Any asset manager worth its salt has something that gives it an edge. For P10, that’s decades worth of proprietary data on an otherwise opaque segment of the market.

The publicly traded firm manages about $30 billion in private equity, private credit, venture capital, and fund-of-funds. It focuses exclusively on companies with less than $250 million in revenue.

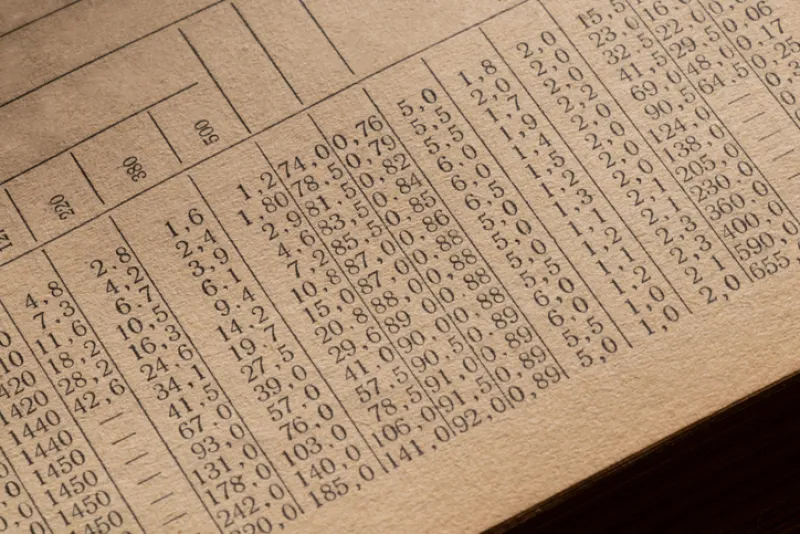

According to CEO Luke Sarsfield, formerly global co-head of Goldman Sachs Asset Management, P10 has collected detailed records on middle-market transactions for more than 20 years.

The firm has what it considers to be among the most comprehensive and actionable data on the North American middle and lower middle market, which it says helps it to generate excess returns for investors across various economic cycles. The data platform aggregates fund, deal, and portfolio company data, giving its managers insights into a less transparent corner of the market, compared to large-cap deals.

Analysis of that data has reinforced P10’s conviction in the middle market. Over time, investments in smaller companies have delivered 200 to 300 basis points of outperformance versus larger deals — a durable trend, not a temporary anomaly, Sarsfield said.

Structural factors amplify the appeal of the middle market. The sheer volume of opportunities creates what Sarsfield calls a “target-rich environment,” with deals that are often more bespoke than the auction-driven transactions dominating the upper end of private equity. Many targets are founder-owned, offering greater scope for operational improvements and value creation. Earlier-stage businesses also tend to operate in less competitive environments and come at lower valuations.

P10 leverages its proprietary data to evaluate each potential deal, mining information from underwriting, operating metrics, and outcomes across comparable companies and transactions. Using its historical insights, the firm is able to identify what has worked — and what hasn’t — across thousands of transactions, said Sarsfield. Last April, the firm acquired Madrid-based Qualitas Funds, giving it a similar data set covering the European middle and lower middle markets, as it looks to expand on this strategy.

Recently, P10’s SOF V fund raised $1.26 billion — the firm’s largest and fastest fundraising to date, exceeding its $1 billion target.

P10 sees significant potential for organic growth. Almost all of its clients currently invest in only one strategy. “The easiest place to find a new client is an existing client,” Sarsfield said.

The firm is developing new products beyond commingled drawdown funds and separately managed accounts. Most recently, it launched an evergreen fund through affiliate Enhanced Capital. It plans to expand into direct lending, asset-based lending, and real assets through affiliates in the coming years.

The firm announced that it will be known as Ridgepost Capital from February 11.