Erik Belz wants everyone to know that he is not starting just “another energy transition fund” at Engine No. 1, the activist investment firm that first made headlines in 2021 for electing three independent directors to ExxonMobil’s board.

After a series of dinners and brainstorming ideas with Christopher James, Engine No. 1’s founder and CIO, Belz said they agreed that there was not enough private equity capital getting invested in natural resources companies, especially ones interested in contributing to the transition from fossil fuels to renewable energy. Among other things, most traditional energy transition funds invest in alternatives, such as solar or wind, and new technologies to pull carbon dioxide from the environment.

In March, Belz, who led investments in natural resources companies making those transitions, joined Engine No.1 to do something he says is different.

“As a natural resource investor for really all of my career, the opportunity to come in and build something now, when capital is sort of moving in the other direction, just really excites me,” he said.

Like others at Engine No. 1, Belz believes the world needs to decarbonize, but also recognize that reliable, traditional natural resources will be needed for decades to come, in part to fuel the development of sustainable energy capabilities. Too many people separate those things based on their ideology and fail to see a “shared reality,” according to Belz.

“You have to believe both of those points together to underwrite what we’re doing” and now, even in a tough fundraising environment, is a good time to start a fund focused on both, Belz said.

Many private capital and traditional asset managers have divested from energy and natural resources companies at a time when the sector still needs capital. Other remaining investors want fossil fuel companies to focus only on paying dividends and buying back shares, Belz said.

That means Engine No.1 has an opportunity both to help natural resources companies run better and be part of the energy transition.

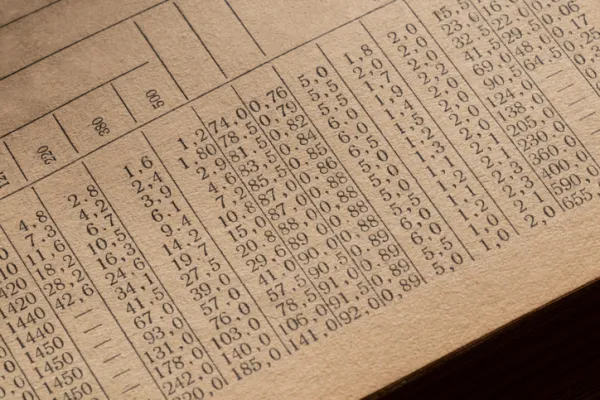

Belz said the new fund will target growth equity opportunities in traditional energy assets; metals and mining; agriculture; and refined products and chemicals.

As an example, Belz said the firm is considering an investment in a North American battery metals producer, analyzing how the business could be more profitable and increase cash flow — typical things new owners would do. But the manager also is exploring hydrogen fuel for the company’s heavy trucks, which could lower fuel costs and make it more sustainable. Engine No. 1 also is considering reprocessing mining waste water to extract more minerals, and building hydro-renewable power sources in remote locations where it is expensive to tap a local grid.

The companies’ capital reallocation to activities other than drilling new wells is also attracting the interest of investors that might otherwise be divesting from the sector.

Some of the largest allocators were pushing back on investments or divesting from natural resources even before 2022 and the current challenging fundraising environment, Belz said. But investors may be interested in a fund that can take advantage of an attractive entry point in the market cycle of the sector, while also contributing to the energy transition.

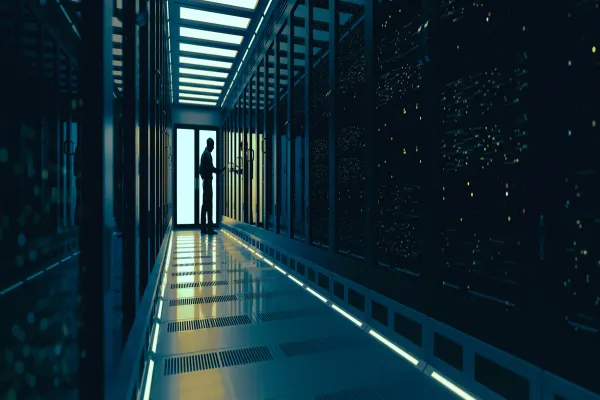

Engine No. 1 plans to do co-investments, in part because of the amount of capital needed to fund some projects. “There haven’t been any meaningful public market capital raises in the broad natural resource space in quite some time. So we’re focused there and we’re focused there to fill that void,” he said.

The natural resource companies like Engine No. 1’s approach, too, Belz said.

“The collaborative partnership approach we’re taking to the natural resource industry has been welcomed because here you’re talking about an industry that has had large scale capital providers who were partners for years, on a dime, turn their back on the sector,” Belz said.

“And the sector is critically important, not only to the broader economy, but I think increasingly important to achieving society’s goal in a decarbonized world.”