As 2026 approaches, one thing is clear: Investors are navigating a market that feels both familiar and fundamentally different. Growth is uneven but still has room to run. Technology is transforming productivity, yet its impact on profits and portfolios is still being tested. Meanwhile, rates across the globe are moving in different directions.

In our 2026 outlook, investment and market leaders from across BNY tackle six questions we believe will shape the year ahead.

1. Can the global economy maintain its delicate balance through 2026?

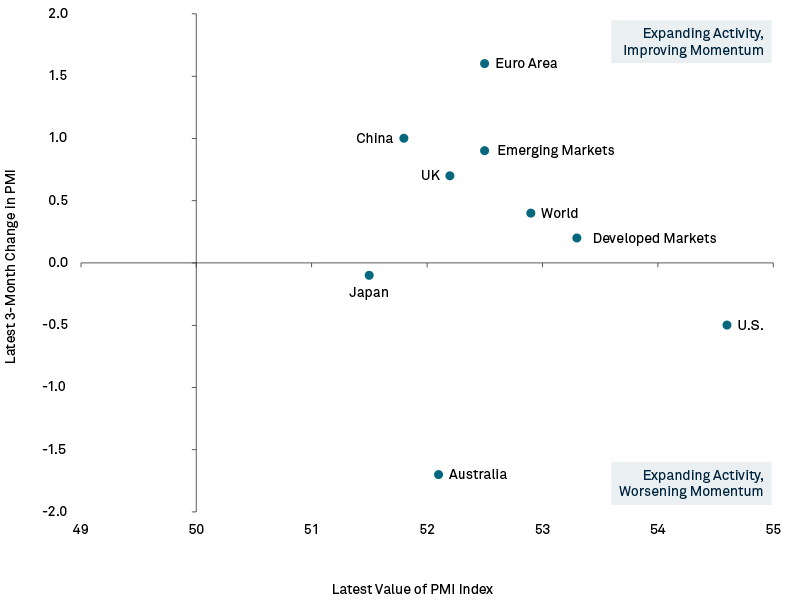

We see forces balancing toward growth re-acceleration, with support from fiscal and monetary policies. U.S. growth is expected to lead in 2026, as the Federal Reserve (Fed) eases and fiscal actions gain traction. Europe should expand modestly, driven by Germany’s fiscal stimulus and improving real incomes. China’s recovery could remain uneven amid property-sector strain and deflation pressures.

Overall, the economy looks primed for a steady advance against a firmer economic backdrop, which also continues to shift. We remain optimistic and will closely watch the evolving signals.

Global Composite PMI Momentum

2. What’s next for central banks?

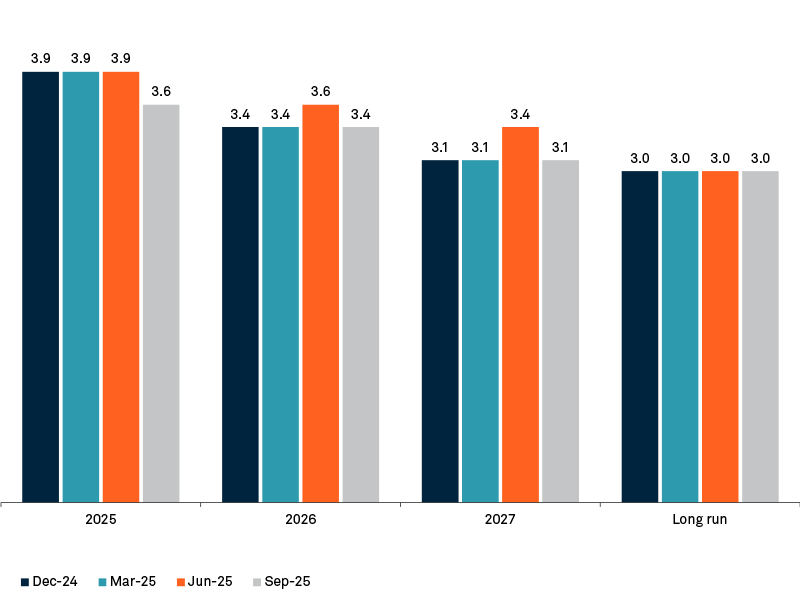

With U.S. inflation projected to be just modestly above target, the Fed will likely emphasize supporting employment and growth, though upcoming board changes could affect the size and speed of rate cuts. The Fed will likely keep cutting rates next year until the economy and financial markets stop it, bringing the lower bound of the range to 2.5% by 2027.

The European Central Bank may ease slightly, while the Bank of England and Bank of Japan are likely to firm policy rates, with the latter negotiating a complicated government transition that leaves it open to domestic political pressure.

