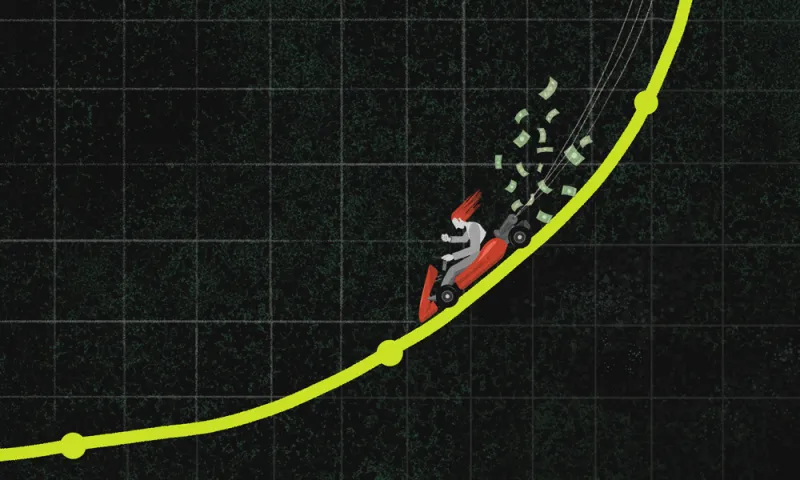

Private equity’s popularity is paying off for industry professionals, who reported higher salaries and bigger bonuses in Heidrick & Struggles International’s industry compensation report.

Managing partners, the most senior professionals at private equity firms, saw the biggest jump in salary, earning 13.6 percent more this year with an average base pay of $786,000, according to the report, released Wednesday. Their total cash compensation, including bonuses, had increased 8.6 percent last year to $1.54 million. The findings of Heidrick & Struggles, a Chicago-based recruitment firm, are based on a survey of 630 investment professionals in North America.

The rising pay follows strong fundraising and steady deal making within the private equity industry, with Heidrick & Struggles pointing to fundraising as a “crucial component in determining compensation.” Private equity firms raised $243 billion in the U.S. in 2017, the most in at least eight years, according to the report.

Among the private equity professionals surveyed by the recruiting firm, 57 percent said their base pay rose this year. Although 2018 bonus compensation was not included in the report, 77 percent of respondents said their bonuses increased last year — some by more than 50 percent.

[II Deep Dive: Hedge Fund Paychecks, Revealed]

More years of private equity experience and higher levels of assets under management translated into higher total cash compensation, Heidrick & Struggles found. Principals — who have experience leading their own investments but no extensive track record — reported an average salary of $289,000 this year, jumping 10.3 percent from 2017, according to the survey.

Sixty-four percent of private equity investment professionals said they receive a discretionary bonus, while 23 percent of those surveyed said their bonuses are based on formulas set by their firms.

Some private equity professionals are also eligible to receive carried interest, a cut of profits from a fund’s investments. All managing partners, partners, managing directors, and principals earn carried interest, the report shows. Managing partners are typically founders, while partners and managing directors are experienced deal makers and board members, according to Heidrick & Struggles.

More junior roles are not always provided carried interest as a form of compensation. Ninety-five percent of vice presidents and 32 percent of associates receive carry, the recruitment firm found.