The numbers have spoken. On Friday the Commerce Department released revised first quarter GDP data confirming investors’ fears that the pace of growth fell during the period at a faster pace than initially estimated. The U.S. economy contracted at an annual rate of 0.7 percent, versus an initial estimate of a 0.2 percent drop. Catalysts ranging from bad weather to a strong dollar were the primary drivers for the decline in economic activity, but the shortfall made only a small dent in U.S. equity indexes, suggesting that investors were prepared for lackluster data. In a note released last week before the GDP revision was announced, Gluskin Sheff + Associates chief economist and strategist David Rosenberg summed up the bullish case for U.S. stocks. “The reason why the stock market has continuously defied the skeptics is because they spend far too much time in valuation metrics, which are very poor timing devices,” he wrote. “The fundamentals matter much more and, while it is true that we are not in an economic boom, consider that a good thing because every boom in the past was followed by a bust — this cycle is steady-eddie.” Rosenberg’s thesis will be tested during the next week as central bankers in Australia, Canada and Europe make monthly rate announcements, and the U.S. releases its all-important jobs numbers.

Monday, June 1: Chinese manufacturing expected to continue its slide. HSBC will release its final May purchasing manufacturers’ index (PMI) data for China on Monday morning. After a disappointing initial May PMI reading that kept a string of three consecutive monthly contractions in play, financial markets may react positively if the final release confirms a downturn as investors anticipate further intervention by the People’s Bank of China.

Tuesday, June 2: Australia likely to hold rates steady. The Reserve Bank of Australia will make its monthly rate announcement, with forecasts for the benchmark overnight lending rate to remain unchanged at a historic low of 2 percent. RBA governor Glenn Stevens and his colleagues have faced a balancing act in keeping rates low to spur demand and employment despite rising concerns over a bubble in Australian property values. Last week RBA deputy governor Philip Lowe praised efforts by the Australian Prudential Regulation Authority to tighten lending controls for mortgages.

Wednesday, June 3: Europe plays the waiting game. The European Central Bank’s monthly policy statement is expected to bring no change in either the pace of asset purchases under the bank’s easing program or interest rates. ECB President Mario Draghi may use the opportunity to address concerns over how the bank views the potential impact of a Greek exit from the euro, a matter weighing heavily on investors’ minds.

Thursday, June 4: The U.K. weighs in on interest rates. The Bank of England’s monthly interest rate announcement will be closely watched by investors as governor Mark Carney and his team balance low inflation and a still fragile job market with a red hot U.K. real estate market. The BOE chief was in the hot seat last month after the bank inadvertently released to reporters details of “Project Bookend,” the contingency plans for an exit from the European Union.

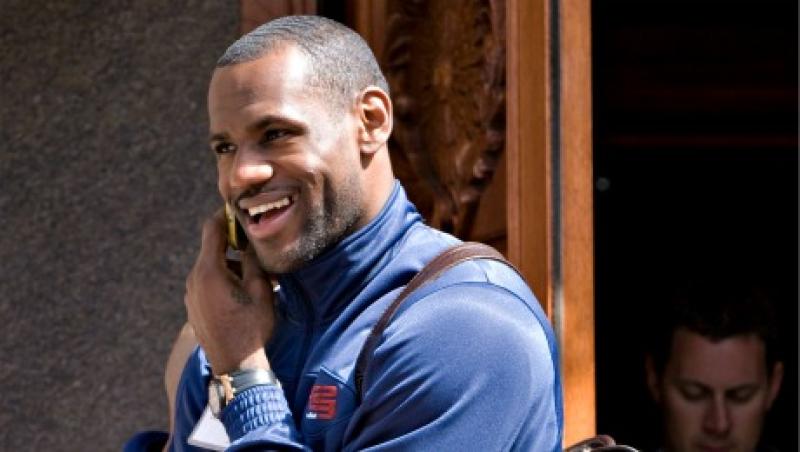

Thursday, June 4: King James holds court in California. The NBA Finals commence with LeBron James’ Cleveland Cavaliers taking on the Golden State Warriors in Oakland. Television viewership of the finals last year increased by almost half-a-million people, according to research firm Nielson. Keeping that interest level will be critical for the bottom line for Disney’s ABC network, which is televising the games. The average price of a 30-second slot during the NBA Finals in 2014 was $520,000

Friday, June 5: The U.S. releases May job figures. In the U.S. the monthly Department of Labor employment report will be carefully watched by investors for any signal that the trajectory of job market gains is shifting. After upbeat comments by both Federal Reserve chair Janet Yellen and San Francisco Fed president John Williams last week, most analysts conclude that it would take a significant shortfall in payrolls to spur the Federal Open Market Committee to delay a rate hike past December.