Andrew Capon, for CME Group

AT A GLANCE

- As electric vehicle demand grows, analysts predict 75% of all mined lithium could go to EVs by 2025

- After miners ramped up lithium production, prices halved between 2018 and 2020

Many of these new modes of transport are powered by the lithium-ion battery. Lithium, the world’s least dense metal (Atomic number 3) is also integral to powering the digital economy – mobile phones, tablets and laptops. But the biggest potential use for lithium-ion battery packs is in electric vehicles (EVs). Analysts at Citi predict that 75% of all mined lithium will go into EVs by 2025.

EV Demand Surges

Even during the midst of the pandemic and a 4.4% decline in global growth in 2020, sales of EVs surged by more than 700,000, topping 3 million globally. That is three times higher than 2017, according to figures from the IEA. China with its drive to clean up its polluted cities has been in the vanguard. However, last year Europe overtook China as the biggest global market for EVs. The latest IMF World Economic Outlook predicts robust global growth of 5.5% in 2021, a far more supportive outlook for growing EV sales than 2020.But the biggest growth driver is the determination of governments to reach their net zero carbon emissions targets by 2050. The UK and Germany have written this into binding legislation by 2050 and 2045, respectively. Both have also taken the radical step of banning the sale of new petrol and diesel cars from 2030.

The United Nations Conference on Climate Change (COP26) hosted by the UK government in Glasgow from November 1-12 is likely to see countries further enhance commitments on carbon emissions. This will come on top of already announced policies such as U.S. President Biden’s green stimulus and the European Union’s Green Deal.

The good news for consumers (and lithium demand) is that the prices of EVs and conventionally powered cars is rapidly converging. Industry analysts expect them to be broadly at parity in 2025. That is largely because the cost of batteries has been falling rapidly. A report by BloombergNEF states lithium-ion battery packs fell in price by 87% between 2010 and 2019. Though that pace of technological gains will be difficult to maintain, the broad trend of price falls is expected to continue.

Supply Boom and Price Crash

Lithium miners have not been oblivious to the rapid adoption of EVs. Sales went from close to zero in 2012 to 1 million units just five years later. Reports began appearing extrapolating exponential growth far into the future. The miners responded by massively ramping up production, a decision which had a disastrous effect on prices which more than halved between the summer of 2018 and 2020.

Lithium prices have been volatile but have bounced in early 2021.

There is no shortage of lithium, but it is difficult to process, requiring a lot of investment in infrastructure. It is extracted in one of two ways: pumped from underground brine reservoirs called salars (Chile has the largest reserves), then extracted through a series of evaporation tanks; or extracted from spodumene rocks (as is done with most of Australia’s lithium production). Globally, there is about a 50/50 split in brine/spodumene rock production, according to Fastmarkets.

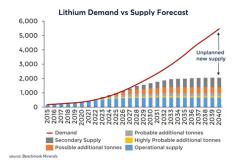

Production and consumption are now broadly at the point of equilibrium. Given the length of time it takes to get new projects on stream, demand is expected to modestly exceed supply from 2022.

Future Tech

Fundamentally, the technology underlying lithium-ion batteries has remained the same since the 1970s.Car manufacturers have been working on a rapidly emerging new battery technology, however. Lithium will continue to play a central role. Solid state lithium batteries use a solid material rather than a potentially combustible gel. These materials are neither volatile nor combustible. The higher energy density would increase the range of EVs by between one-third and a half with the same battery weight as a lithium-ion battery. Toyota have a solid state battery powered car prototype due to launch in 2021 with production expected in 2024, according to an article in The Nikkei in December 2020.

Lithium may also have a future role to play in the Holy Grail of cheap, limitless, zero carbon energy: nuclear fusion. Teams around the world are working on tokamaks. This is a magnetic confinement device designed to produce controlled nuclear fusion. The most ambitious project is the International Thermonuclear Experimental Reactor being built in France. Its target is to generate 500MW of electricity by 2035.

It may take a while for solid-state batteries to be fully commercially viable. Tokamak fusion reactors are still a relatively distant prospect. However, the central role lithium will play both in the batteries that power our tech, and increasingly our cars, will ensure its relevance for many years to come. China sees it as strategically important and has been securing its supply chain. In May 2018, Tianqi Lithium paid $4.1 billion to buy a stake of just under 25% in Chile’s SQM, the world’s second largest producer.

“Gigafactories,” Elon Musk’s once novel word for his five battery factories around world, will soon be regarded as critical national infrastructure. It is estimated that Europe needs 30 gigafactories by 2025 and Volkswagen Group alone are reportedly planning to build six. The IEA thinks demand for lithium will increase 40–fold by 2040. Once a rarely used commodity, lithium is about to take its place as an indispensable metal of the future.

Read more articles like this at OpenMarkets