Self-storage has demonstrated itself to be a resilient and important component of real estate portfolios. Since Heitman began investing in the sector in 1996, we have observed its durability and outperformance against traditional sectors throughout economic cycles. As fundamentals improve driven by structural tailwinds, we believe today presents a compelling opportunity for adding self-storage to a diversified real estate portfolio.

THE CASE FOR SELF-STORAGE

Strong Historical Performance

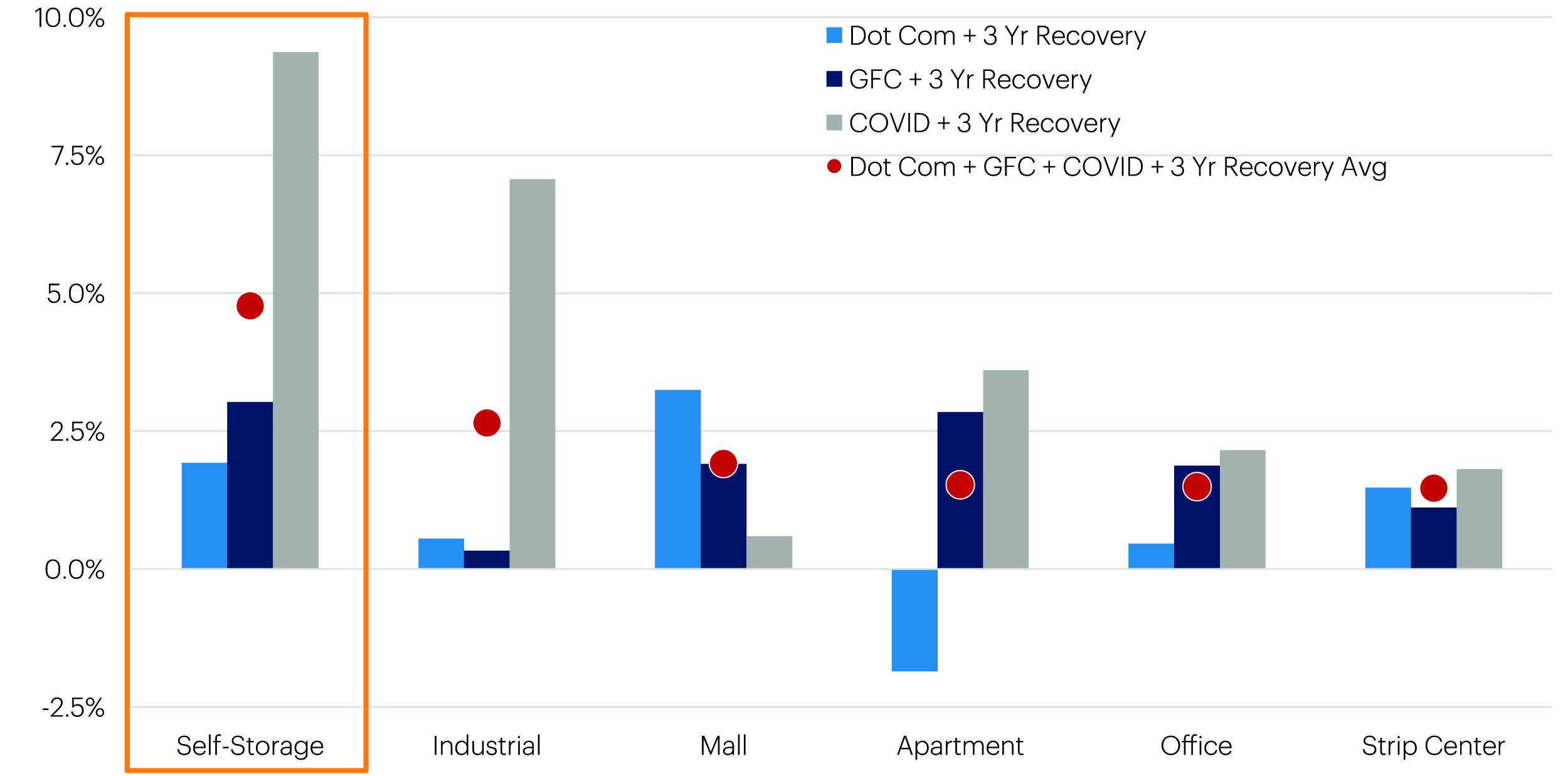

Over the past 15 years, self-storage has delivered the highest long-term NOI growth compared to traditional property types. Additionally, the sector has outperformed the ODCE index in total return across every period since 2013 — by an average spread of 5.6%.1 Low operating expenses, short lease terms, and demand drivers that are less linked to the macroeconomy result in steady cash flows, regardless of the point of the economic cycle. This resilience is illustrated in the sector’s outperformance during recessions. Self-storage has outperformed all other sectors in terms of same-property NOI growth during the previous three recessions and their subsequent recovery periods.

FIGURE 1

SAME PROPERTY NOI GROWTH DURING THE DOT COM (2001-2004),

GLOBAL FINANCIAL CRISIS (2007-2012) AND COVID-19 (2020-2023) RECESSIONS

1. Green Street database, accessed 2025 Q4

Diverse Sources of Demand

Self-storage benefits from a wide and diverse set of demand drivers. While recent attention has focused on the housing market’s impact on demand, many of the sector’s fundamental demand drivers, such as favorable demographic trends and growing user adoption, remain intact.

Even with an estimated 10% decline in new demand attributable to housing market headwinds, younger generations’ increased propensity to rent as well as strong retention of existing customers have contributed to solid occupancy levels.2 Older renters tend to stay longer, often for life transition reasons that are less sensitive to rent increases. We are seeing this inelasticity reflected in Heitman’s portfolio; the average length of stay has increased by 25% since 2014 and currently sits at roughly 24 months. The successful deployment of rent increases on existing customers has prevented prolonged downturns historically.3

