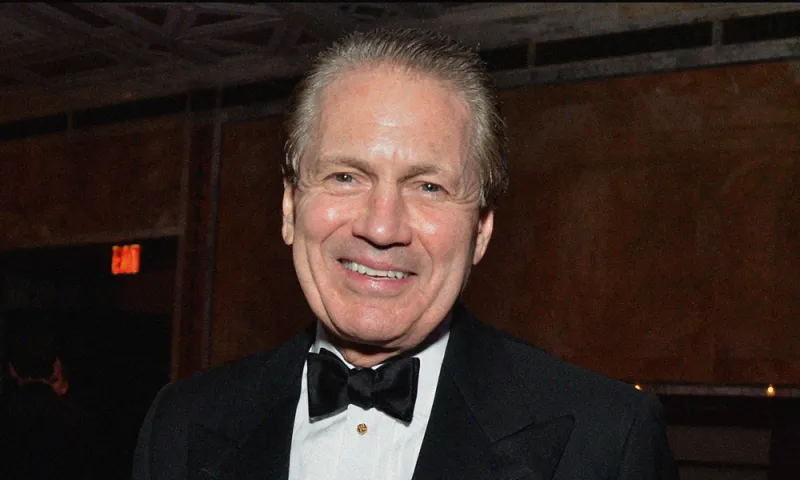

Two Sigma has named Tom Hill, the former head of Blackstone’s alternative asset management unit, to fill the newly created role of chairman of its private investing business.

Hill, who has been in a consulting role with the quantitative hedge fund firm since early 2019, will now set strategy and growth plans across its private businesses, according to a Two Sigma statement Thursday. That includes the firm’s Two Sigma Impact, Two Sigma Ventures, and Sightway Capital divisions.

Two Sigma has been investing in private markets for more than a decade, bringing its “scientific approach alongside its technology and data science expertise” to new strategies, according to the statement. Most recently, the firm started Two Sigma Impact, a private equity business that aims for “superior returns and positive social outcomes.”

“Our private investments business is an important part of the future of Two Sigma and we are confident in our ability to deliver differentiated returns in private markets under Tom’s leadership,” John Overdeck, co-founder and co-chairman of Two Sigma, said in the statement.

Two Sigma Ventures focuses on early-stage venture capital investment in “transformative companies harnessing information growth and computing power to change the world,” while its private equity group Sightway Capital invests in “data rich industries such as financial services and real assets,” according to the statement.

[II Deep Dive: KKR Moves to ‘Democratize’ Private Equity as SEC Signals Industry Scrutiny]

Before 2019, Hill served as president and chief executive officer of Blackstone Alternative Asset Management, which he built into “the world’s largest discretionary investor in hedge funds,” Two Sigma said. He joined private equity giant Blackstone in 1993 and retired from BAAM at the end of 2018.

“We have known Tom for over 20 years and he has always been a strong advocate for the ability of technology and data to help solve the toughest challenges across financial services, which is core to Two Sigma’s mission,” David Siegel, the firm’s co-founder and co-chairman, said in the statement.