Key Takeaways

- Energy stocks led a recent stock market rally amid rising tensions between the U.S. and Venezuela. Oil prices also edged higher.

- Despite initial reactions, investors should stay balanced in their approach amid any geopolitical-driven market turbulence.

Energy stocks powered a recent stock market rally as oil prices inched higher after the recent U.S. actions in Venezuela. Here’s what investors need to know about how events in Venezuela may impact oil prices and stocks.

Venezuela and oil prices

While oil prices initially rose nearly 2% on January 5, climbing above $58 per barrel, they remain near post-pandemic lows. Much uncertainty remains as to how the situation in Venezuela will unfold over time, including how oil markets will be impacted in the near term.

Venezuela has the world’s largest proven oil reserves (roughly 17% of global reserves), but it accounts for less than 1% of global production at roughly 800,000 barrels of oil a day—of which it exports about 500,000 barrels. That might be why there was initially a muted market response to the recent events in Venezuela.

Some fears of a disruption to global energy production that helped drive oil prices up are occurring amid a bearish period for oil prices. In addition to the first several months of any year typically being a strong supply and low demand period, more U.S. shale source development and increasing efficiencies procuring those resources have helped put a ceiling on oil prices in recent years. That led to oil trading near multiyear lows prior to events in Venezuela.

What’s next for oil prices? Kristen Dougherty, portfolio manager at Fidelity, thinks it may take some time for any changes in Venezuela oil production to have a notable impact.

“Given the abruptness of the political transition in Venezuela, and the country’s long history of underinvestment in its energy infrastructure, I expect any material changes in Venezuela’s oil exports will take an extended amount of time before they can affect global oil supply, and thus affect oil prices,” Dougherty notes. “And I still think oil prices are likely to remain range-bound in 2026, as phased output increases from the Organization of the Petroleum Exporting Companies (OPEC) are gradually absorbed by steady global demand.”

Why oil prices matter

While the full impact of recent events on oil prices and the broad market may be uncertain, investors may want to monitor the situation. That’s because oil prices have been a critical factor impacting inflation, interest rates, and stock markets.

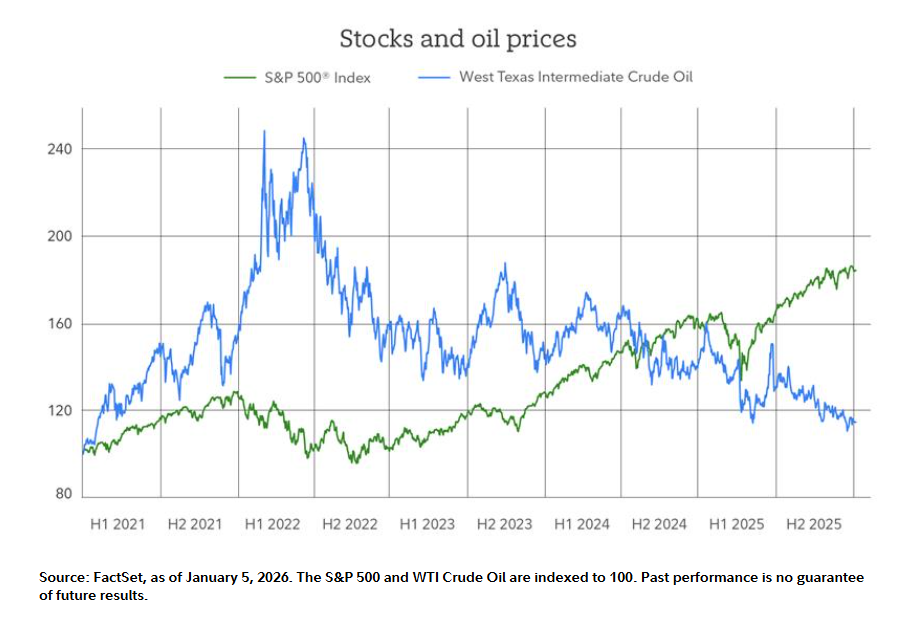

Consider the chart below, which shows the somewhat inverse relationship between the S&P 500 and oil over the past five years. When oil prices have been falling and/or are relatively low, stocks have tended to rally. Conversely, when oil prices are rising and/or are relatively high, stocks have generally not performed as well.