A Natural Hedge Against Inflation

Self-storage’s performance during the last several years — marked by the highest inflation rates in four decades — illustrates the sector’s lower sensitivity to rising costs. From Q1 2020 to Q2 2025, storage delivered 9.5% annualized total returns, second only to industrial, spanning both the sharp run-up in move-in rents.4

This can be attributed to:

1. Short lease terms which allow operators to reprice rents monthly, enabling rapid response to rising costs. This is an advantage over property types with multi-year leases that do not include inflation-indexed escalations.

2. Storage remains relatively affordable despite broader housing cost pressures. Today’s average storage cost-to-income ratio is 1.8%, well below the 2012–2019 average of 2.3%. The relatively low monthly expense, combined with widespread use of autopay programs supports retention even when rents rise.

3. Storage’s high NOI margins compared to the sector’s long-term averages and low capex requirements limit cost escalation, providing operators with greater flexibility during inflationary periods.

Collectively, these characteristics allow storage operators to adjust pricing quickly, maintain demand, and preserve margins as expenses rise. Read more about how self-storage can act as a hedge against inflation.

Built-In Diversification

Self-storage can add multiple dimensions of diversification to a real estate portfolio. Customer demand stems from various use cases, limiting exposure to one industry or demographic. Additionally, the sector’s performance is driven by local trade area dynamics rather than broader markets. This combined with smaller transaction sizes allows investors to build portfolios that can span exposure across assets and geographies, thus limiting event risk.

WHY NOW?

Favorable Demand Outlook

We expect self-storage demand to remain robust, driven by the aging U.S. population, increased adoption among high growth cohorts, and longer tenant stays. Heitman’s demographic based demand model — incorporating household growth, storage propensity by age, renter segmentation, and length of stay assumptions — indicates that demographic and usage trends are expected to drive more than 20% demand growth over the next decade. This far outpaces the 4.8% growth seen over the previous ten years.

