As hedge funds come back into vogue, top allocators are thinking about how the alternative strategies fit into their portfolios — and what their next best investment will be.

The market is rapidly changing, with interest rates and inflation rising, geopolitical tensions ramping up, and a potential recession on the way. To stay competitive, investors are turning to tried and true strategies like trend following or macro managers, as well as innovative products like hybrid funds and cryptocurrencies.

“Hedge funds have been marketed many ways to our industry,” said Sam Gallo, chief investment officer at the University System of Maryland Foundation. “I remember when they were marketed as an equity substitute, then they were marketed as fixed income, then they were marketed as uncorrelated to anything. That’s the wrong way to look at them.”

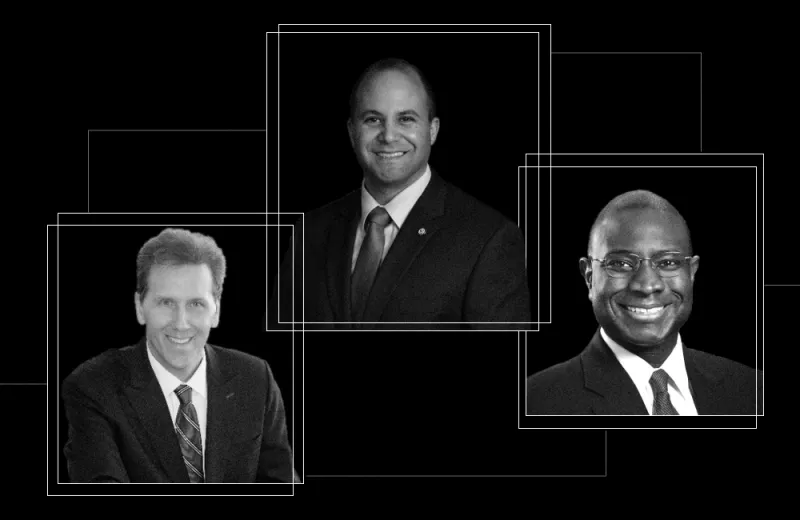

According to Gallo — along with several other allocators whose funds took home trophies at Institutional Investor’s Hedge Fund Industry Awards — hedge funds should be seen as investments that complete and diversify a portfolio. Here’s how they use them.

At the University System of Maryland Foundation, hedge funds are not an asset class, but an investment vehicle used throughout the portfolio. “We think they’re a very necessary part of the portfolio for risk mitigation and return enhancement,” said the fund’s chief investment officer Sam Gallo.

Gallo views himself as a portfolio constructionist, focusing most on how a new investment fits within the fund’s pre-existing portfolio framework.

“I like the multi-strategy and event managers because they’re very flexible in their use of capital,” he said. “They go where opportunity is. That's probably more traditional.”

For the WK Kellogg Foundation, hedge funds are a portfolio diversifier. The foundation has a 16 percent allocation target to the asset class, and is currently slightly overweight, with 20 managers in the portfolio.

“Our quant strategies and trend following strategies have performed very well year to date,” said Reginald Sanders, director of investments at Kellogg. “Again, that’s due to how diversified our approach is.”

The South Carolina Retirement System Investment Commission uses a portable alpha program to manage its hedge fund investments. In April, the pension fund increased its allocation to the strategy from 12 percent to 15 percent after it earned $1.2 billion for the organization since its inception in 2016.

“We really want to be really methodical about how we build the portfolio,” said Bryan Moore, managing director of public markets. “The pandemic was a time when we were very active in our portfolio. That allowed us to build a lot of great relationships and gain access to funds that historically hadn’t been open to new capital.”

In the past few months, the pension fund has been benefiting from its allocation to macro managers that have “ridden the wave of this rising rates theme,” Moore said. “We’re seeing those gains start to be crystallized.”

At Cleveland Clinic, the hedge fund program is focused on absolute returns and is managed by its credit team. Designed to be defensive, the pool of capital has received more money over the years as fixed income returns have dried up.

“We run a highly concentrated portfolio of ten managers and think of it as really being market-neutral event-driven global macro and relative value,” said chief investment officer Stefan Strein.

According to Strein, doubling down on macro and market-neutral hedge funds has paid off over the past year.

“By miracle of miracles, they’ve performed remarkably,” he said. “Performance can always change, but on the one-year basis it looks quite strong as the global macro managers have played commodities beautifully. The market-neutral and more defensive managers have really done quite well.”

South Carolina’s retirement system is currently looking at adding commodities-related strategies. While the overall performance of the subsector looks strong, Moore and his team are worried that “survivorship bias” could be masking some failures. The fund is working with its hedge fund consultant Albourne to see if “there’s a graveyard of managers. We want to know: Is there a risk there not showing up?” Moore said.

Gallo, meanwhile, is interested in hybrid hedge fund structures, although he said his fund hasn’t yet invested in them. He said he likes that these managers are using what they learned in the public markets in the private ones. “They’ll say that I want time to be on my side,” Gallo said of the managers. “As an endowment CIO, if there’s anyone who could appreciate it that’s me.”

Both Gallo and Sanders are considering eventually adding cryptocurrency strategies to their portfolios.

“I could see a potential hedge fund manager coming into the portfolio that does a blockchain crypto fund,” Gallo said. “They can explore opportunities that are a little more liquid so you don’t have to wait 15 years to get your capital back.”

But right now, according to Gallo, the options are slim. In his view, cryptocurrency assets don’t yet have stable correlations. Take growth stocks, for example: Sometimes cryptocurrencies move with them; other times, they move against them.

“For many of the cryptocurrencies, the stability of their correlation has been our biggest concern,” Gallo said.

But he’s optimistic. “I think they’ll stabilize the correlation but still offer inefficient positive alpha. I'm a portfolio constructionist — that’s every portfolio constructionist’s dream.”