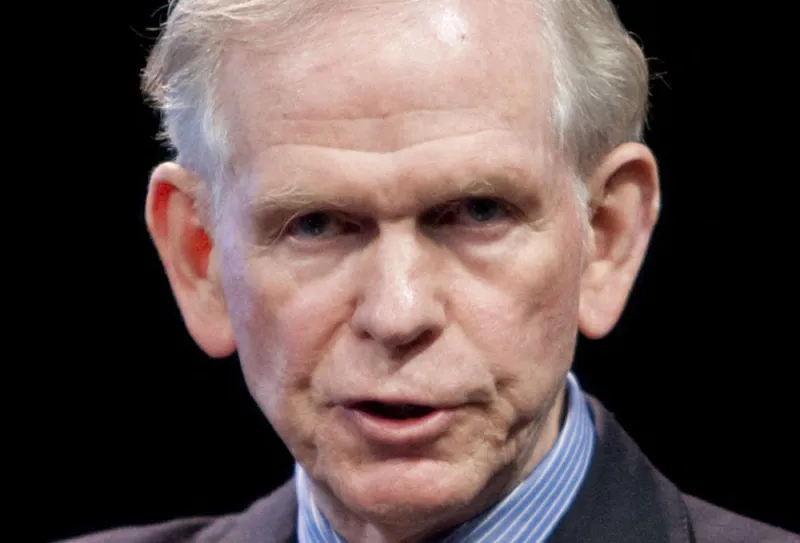

GMO, the investment firm co-founded by Jeremy Grantham, sees buying opportunities in a stock market roiled by coronavirus fears.

“There are not a lot of historical pandemics to look at,” Ben Inker, head of GMO’s asset allocation team, said Thursday in a phone interview. “This is the kind of event that, as we saw over the last few weeks in China, can have an extreme short-term impact on economic activity.”

While a global recession would not be a “weird” outcome from the coronavirus pandemic, Inker does not expect the event to be extreme enough in depth and duration to cause “massive dilution” to shareholders or change the return on capital over the long term.

GMO’s view of fair value hasn’t changed much after the stock market’s plunge this week, according to Inker. With prices being lower, “we get more excited about equity,” he said.

The U.S. stock market came into the coronavirus turmoil “awfully expensive to history,” said Inker. GMO continues to see investment opportunities, particularly in value-oriented stocks in emerging and international markets that had already looked cheap relative to large-cap U.S. equities.

[II Deep Dive: Why Is No One Listening to Jeremy Grantham?]

GMO had its entire staff work remotely Thursday, a move that followed readiness exercises and infrastructure testing to ensure operations run smoothly amid coronavirus concerns.

It was the first time the Boston-based company had everyone working from home since testing employees’ ability to do so individually, Inker said. GMO will keep testing measures already in place to avoid any interruption of its business, investment, and client services activities.

The viral outbreak has overturned financial markets, but the long-term impact on the economy and companies’ earnings is likely to be minor, according to Inker.

“This is not like a major war where all the factories get destroyed,” he said. “It doesn’t strike us as likely to really impact the economy’s ability to function once we get beyond the acute throes of trying to deal with the virus.”