Three major themes drive this acceleration:

1. Broader consumer adoption

2. Millennials aging into the 45–59 segment, when household size, consumption, and storage needs typically peak

3. Rapid expansion of the 80+ age cohort, whose life events often trigger storage use

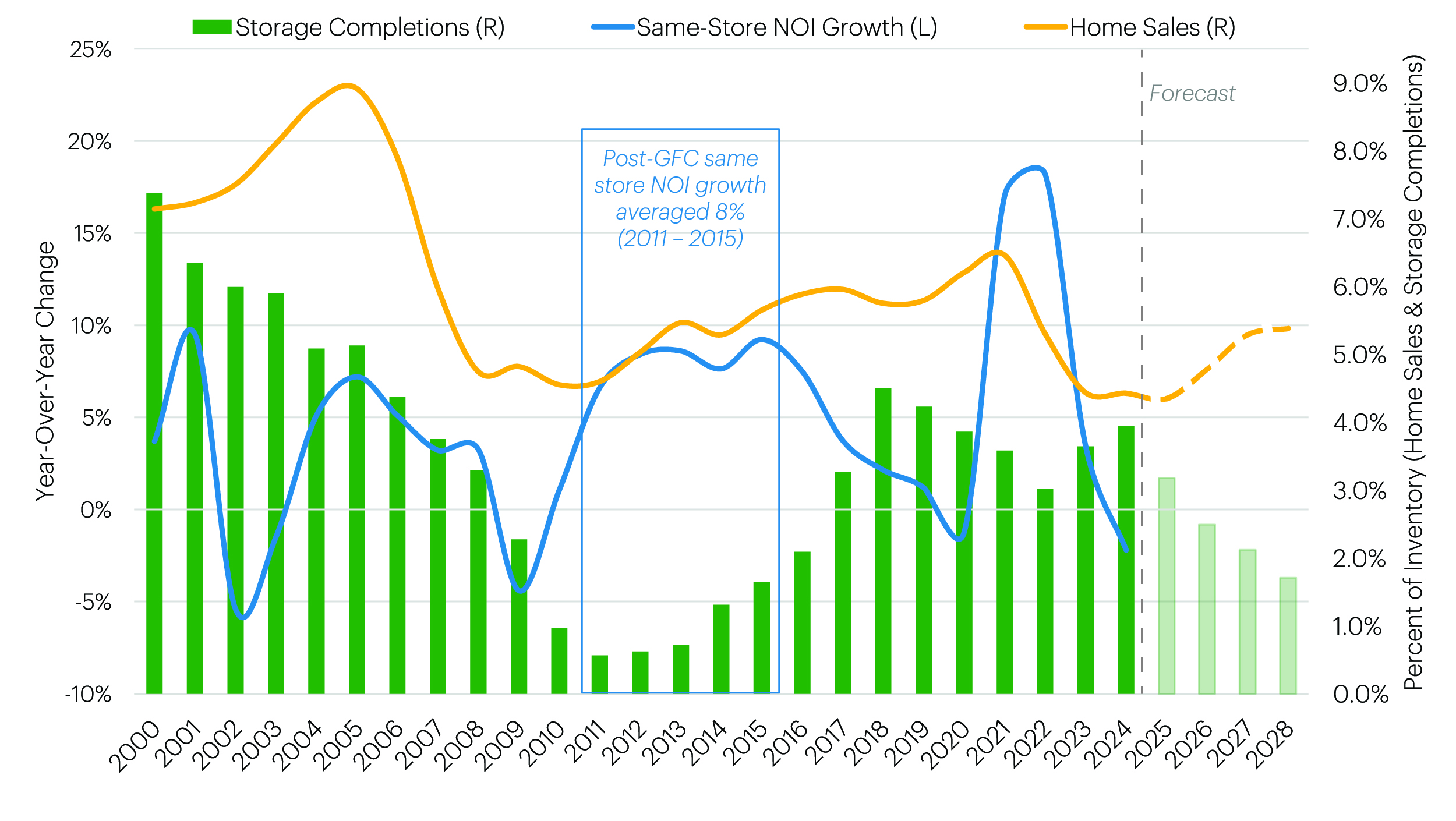

Housing mobility remains an important contributor to storage demand. A prolonged stagnation in home sales could temper the pace of recovery, however, economists expect activity to rebound gradually in 2026 as anticipated Federal Reserve rate cuts should ease longer-term yields that influence mortgage pricing.

