Argentina made history in 2001 when it defaulted on nearly $100 billion of sovereign debt amid an economic depression. Unemployment surged to 26 percent, poverty rates escalated, and several major companies went bankrupt. Yet the decision to default and devalue, abandoning the Argentine peso’s fixed peg to the U.S. dollar, paved the way for a dramatic turnaround.

The adoption of stimulative fiscal and monetary policies under then-president Néstor Kirchner, who took office in May 2003, helped fuel the recovery. The rise of a commodities supercycle also boosted the economy, driving up the value of soybean exports in particular. The net result: Argentina grew at a rate of between 7 and 9 percent a year from 2003 through 2008, and the country enjoyed large fiscal and current account surpluses.

In an emerging market like Argentina, economic prospects and political risk are tightly bound together, influencing the confidence of domestic and foreign investors alike. Those factors have been a toxic cocktail of late. The economy has fallen into another rut since President Cristina Fernández de Kirchner, who succeeded her husband in 2007, started a second term in 2011. The economy dipped into recession last year, and inflation is hovering around 40 percent, according to private consultants, one of the highest rates in the world. The country also defaulted for a second time in 12 years last July when it failed to pay interest to so-called holdout creditors, led by Paul Singer’s NML Capital. The holdouts rejected the terms of Argentina’s previous debt restructurings of 2005 and 2010 and persuaded a U.S. judge to back their demand for repayment in full. Adding insult to injury, Argentina was overtaken by Colombia last year as the third-largest economy in Latin America, behind Brazil and Mexico.

Now investors hope that this October’s presidential election will produce a government committed to reforms that can jump-start growth. The task won’t be easy. “At the end of the day, this administration will give up a macroeconomic legacy that will be challenging to manage,” says Marcos Buscaglia, head of Latin American economics at Bank of America Merrill Lynch Global Research. “There will be low international reserves, high inflation, a high fiscal deficit, and there will be a misalignment in relative prices.”

To revive the economy the next government needs to make a sharp break from the Fernández policies of deficit spending and tolerance of high inflation, and adopt market-friendly reforms to attract capital, analysts say. The new president should also devalue the currency and reach agreements with holdout creditors to allow Argentina to reenter international capital markets, they add. The leading presidential candidates — Buenos Aires Mayor Mauricio Macri, Fernández’s former chief of staff, Sergio Massa, and Daniel Scioli, governor of the province of Buenos Aires and former vice president under Kirchner — are making market-friendly noises, says New York–based Buscaglia.

“We are optimistic on Argentina in the sense that we think that they’re going to see possible policy change after the elections and that there’s going to be more consensus policies,” says Buscaglia. “We just try to be realistic and also understand that at the same time this country needs an adjustment.”

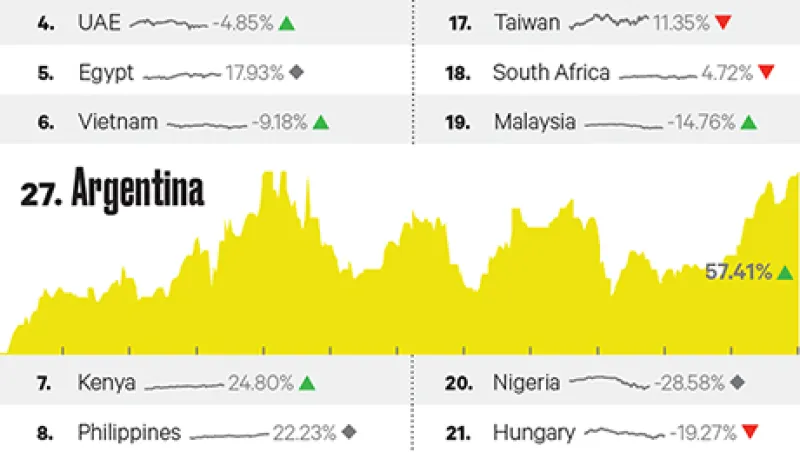

Financial markets are already reflecting hopes of a change. The Buenos Aires Stock Exchange’s Merval Index was up 83.17 percent over the past 12 months, as of mid-March, and a rally in Argentine bonds has trimmed the yield spread over U.S. Treasuries to some 600 basis points from 800 a year ago.

“What you have is a phenomenal upsurge of financial asset prices of sovereign bonds, corporate bonds and equities,” says Ricardo Cavanagh, head of equities for Argentina and the Andean region at Itaú BBA. “This is basically the perception that Argentina will be reopening to capital markets and introducing changes to some ongoing policies.”

“The most important factor is that there is a business expectation that things will improve in terms of microeconomics,” says Buscaglia, “so it’s not a time to be heading out of Argentina. It’s a moment to keep your feet on the plate and wait for change.”