Appropriate Fed Funds Rate

3. How are diverging rate paths shaping fixed income in the U.S., Europe and emerging markets (EM)?

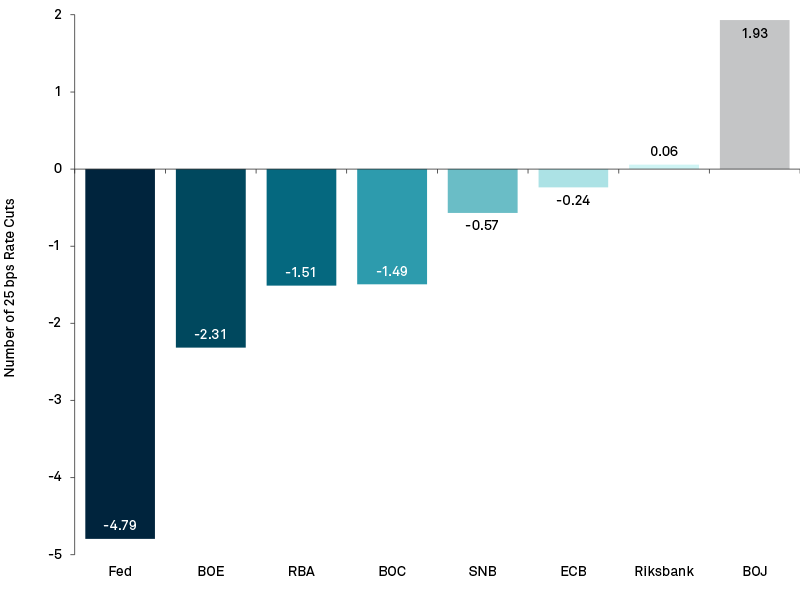

After years of synchronized easing, monetary paths now vary. This dispersion is creating new opportunities in fixed income but also demands a more selective approach. In the U.S., the Fed’s renewed rate cuts and fiscal expansion could support front-end Treasuries and high-quality credit, though long-end risks remain.

The European Central Bank faces uneven growth and fiscal strain, especially in France where widening deficits and political gridlock over deficits make a resolution difficult. The Bank of England is navigating stubborn inflation and wage growth. Most countries in Latin America and Asia are in the process of cutting rates while retaining policy flexibility in case growth momentum slows.

Opportunities are becoming more idiosyncratic and investors who stay nimble and selective across regions, duration and credit quality may be well positioned to capture them.

Interest Rate Expectation

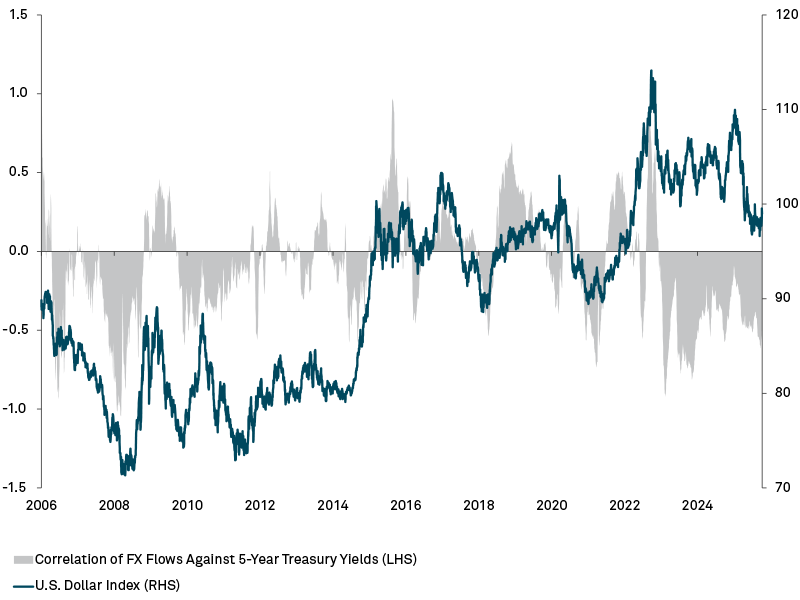

4. Is 2026 a turning point for the U.S. dollar?

As the world continues to shift toward a multi-polar balance of power, we think multiple reserve currencies will be used for trade finance, payments and store of value. As fiscal vulnerabilities across developed economies weigh on major currencies, the U.S. dollar’s safe haven status is on softer footing. We think investors will increasingly hedge their U.S.-dollar exposure. Demand for U.S. assets will also matter. Overseas investors are generally underweight the U.S., and given our view for U.S.-led growth in 2026, it is likely they may increase their exposure to U.S. assets while actively managing the currency exposure.

