During multiple periods of market stress over the past decade, the transparency, access, liquidity, and efficiency of on-exchange trading proved valuable to fixed income investors. Yet, certain market participants theorized about what might happen should fixed income ETFs be tested by an unprecedented market shock such as that triggered by the pandemic. Questions persisted about whether ETFs would be able to withstand the pressure of continuous selling, and whether they might exacerbate price declines in the underlying markets.

When the shock came, the results were clear: Fixed income ETFs not only held up under stress, but they became important tools for market participants. Institutions turned to the most liquid fixed income ETFs as sources of real-time price discovery and cost-efficient execution when transparent quotations and liquidity had sharply deteriorated in individual bonds.

Volatility followed by surge in fixed income ETF trading

Investors have historically increased their use of fixed income ETFs during times of uncertainty, because the funds have shown to be efficient and effective tools for rebalancing holdings, hedging portfolios, and managing risk. During Q1 2020, which saw the onset of the COVID-19 crisis in America, trading in U.S. fixed income ETFs surged to $1.3 trillion – half of the $2.6 trillion for all of 2019.[1]

During volatility jumps, investors want to weigh all their options and have maximum flexibility. Practically speaking, that means they need liquidity, and U.S. corporate fixed income ETFs demonstrated they could provide incremental liquidity to the market as trading rose at a faster rate than trading in individual bonds as credit risk spiked.

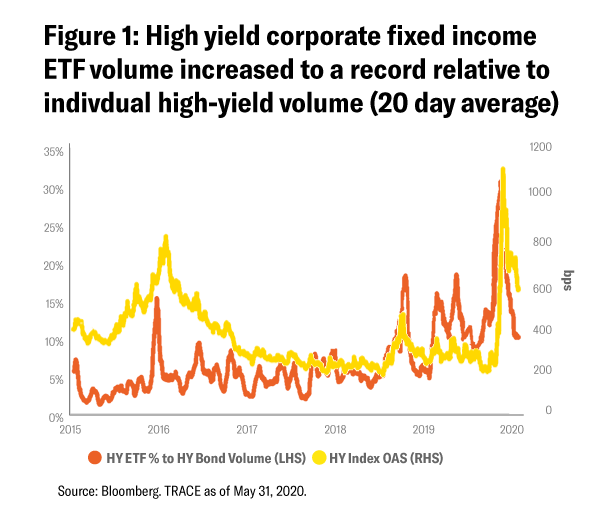

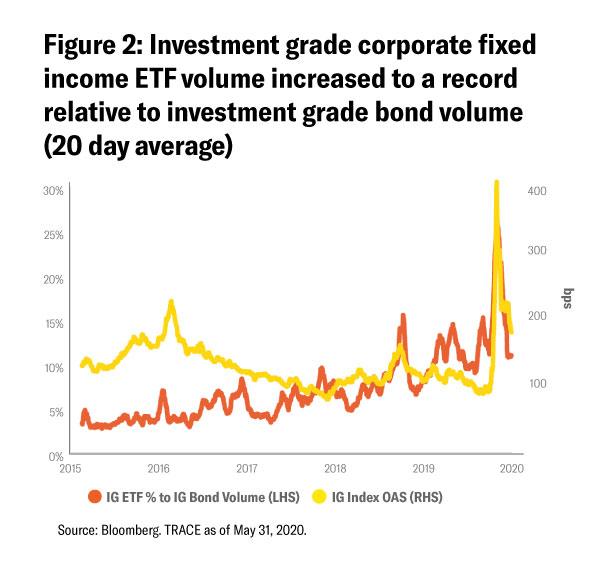

Trading volume in all U.S.-listed high yield fixed income ETFs averaged as much as $7.8 billion per day in March 2020 and represented as much as 29% of individual high yield bond trading in the over-the-counter (OTC) market; for comparison, high yield fixed income ETFs averaged around 11% of OTC high yield trading in 2019.[2] The trend was similar in U.S. investment grade corporate bond trading, where fixed income ETFs in March represented as much as 24% of individual investment grade bond trading in the OTC market, compared with 10% in 2019.[3]

In both high yield and investment grade, as markets became more volatile, investors turned to fixed income ETFs.

Fixed income ETFs are indicators of real-time, actionable prices

Many fixed income ETFs traded billions of dollars and tens of thousands of times per day on exchange during the peak of 2020’s early-year market volatility.[4] This frequency of trading is orders of magnitude more often than the most heavily traded corporate bonds.

