< Fintech's Most Powerful Dealmakers of 2016

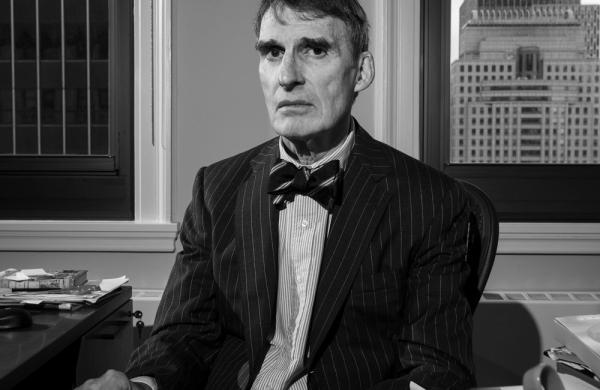

9. Darren Cohen

Global Head of Principal Strategic Investments

Goldman Sachs Group

PNR

A college major in philosophy and political science (Emory University, 1996) wouldn’t ordinarily point toward a career in financial technology, but it did for Darren Cohen, global head of principal strategic investments (PSI) at Goldman Sachs Group. Cohen is on his second tour with the New York–based bank: He started in 2000 as a software and technology sector analyst in London and returned in 2007 after four years covering software and technology services and surfacing investment ideas for Calypso Capital Management, a New York–based hedge fund. Over his years following fintech, “the pace of change, investment technology, the whole landscape has accelerated,” says the 42-year-old. (Thomas Jessop, No. 8 last year, who reported to Cohen in the PSI group, has since moved into a technology business development role at Goldman.) Examples of PSI holdings, generally defined as technologically disruptive and strategically related to capital market activities, are market analytics platform Kensho Technologies and Symphony Communication Services, the secure messaging and collaboration venture that was spun out of Goldman. Motif, a retail trading platform, and machine-learning analytics company Context Relevant are among more than 70 holdings in the Goldman portfolio, which, Cohen contends, is one of the biggest in the fintech world. “The company has always viewed technology as critical and has always been aggressive with technology because it affects how we make markets with our own clients,” he says. “The PSI team has been at the epicenter of most of the major market structure events in our industry.” The profile of co-investors has changed: They increasingly tend to be West Coast venture capital firms and buy-side clients rather than investment banks. Facing heightened regulation and other market headwinds, he says, firms “have realized over the past two years that disrupting financial technology is harder than the hype suggests.”

The 2016 Fintech Finance 35

General Atlantic

Bain Capital Ventures

Evercore Partners

Robinson IV RRE Ventures

Financial Technology Partners

Anthemis Group |

Brad Bernstein FTV Capital

von Dohlen Broadhaven Capital Partners

Goldman Sachs Group

Nyca Partners

Ribbit Capital

Partnership Fund for New York City |

Digital Currency Group

Propel Venture Partners

Santander InnoVentures

SenaHill Partners

AXA Strategic Ventures

Citi Ventures |

Accion International

Marlin & Associates

CME Ventures

Andreessen Horowitz

Euclid Opportunities

SWIFT |

Life.SREDA

TTV Capital

Startupbootcamp Fintech

Innovate Finance

Bank of America Merrill Lynch

Fintech Innovation |

AMTD Group

FinTech Hong Kong

Future Perfect Ventures

Monetary Authority of Singapore

de la Miel Rakuten FinTech Fund |

| |