U.S. Dollar Index

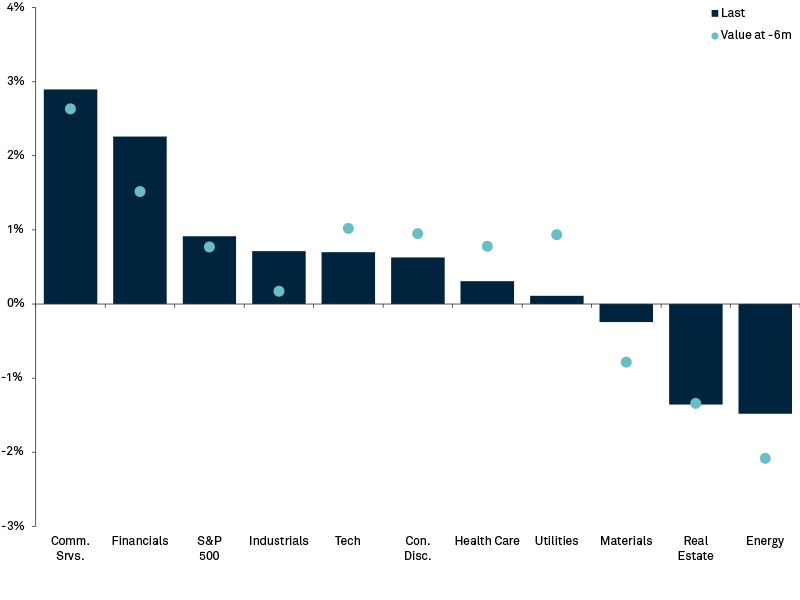

5. Are U.S. equity valuations too rich?

We see today’s valuations as part of a higher-multiple environment supported by stronger profitability and a larger index weight to tech. Economic and earnings growth remain resilient, with global earnings revisions trending higher and profitability broadening beyond big tech. Rising productivity and ongoing AI adoption should further reinforce record-level margins and long-term earnings growth. In our view, higher valuations reflect stronger fundamentals.

Change in Profit Margins Relative to 6-months Ago

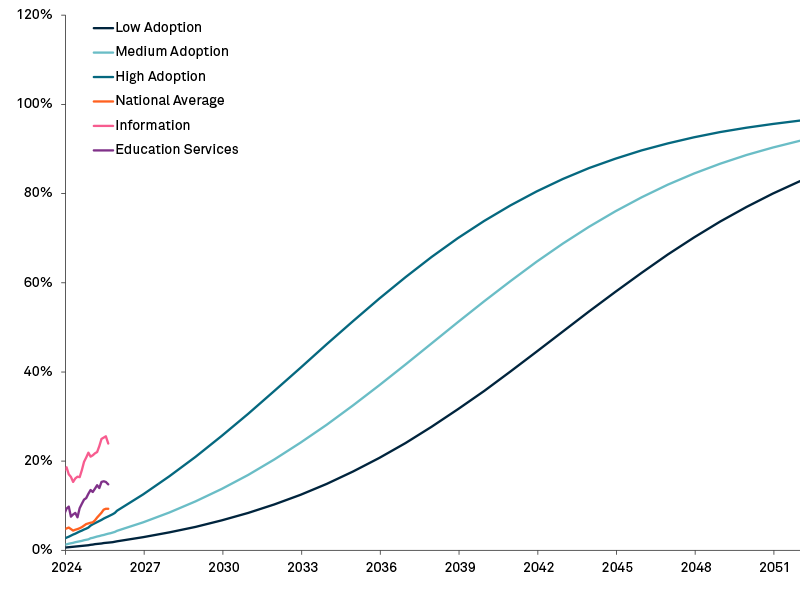

6. Who are the long-term winners of AI?

AI lowers the cost of accessing and transforming information, reducing the scarcity that underpins information-based competitive advantages. As a result, sectors whose advantages stem from physical assets, regulatory barriers or network effects may find their advantages preserved, and AI-related productivity gains in these sectors could more likely accrue to shareholders.

At the same time, AI’s impact extends beyond productivity to demand — as prices fall, more consumers can access previously out-of-reach goods and services. This dynamic may unlock new markets and drive broader profitability. AI’s winners will be firms that convert technological efficiency into enduring demand and durable market power.

U.S.: Rate of Generative AI Adoption

Allocating for a Multi-Dimensional World

Investors are facing the unexpected in 2026, so broad diversification is a leading theme. Overall, robust balance sheets, supportive macro conditions, and accommodative monetary policies provide ample support for the global economy to continue to grow and for risk assets to perform. In our view, opportunities come from both leaning into U.S. market strength while identifying emerging opportunities across sectors, regions, and asset classes. Evolving fiscal dynamics, divergent monetary policy and currency headwinds remain risks. The risks are real, but so are the opportunities. We believe markets are positioned for growth in a supportive, but increasingly multi-dimensional, environment.

Download our full investment outlook for 2026 to explore these questions further and see how BNY Investments can help you navigate the year ahead.

BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material and any products and services mentioned may be issued or provided in various countries by duly authorized and regulated subsidiaries, affiliates, and joint ventures of BNY. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

© 2025 The Bank of New York Mellon. All rights reserved. Member FDIC.

MARK-856811-2025-12-22