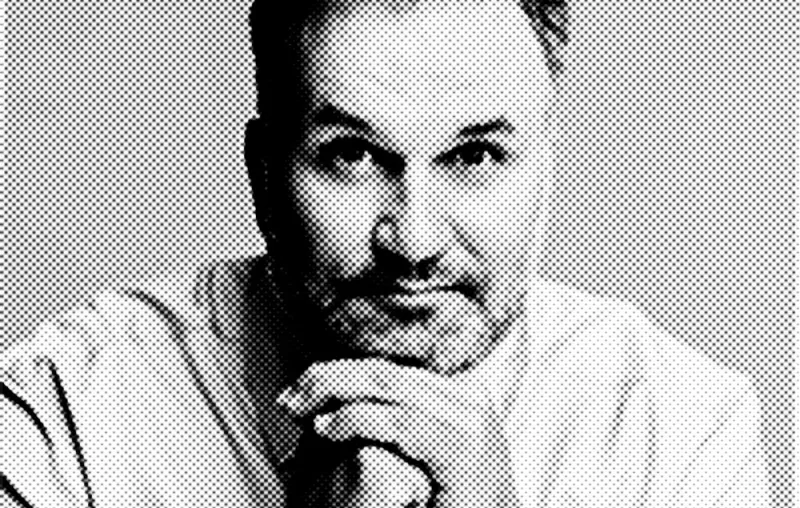

Samuel Kunz, head of asset allocation and investment strategy for the University of California, has left the UC investment office for a wealth management job.

In his role as head of investment strategy, Kunz set the strategic and tactical asset allocations for the university’s pension, defined contribution plan, working capital, and captive insurance program, which combined have more than $105 billion in assets. Kunz resigned on Monday, according to a source familiar with the matter. A University of California spokesman did not return calls by press time.

[II Deep Dive: Behind Closed Doors, University of California Officials Address Mismanagement Claims]

Kunz is leaving the university to join Core Financial Partners in Los Angeles as the firm’s first chief investment officer.

Core was founded in 2010 by John Koudsi, an entrepreneur and adviser. The wealth management arm of the Kobre Companies, Core uses the endowment model with a heavy allocation to private investments to manage high-net-worth investors’ wealth. The company operates like a family office.

Kunz, who had reported directly to chief investment officer Jagdeep Bachher as a managing director at the UC investment office, had been with the university since November 2014.

Baccher had hired Kunz and a number of other executives shortly after he joined the university as CIO in April 2014. In 2018, three executives left one after another, including senior managing director Eduard van Gelderen. Gelderen, the former CEO of APG Asset Management, exited after only a year on the job. Investment officer Tom Fischer and head of equities Scott Chan also resigned their posts in 2018.

That same year, an investigation by Institutional Investor found that Bachher had allegedly used investment staff for personal errands, overrode asset-class heads’ opposition to invest with UC’s ex-investments chair, and twice leaked confidential information about an outgoing employee.

More recently, II reported that UC still owned oil companies, despite the university’s claims of being fossil free.