The University of California’s investment office is moving to divest from activist investing firm Elliott Management Corp, an email from a UC staffer reviewed by Institutional Investor shows.

Both the Communications Workers of America union and the Private Equity Stakeholder Project — which represents workers and other stakeholders at private-equity owned companies — are pushing institutional investors to drop Elliott due to underperformance and its activist position in AT&T.

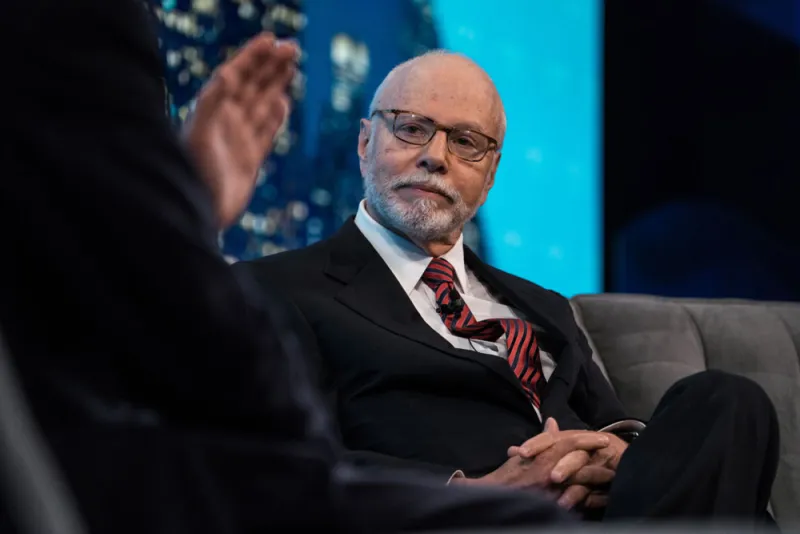

Elliott disclosed a $3.2 billion stake in the communications giant in September, II reported at the time. Elliott’s Paul Singer penned a letter to the company, calling into question its M&A record and “deteriorating operational performance.”

In January, the University of California’s director of ESG replied to an email from Pilar Sorensen, a representative from the Private Equity Stakeholder Project.

“As it turns out, UC Investments is in the process of phasing out its relationship with Elliott Management,” Wendy Pulling wrote in the message, which the Private Equity Stakeholder Project verified as authentic.

The university system had invested with Elliott’s International Fund, a public document shows. The net internal rate of return on its investment, which was made after January 1, 2017, was 7.5 percent, the document shows. The base value of the UC retirement plan portfolio’s investment in Elliot was nearly $276 million a portfolio document shows, the general endowment fund had $176 million worth as of June 30, per a separate document.

A spokesperson for the University of California investment office declined to comment.

[II Deep Dive: Paul Singer Has Been Called a ‘Doomsday Investor.’ Now He’s Hoping for Calm Waters.]

The Communications Workers of America said in a statement that after Elliott bought a stake in AT&T in September, the company cut more than 4,000 jobs during the fourth quarter of 2019 and initiated $30 billion in stock buybacks.

The group, which represents 100,000 AT&T workers, has been contacting institutional investors including public pension funds and endowments and foundations, pushing for them to ask Elliott questions about its AT&T campaign. A spokesperson for Elliott did not respond to an email seeking comment.

Note: This article was updated April 14 to include investment values.