It’s not easy for investors to grasp the dynamics of consumer spending across emerging markets. We at AllianceBernstein think the best way is to look inside the refrigerators of people across the developing world.

Refrigerators are more than just a place to store perishables. Their contents speak volumes about their owners, and their proliferation signals a country’s economic progression. Fridges and their contents, therefore, can serve as a guide for investors seeking to understand the spending habits of emerging-markets consumers — a group that is projected to increase spending eightfold, to $63 trillion, by 2030, according to our forecasts, based on OECD data.

Emerging-markets consumers defy straightforward classifications. Some analysts look at income, assets or people per room as a framework. In our view, this approach is flawed. For example, standard of living measures take into account possession of certain items to determine a household’s socioeconomic status. Under such a rubric, a person with items including a laptop computer, television, mobile phone and sound system could be classified as rich. Yet in our field research, we’ve met people in countries like Ghana whose ramshackle homes are full of electronic devices yet by other measures would be considered poor.

Kitchens offer a more honest reflection. Behind the fridge door lies an abundance of information that can help us understand who emerging consumers are and how they’re likely to spend money. We’ve analyzed the contents of 70 refrigerators in rural and urban homes that we visited across 12 developing countries, from Chile to China. Although it may not be a statistical sample, the initial patterns we’ve seen suggest that the inside of a fridge mirrors the socioeconomic status of a home.

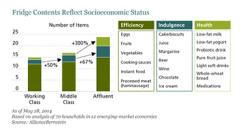

In working-class homes, fridges are used mainly for efficiency items (see chart), which include staple goods such as eggs, fruits and vegetables and some precooked food. Fridges in middle-income households tend to have more indulgences on hand, from alcoholic beverages to ice cream and cheese. And for affluent households, where health is often a primary concern, we can expect to find foods like low-fat yogurt or 100 percent fruit juice.

Why is this important? Once we understand how people’s tastes change as their income levels increase, we can also figure out how best to invest in different countries’ consumer goods sectors.

Our research suggests that Chinese consumers are in the indulgence phase. Companies that make products like beer, butter and chocolate stand to benefit from rising incomes there. Indian families are still buying fridges and filling them with efficiency items like milk, yogurt and ready-made sauces. Brazil has already shifted toward health mode, which should see high-end food producers draw more spending.

Each phase of this consumer evolution is likely to last several years in any given country. Moreover, we believe that this framework can help us learn more about consumers beyond their eating habits. Those who stock their fridge with indulgence items are also more likely to spend in other areas, such as going to the movies or taking short, domestic vacations. Health-conscious eaters will probably also be inclined to buy more health care and beauty products. And the life efficiencies provided by refrigerators can help emancipate women from the home — and empower them to generate income. This could have huge implications for economies and future consumer spending patterns, as it did in the U.S. during the 1950s.

Of course, specific investing conclusions differ in every country. We also need to study market environments and company fundamentals to identify successful portfolio candidates. But by peering into the depths of refrigerators across the emerging-markets world, we think investors can gain vital intelligence to understanding the people, lifestyles and spending habits that will unlock earnings growth in consumer goods companies.

Tassos Stassopoulos is a senior vice president and manages the emerging consumer portfolio, as well as the global growth and thematic portfolios, at AllianceBernstein in London.

See AllianceBernstein’s disclaimer.

Get more on emerging markets.