So much for the CTA recovery.

Although most computer-driven hedge funds enjoyed a strong December, commodity trading advisers, trend followers, and other computer-driven strategies posted their second-straight losing quarter.

As a result, most of these funds finished 2016 with losses. Société Générale Prime Services’ flagship SG CTA Index declined 2.86 percent for the year, while the SG Trend Index lost 6.19 percent, its first losing year since 2012. Short-term traders did a little better, finishing the year up a slight 0.31 percent.

Altogether, Société Générale reports that just seven of 20 CTA index constituents made money last year.

“Managed futures will likely be considered the biggest disappointment in the hedge fund industry in 2016,” hedge fund data collector eVestment states in its year-end wrap-up.

September marked the first losing quarter for the strategy since the second quarter of 2015. As is usually the case, the strategy started to see a surge in new money after posting strong gains in 2014 and early 2015, eVestment points out. What’s more, managed futures was the only “primary strategy” with positive fund flows in 2016, underscoring investors’ penchant for chasing returns.

EVestment stresses that large managed-futures funds were the only group within a primary strategy to generate losses in 2016.

“CTAs emerged by mid-2015 as strong hedges against most asset classes’ volatility, and diversifiers in hedge fund allocations,” states a new report published by Lyxor Asset Management, a unit of Société Générale. “This is no longer the case today, and will probably remain so until volatility firms up again.”

In its separate report, Société Générale points out that for the entire year, bond indexes led the way for these computer-driven funds, gaining 7.92 percent, followed by equity indexes, up 3.99 percent.

On the other hand, the commodity sector lost 9.92 percent, “with challenging conditions for trend followers in the majority of commodity markets,” according to a report.

Lyxor points out that in recent weeks CTAs “profoundly reshuffled” their bond exposures. “They are now short bonds in most regions, with the exception of Europe,” it adds. “They turned meaningfully long equities.”

They are also long the U.S. dollar and cyclical commodities and short precious metals. “CTAs’ fate is now tightly linked to the pace of the regime shift,” Lyxor adds.

In any case, many of the largest funds posted the biggest losses last year.

For example, David Harding’s Winton Futures Fund lost 3 percent, after gaining slightly less than 1 percent in 2015.

As a result, the parent company, Winton Capital Management, has suffered a total of $480 million in redemptions. It had enjoyed a surge in assets at the beginning of 2016, rising by nearly 22 percent to $33.76 billion.

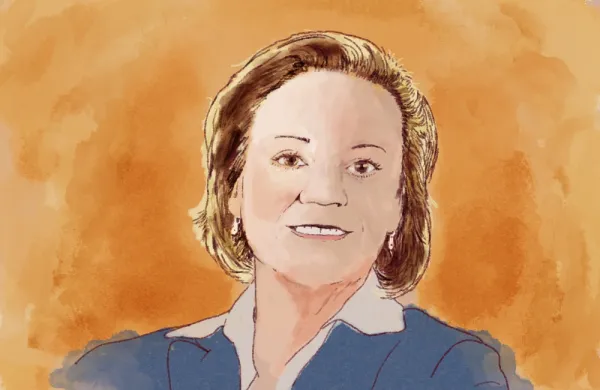

The BlueTrend Fund, managed by Leda Braga’s Systematica Investments, fell 11 percent in 2016, having moved into losing territory in the third quarter. The fund manages about $6.4 billion, down from $7.87 billion a year ago.

The International Standard Asset Management (ISAM) Systematic Trend fund, managed by Stanley Fink’s London-based ISAM, fell 12.18 percent last year. It rose nearly 15 percent in 2015 and nearly 62 percent in 2014. It runs about $1.8 billion.

The CCP Quantitative Fund - Aristarchus Program, managed by Cambridge, UK–based Cantab Capital Partners, fell 7.38 percent last year. This is the fund’s third loss in the past four years. The $2.2 billion fund also lost 8.2 percent in 2015 after gaining more than 39 percent the previous year.

Cantab was founded in 2006 by Ewan Kirk, who ran Goldman Sachs’ quantitative strategies group in Europe and oversaw quantitative technology for the firm, and Erich Schlaikjer.

The $2.6 billion QMS Diversified Global Macro fund, managed by QMS Capital Management, lost 10 percent last year. The Durham, North Carolina, firm is headed by Michael Brandt, who is also the Kalman J. Cohen Professor at Duke University’s Fuqua School of Business.