A good example of this dynamic occurred in 2025, when the S&P 500 gained 17% as crude oil lost nearly 20%—the largest annual decline in oil prices in 5 years.

At the sector level, rising oil prices tend to be bullish historically for energy stocks and bearish for most other sectors. Alternatively, falling oil prices tend to be bearish historically for the energy sector and bullish for most other sectors. That's because energy costs, which are a ubiquitous operating cost for most businesses to varying degrees, can impact the profitability of a business. Oil prices can be a particularly significant factor for industries like airlines and transportation.

Additionally, prices for gasoline and heating oil—which are derivative products of crude oil—can influence consumer spending. Higher prices can limit discretionary spending, while lower prices can enable more spending. Higher prices can also impact the Fed’s willingness to cut interest rates.

Energy stocks power up

In 2025, the energy sector gained 5.5%, well below the S&P 500’s 17% price return. However, the energy sector was initially the biggest mover when news broke about events in Venezuela. The bullish sentiment for energy stocks appears to be based on the idea that U.S. oil companies may play a role in rebuilding Venezuela’s oil infrastructure.

“There has been a worsening disconnect between the quality of a country’s reserves and their ability to produce those reserves in ways that contribute to the global market,” Dougherty notes. “The prospect of reversing that is an exciting opportunity for oil and gas producers with historic in-country expertise and to oilfield services companies whose technology would be needed to reverse years of decline over the medium term.”

To that point, the energy equipment and services industry surged 7% in the immediate aftermath of U.S. initiatives in Venezuela.

Investing considerations

Investors seemed to initially sidestep market risks that may have arisen from the recent actions in Venezuela as stocks reached fresh all-time highs. However, markets can move rapidly—especially if there are new developments.

Much like other recent geopolitical tensions that have flared up around the globe, this can serve as a valuable reminder that, while monitoring markets and having a plan to adapt to changing market conditions as needed makes for smart strategy, investors should remain calm during such times. If the recent tensions in Venezuela lead to some market volatility, stay balanced and diversified amid any short-term fluctuations.

Find more research, market perspectives, and analysis from Fidelity’s thought leaders on Fidelity for Institutional Investors.

Please visit Fidelity’s Communities on Alternative Investments.

Past performance is no guarantee of future results.

This information is intended for the sole use of institutional investors. Retail investors and any other persons who are not institutional investors should not act or rely on this information.

Unless otherwise expressly disclosed to you in writing, the information provided in this material is for educational purposes only. Any viewpoints expressed by Fidelity are not intended to be used as a primary basis for your investment decisions and are based on facts and circumstances at the point in time they are made and are not particular to you. Accordingly, nothing in this material constitutes impartial investment advice or advice in a fiduciary capacity, as defined or under the Employee Retirement Income Security Act of 1974 or the Internal Revenue Code of 1986, both as amended. Fidelity and its representatives may have a conflict of interest in the products or services mentioned in this material because they have a financial interest in the products or services and may receive compensation, directly or indirectly, in connection with the management, distribution, and/or servicing of these products or services, including Fidelity funds, certain third-party funds and products, and certain investment services. Before making any investment decisions, you should take into account all of the particular facts and circumstances of your or your client’s individual situation and reach out to an investment professional, if applicable.

Because of their narrow focus, sector investments tend to be more volatile than investments that diversify across many sectors and companies.

The S&P 500® Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent US equity performance.

Indexes are unmanaged. It is not possible to invest directly in an index.

Investing involves risk, including risk of total loss.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC; and institutional advisory services through Fidelity Institutional Wealth Adviser LLC.

1243486.2.0