Favorable Supply Outlook

Development peaked in 2018–2019 but new construction has slowed sharply. In 2025, deliveries as a share of existing inventory fell below the long-term average, and new projects today face substantial barriers, including rising construction costs, higher interest rates, and tighter financing. With input costs up 65% since 2019 and cap rates about 50 bps wider, Green Street analysis suggests that market rents would need to rise approximately 50% from current levels for new construction to pencil. Meaningful new supply is unlikely to materialize until market rents recover. We believe this will benefit existing assets and make the current environment a compelling entry point.

The Opportunity Today

Self-storage fundamentals have begun to stabilize following a period of moderation. Operators can capture revenue growth across scenarios due to the sector’s dynamic pricing. Additionally, unlevered storage prices remain roughly 25% below 2022 peaks, creating potential value recovery. Historical precedent reinforces our outlook. Current conditions mirror the post GFC period, when homebuying activity slowed materially but self-storage still delivered several years of same store NOI growth above 8%, driven largely by limited new supply. With similarly constrained supply today, current market dynamics suggest the sector is well positioned.

FIGURE 2

HOME SALES AND SELF-STORAGE NOI GROWTH

US 2000 – 2028F

* Home Sales represents all existing single-family transactions, not seasonally adjusted

Data Sources: Moody’s Analytics Data Buffet; Green Street Analytics (both sources accessed as of 2025 Q4)

CONCLUSION

Self-storage continues to demonstrate its value as a resilient, high-performing, and diversifying component of real estate portfolios. We believe strong historical performance, inflation resistant characteristics, and favorable demand–supply dynamics present a compelling entry point for investors. Heitman’s experience, scale, and operational sophistication position us to capitalize on this opportunity and attempt to deliver strong outcomes for our investors. Learn more about Heitman’s experience and advantage in the sector.

Disclaimer

Although the written materials contained herein were prepared from sources and data presumed by Heitman to be reliable, Heitman makes no representation or warranty, express or implied, with respect to their accuracy, timeliness or completeness. You are additionally informed that any information contained herein is always subject to change without notice. Finally, any statements contained herein that are “forward-looking statements” or otherwise are not historical facts but rather are based on expectations, estimates, projections and opinions of Heitman involve known and unknown risks, uncertainties and other factors. Actual events or results may differ materially from those reflected or contemplated in such statements. Accordingly, Heitman expressly disclaims any responsibility or liability for any loss or damage that may be incurred by any party who relies on the written materials contained herein.

Confidentiality Notice

The information contained herein is confidential and shall not be copied, reproduced, used or disclosed, in whole or in part, without the express written consent of Heitman, which may be withheld in Heitman’s sole and absolute discretion.

1. Past performance is not necessarily indicative of future results, and there can be no assurance that Heitman will achieve comparable results, be able to effectively implement its investment strategy, achieve its investment or asset allocation objectives or avoid substantial losses. ODCE is NCREIF Fund Index Open End Diversified Core Equity. Returns are sourced from NCREIF database filtered to ODCE funds and are gross of fee, unleveraged property level returns at legal share. There can be no assurance that the current and future investments of the Fund will perform at similar levels in the future.

2. CUBE, EXR, NSA, PSA 2Q 2025 Supplemental Financial Reports, accessed July 2025

3. Same-store NOI growth for self-storage during the most recent economic downturns and the subsequent three-year period (Dot Com, GFC, and COVID) has averaged 4.8%, outperforming all traditional property types. Green Street database, accessed Q1 2025.

4. Annualized total returns are an average of NPI returns from Q1 2020 to Q2 2025 and Green Street’s Commercial Property Return Index from 1/2020 to 6/2025. The eight property types included in the analysis were chosen because both NCREIF and Green Street provided returns for the period.