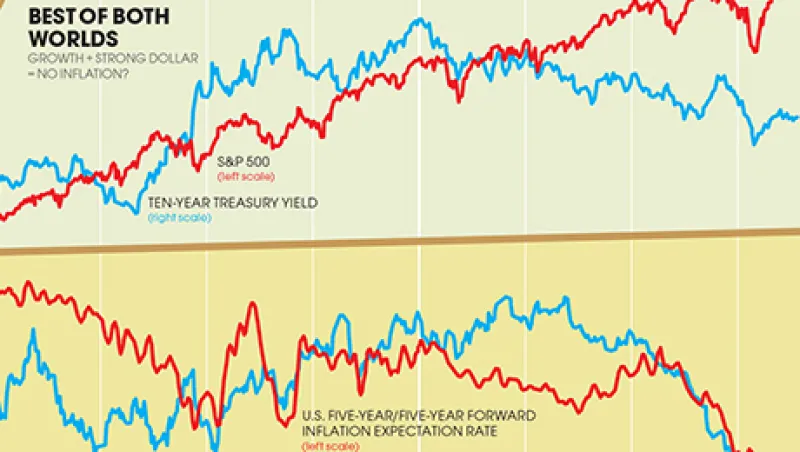

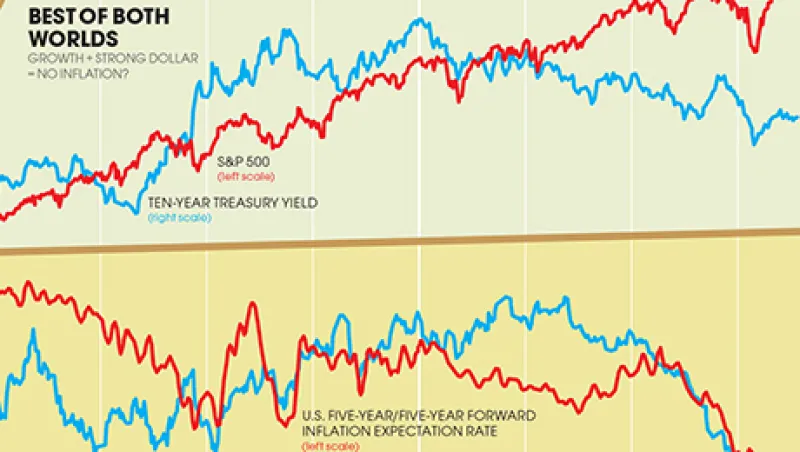

Is Growth and Low Inflation Coming to an End in the U.S.?

The U.S. is enjoying strong economic growth, but will a Fed rate hike and weak global economy cut the good times short?

Editors

December 14, 2014