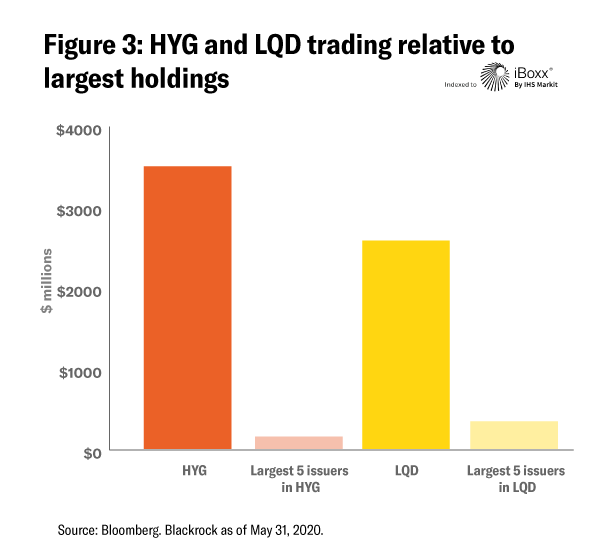

On March 12, one of the worst days for equity markets in modern history and a day during which credit markets sold off sharply, the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) traded almost 90,000 times on exchange compared with just 37 times on average for its largest five bond holdings.[5]

From February through April, the iShares iBoxx $ High Yield Corporate Bond ETF’s (HYG) and LQD’s average daily dollar trading volume was 25 times and 7.5 times more per day, respectively, than their five largest bond holdings.[6]

High trading volumes support the notion that fixed income ETFs provided actionable prices for investors at a time when the underlying bond market was challenged. The on-exchange market prices for fixed income ETFs reflected both absolute and relative values and helped enable investors to understand rapidly changing market conditions.

Because they offer real-time pricing and trade often, fixed income ETFs are central to valuation, portfolio construction and risk management for institutional investors. In particular, fixed income ETFs have emerged as benchmark references for returns, volatility and market sentiment.

More efficient to trade, too

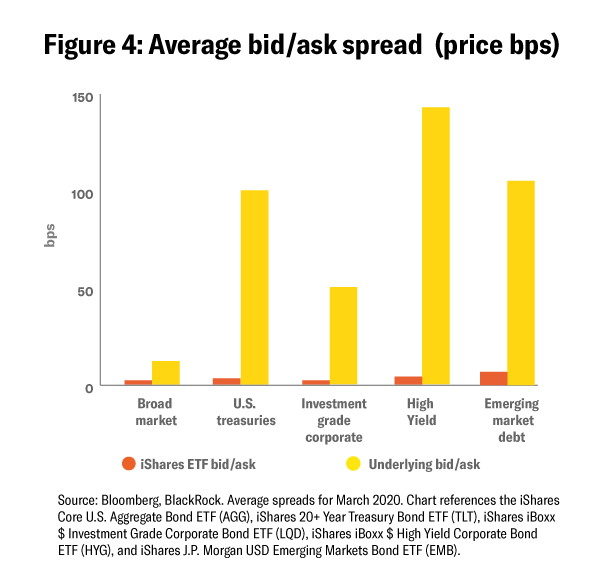

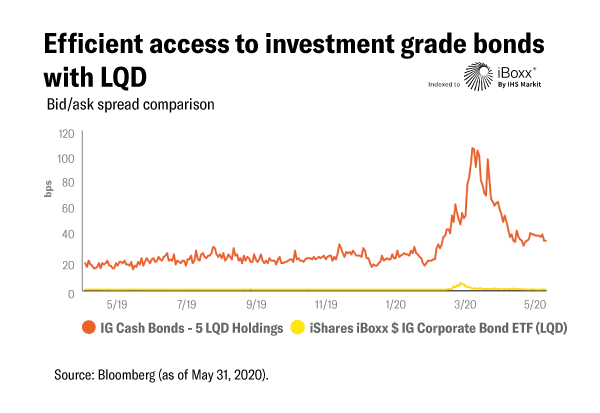

Market volatility creates pricing uncertainty and often translates into wider bid/ask spreads for all securities. Investors who turned to fixed income ETFs during the volatile early months of 2020 found not only real-time, actionable pricing but also lower transaction costs than were available in individual bonds.

While bid/ask spreads for fixed income ETFs did increase somewhat during this period of market volatility, they remained lower for iShares flagship fixed income ETFs than for individual bonds and bond portfolios across sectors; from the emerging markets to U.S. Treasuries, bid/ask spreads of the most liquid iShares fixed income ETFs remained lower than corresponding underlying bond portfolios (Figure 4).

“Fixed income ETFs proved valuable in helping our fund effectively navigate the COVID-19 crisis environment,” says Jeb Burns, CIO, Municipal Employees’ Retirement System of Michigan. “Even as volatility soared, we were readily able to raise cash by selling ETFs in order to meet our plan’s benefit payment needs. We were able to use the liquidity generated from Treasury ETFs to meaningfully allocate to high yield and emerging market debt ETFs during the course of March 2020. Building similar size positions in the cash bond market would have been extremely challenging given the deteriorating liquidity in those markets.”

While fixed income ETF trading costs are generally cheaper than those of the underlying bonds, this difference was magnified during 2020’s market turbulence – yet another signal they are up to the toughest challenges.

