender's interest in the senior loan. Certain participations in senior loans are illiquid and difficult to value.

The Fund currently intends to effect creations and redemptions principally for cash, rather than principally in-kind because of the nature of the Fund's investments. As such, investments in the Fund may be less tax efficient than investments in ETFs that create and redeem in-kind.

Invesco Distributors is not affiliated with Chris Ip or North Carolina State University.

Shares are not individually redeemable and owners of the Shares may acquire those Shares from the Fund and tender those Shares for redemption to the Fund in Creation Unit aggregations only, typically consisting of 10,000, 20,000, 25,000, 50,000, 80,000, 100,000 or 150,000 Shares.

Before investing, investors should carefully read the prospectus and/or summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the fund(s), investors should ask their financial professional for a prospectus/summary prospectus or visit invesco.com/fundprospectus

Not a Deposit; Not FDIC Insured; Not Guaranteed by the Bank; May Lose Value; Not Insured by any Federal Government Agency

Issued in the United States by Invesco Distributors, Inc., 1331 Spring Street NW, Suite 2500, Atlanta, GA 30309.

NA5085122