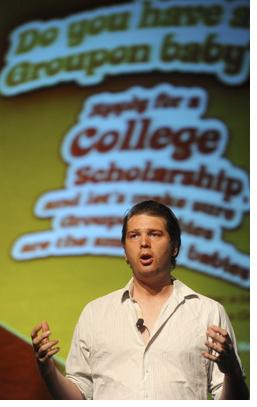

No doubt, Groupon founder Andrew Mason’s decision to reject a $6 billion buyout offer from Google is frustrating, maddening and inexplicable to most people. That’s a lot of money for a company created in Chicago in November 2008 by a 30-year-old entrepreneur with $1 million in seed money from Internet entrepreneur Eric Lefkovsky, his former boss.

It has grown like wildfire with a winning formula of helping retailers in 150 markets in the U.S. and 100 markets in Europe, offering deep-discount deals of the day to groups of consumers who join the site. It now has at least 35 million registered users. It claims to have added 3 million subscribers just last week, thanks to its recent publicity.

While Groupon hasn’t elaborated on the logic of its decision, it isn’t that hard to understand why entrepreneurs and venture capitalists don’t rush to sell their company, even if they can pocket profits in the billion-dollar range.

The first thing to understand about Groupon is that it’s no dot-com flash in the pan. The company is generating $50 million in cash every month. It’s a real business, not just a “story” generating endless talk of future profits that never materialize. With great cash flow and a clean balance sheet, this company is in charge of its own destiny. It doesn’t need a buyout. Some entrepreneurs rush for the exit at the first opportunity. That can be viewed as a sign of weakness or a lack of confidence in the long-term viability of the business.

For all its success, Groupon is still in the early stages of its growth. It has yet to tap the entire U.S. market, let alone the international market. Given the potential for future profitable growth, $6 billion may be just fraction of its ultimate value in the market. Facebook had plenty of opportunities to sell in its very early years, and Mark Zuckerberg could have easily pocketed billions, just as Mason could do right now. But Zuckerberg had a vision of Facebook as more than just a big company: he viewed it as a global communications platform of the first order, on par with Microsoft’s operating system or Apple’s iPhone or iTunes. Zuckerberg remained committed to that vision, and today Facebook’s value in the private market is $44 billion and rising.

Mason seems to view Groupon as a company with similar potential, and there is every reason to take that argument seriously. In short, Mason is going for the full Facebook.

“Groupon is not only advertising, and it’s not only e-commerce. It’s a combination of both. It’s serving both purposes for local businesses. It’s definitely a mistake to think of the size of this market, as the size of the Yellow Pages market at its peak, for example. It’s potentially so much bigger than that because it’s really the size of every empty salon chair, plus every empty restaurant table, plus every empty massage table, plus etc., etc. The stat that we throw around is that 80 percent of people’s disposable income is spent within two miles of their house,” Mason tells the Times.

It’s not clear, either, that Google would be an ideal owner of Groupon. A deal between the companies makes sense in theory, but the fact is that most M&A deals fail to generate value. Execution is everything, and given the difference in corporate cultures, it’s unclear whether Mason would stay, and how Groupon would fare without him at this point in its young life.

Finally, Groupon is a venture-backed company. According to All Things Digital, the Wall Street Journal blog, the company has raised $170 million from Accel, Battery Ventures, New Enterprise Associates, and others.

Its VC investors have good reason to hang around until they believe the company has reached its full value. If they believe the company is worth $6 billion, they should sell now. But if they believe that it has the opportunity to generate more, the logic of the VC business dictates that they must hold out for more. "Most VC deals don't make it really big, so it's important that the ones that have that potential go all the way," Jay Levy, the co-founder of New York-based VC firm Zelkova Ventures explained in a story that I wrote for Portfolio.com.

Mason is determined to take Groupon all the way. There’s no guarantee of success. He will face competition from Google, Facebook and Amazon, which has invested in Groupon rival called Living Social. And sometimes, it’s a mistake not to sell. Yahoo! probably miscalculated when it passed up a buyout offer from Microsoft. But that was a very different case. Yahoo! is long-passed its early high-growth phase of life, while Groupon is just getting started in a brand new market that it has pioneered.

It’s a long and unlikely trip, but the odds of Mason and Groupon creating a new global retail and advertising venture on the scale of Microsoft, Google or Facebook actually look pretty good.