ETFs in Action: Studies in Institutional Adoption

During the worst of the market turmoil in February and March 2020, fixed income ETFs became central to the investment decision-making process for a growing number of institutional investors. Given the lack of liquidity and price discovery in the underlying markets, portfolio managers and traders used fixed income ETFs to: understand rapidly changing market conditions; help price individual bonds and portfolios; determine absolute and relative value opportunities that underpin allocation decisions; implement decisions rapidly and efficiently; and hedge unwanted risk. Here are two examples that highlight why and how institutional investors pivoted to fixed income ETFs during the extraordinary market volatility, and how fixed income ETFs are like a technology that can potentially offer flexibility, lower trading costs and the convenience of market access.

Use case #1: Liquidity management

Buyer: An asset manager elects to use high yield fixed income ETFs for the first time.

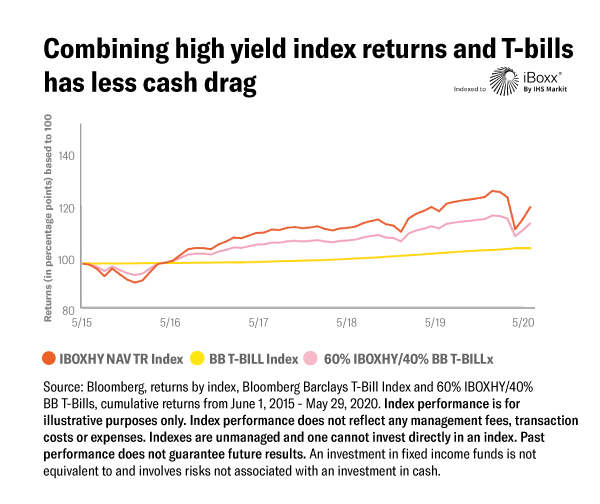

Background: Asset managers need liquidity to manage fund subscriptions and redemptions while remaining invested to avoid cash “drag” that can lead to underperformance. The certainty of execution matters most in assets such as high yield bonds, where transacting in individual securities can be time-consuming and expensive.

Challenge: During March 2020, extreme volatility diminished liquidity in the high yield market. Fund portfolio managers struggled to sell bonds to raise cash to meet redemption requests. At the same time, as market sentiment turned positive, it was hard to buy enough high yield bonds to keep pace with the rally.

Traditional approach: Traditionally, high yield bond fund portfolio managers created liquidity tiers, or “sleeves,” using the most liquid securities within a given asset class and cash-like instruments including money market funds.

Fixed income ETF approach: Needing to take quick action in the context of market volatility, one large asset manager purchased $250 million of HYG. It was the first time the manager had used a fixed income ETF and did so for liquidity, speed and efficiency. By using HYG in their liquidity sleeve instead of high yield bonds, this asset manager was able to access both yield and market beta while maintaining the ability to liquidate, if necessary.

Use case #2: Strategic Asset Allocation

Buyer: An insurer puts investment grade corporate fixed income ETFs at the center of their portfolio.

Background: Life insurers deal with significant premium cash flows every day. Their businesses depend on quickly and efficiently investing such cash flows at high enough yield to meet their liability obligations.

Challenge: Finding individual investment grade bonds was difficult because liquidity and new issuance dried up in February and March 2020. During this time, bid/ask spreads for investment grade bonds widened from about 25bps to over 100bps, in price terms, while LQD’s bid/ask spread stayed below 2bps over the same period.[7]

Traditional approach: Traditionally, insurers relied heavily on individual investment grade bonds for liability matching, often by investing in newly issued bonds, which tend to be highly liquid.

Fixed income ETF approach: One major U.S. insurer was faced with the prospect of holding too much cash and earning too little income. To help remedy this mismatch, the insurer invested in the highly liquid LQD.

[1] BlackRock, Bloomberg (as of May 31, 2020).

[2] SIFMA TRACE; BlackRock; Bloomberg; on March 20, 2020, the 20-day average for U.S. high yield bond ETFs reached $7.8 billion compared with $27.4 billion in individual bonds.

[3] SIFMA TRACE; BlackRock; Bloomberg; on March 25, 2020, the 20-day average for U.S. investment grade bond ETFs reached $6.9 billion compared with $28.8 billion in individual bonds.

[4] BlackRock, Bloomberg (as of May 31, 2020).

[5] BlackRock, FINRA TRACE (as of May 31, 2020).

[6] Bloomberg, BlackRock (as of May 31, 2020).

[7] Bloomberg (as of May 31, 2020).

FOR INSTITUTIONAL INVESTORS ONLY – NOT FOR PUBLIC DISTRIBUTION

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Shares of iShares ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Shares are not individually redeemable from the ETF, however, shares may be redeemed directly from an ETF by Authorized Participants, in very large creation/redemption units. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

This material is provided for educational purposes only and is not intended to constitute investment advice or an investment recommendation within the meaning of federal, state or local law. You are solely responsible for evaluating and acting upon the education and information contained in this material. BlackRock will not be liable for direct or incidental loss resulting from applying any of the information obtained from these materials or from any other source mentioned. BlackRock does not render any legal, tax or accounting advice and the education and information contained in this material should not be construed as such. Please consult with a qualified professional for these types of advice.

The iShares Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices Limited, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with Markit Indices Limited.

©2020 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

ICRMH1020U-1318287-1/1