As Western military powers fought to contain Libyan leader Moammar Gadhafi’s crackdown on rebels, investors gained confidence on Tuesday that disruptions in the energy market would be limited.

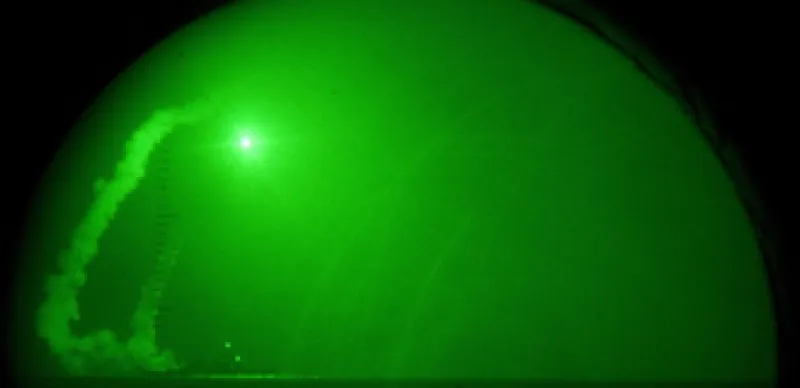

A US military official said on Monday the no-fly zone will be increased, and that US, French and British forces had fired at least 10 more missiles at Libyan military targets, including a compound where Libyan leader Colonel Moammar Gadhafi has operated.

Crude oil prices fell 64 cents a barrel in New York on Tuesday to $101.69, giving up much of the prior day’s gains. On Monday, the price of a barrel of oil on the New York Mercantile Exchange rose $1.26 to $102.33, and the price of European benchmark Brent rose 82 cents to $114.75.

While prices are shifting by the day, Brent is up from a 52-week low of $69.55. West Texas Intermediate, traded in New York, is up from a 52-week low of $68.01. Brent is up 21 percent for the year to date, and WTI is up 11 percent. Europe is tied more closely to exports from the Mideast, while US regional supplies draw from the Gulf of Mexico and other regions, too.

The question now is whether prices will continue to rise.

The sentiment on Tuesday was that events in the Middle East and North Africa were unlikely to push prices much higher. “The unrest in Libya seems to be priced in almost completely by now,” Eugene Weinberg, head of commodities research at Commerzbank AG in Frankfurt, told Bloomberg TV.

Others believe that the risk of contagion can’t be ruled out.

“Event risk is building in the oil market,” Deutsche Bank analysts said Monday in a report. The obvious risk factor is Libya, but there is rising intensity of conflict in Yemen, where military commanders have switched sides and joined forces with rebels.

The risks in Bahrain are rising, too. Saudi forces have crossed the border into Bahrain to help maintain order. That has roused the ire of Saudi rival Iran. The presence of a US naval base in Bahrain complicates the military situation as well, creating the potential for wider US involvement. “The situation in Bahrain warrants more attention from the market,” a commodities researcher at Barclays Capital said.

Libyan oil production is dropping and is expected to fall to zero in April. The Saudis have been making up the difference in a bid to keep prices from rising too fast. But Saudi excess capacity is falling, creating a relatively thin margin of safety. If the regional conflict in the Middle East and North Africa continues to widen, Saudi Arabia’s excess capacity could hit the limit. And should the Saudi regime trigger more domestic protests or become engaged in a more serious military operation, its own production capacity could be diminished.

Investors have been betting very heavily on higher oil prices. On Thursday 17th, Goldman Sachs energy analyst David Greely said in a note to investors that net speculative long positions in oil had reached 391 million barrels. In contrast, when oil reached a peak of $145 a barrel in July 2008, net speculative long positions were less than 100 million barrels, he said.

How high can oil prices go? That depends on a range of factors, from global economic growth to the crisis in Japan, which will lessen reliance on nuclear energy and boost demand for oil, coal and natural gas. All of those factors – and the upheaval in the Middle East – will bear watching.

Greely says that each 1 million barrels in speculative long positions boosts the price of oil by 8 to 10 cents. Since the net speculative long position has increased by about 100 million barrels since the uprising began, it appears that the market has put a $10 per barrel risk premium on oil.

“With reports of protests in Syrian and Yemen, hostilities at the Gaza/Israel border, and Saudi troops in Bahrain, the risk of political contagion remains,” he says. “These developments suggest that the $10 per barrel risk premium may be too modest. The balance of risks remains clearly skewed to the upside.”