Investors are fleeing emerging markets equities en masse. We at AllianceBernstein think they need a new playbook. Great investments can still be found across the developing world — just not in the usual places.

Macro conditions are a lot harsher than they have been over the past decade, when China’s manufacturing juggernaut was in ascendance and spreading prosperity to other developing countries. Investors can no longer treat emerging markets as a homogeneous bunch — and should be prepared for rougher economic cross-currents ahead.

But in our view, investors shouldn’t reject these stocks outright. Emerging markets are still home to many of the world’s fastest-growing economies and most dynamic companies. New and exciting opportunities are surfacing every day. As we see it, winning in the future will depend on identifying pockets of strength — even in weak economies — and catching nascent trends before they become obvious to others.

Our first order of business, then, is to vanquish some of the long-held misconceptions obscuring today’s emerging-markets investment picture. Here are five standouts:

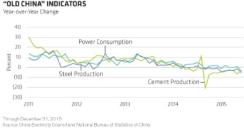

You have to predict Chinese policy to win. Wrong. The measures that pertained to a bygone China — flatlining power, cement and steel production — are signs of an economy losing steam (see chart 1). But even under conservative forecasts, China’s growth is still expected to create an economy the size of South Korea, Canada or Spain every two to three years. It defies logic to say that China isn’t incubating vast opportunities.

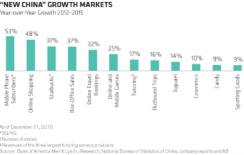

Many of these opportunities include burgeoning industries catering to China’s rising consumer class (see chart 2). Mobile phone subscriptions, Internet shopping and online gaming are growing robustly. Sales of chewing gum and candy are brisk, as is spending on movies, foreign travel, sportswear and cosmetics. Starbucks coffee shops are popping up in every major city. We think these businesses have only scratched the surface of their growth potential.

It’s all about the commodities supercycle. Not quite. Such cycles are born every 20 to 40 years. The most recent one peaked in 2010. Resource-dependent economies and industries will remain hard-pressed as pricing normalizes. But those that consume resources — India, for one — are already reaping rewards.

More to the point, emerging-markets investors need to keep their vistas wide. The industrial-manufacturing suppliers in Mexico, Vietnam, Poland, Hungary and the Czech Republic should continue to gain from China’s waning status as a source for low-cost labor and from reviving demand from developed-markets customers. We’re also keeping an eye on developments in Argentina. Actions by the country’s newly elected, reform-minded government to undo the damage of the former regime’s policies have already reduced sovereign bond spreads and improved the competitiveness of its export industries.

The aging populations of emerging Asia are also helping certain sectors expand. For example, South Korean convenience store operators are gaining share with their small-format stores, which are easier for their increasingly elderly customers to navigate.

Emerging-markets consumers are the only source of growth. Here’s why not. Shoppers in developing economies are indeed creating big opportunities for investors. But they aren’t the only game in town. Many emerging-markets companies are making steady inroads with developed-markets consumers. A large share of the earnings growth of Mexican food-processing company Gruma is coming from selling tortillas to customers in the U.S. Certain Mexican airports have become malls with runways, profiting from a captive customer base of big-spending foreign travelers. Yarn spinners, fabric mills and sneaker makers in Asian emerging markets are riding the phenomenal popularity of athleisure sportswear in the U.S. and Europe.

A stronger U.S. dollar is bad for all emerging-markets companies. Not exactly right. The strong greenback is a boost for developing-world companies selling mostly locally made products to global markets. Brazilian jet maker Embraer and pulp-and-paper producers Suzano Papel e Celulose, also based in Brazil, and Sappi, based in South Africa, are in this category.

The best way to access EM growth is to invest in EM-domiciled companies. Not always. Sometimes the developed-markets parent of a developing-markets subsidiary offers investors a more attractive entry into a lucrative emerging-markets business. For example, Suzuki Motor Corp. may look more attractively valued than its Indian subsidiary, Maruti Suzuki India — a key profit driver — for playing auto sales growth in emerging markets. Similarly, owning parent company Anheuser-Busch InBev may be a better deal than owning its Brazilian subsidiary, Ambev. In addition to a stake in Ambev, Anheuser-Busch InBev gets you a dominant position in Mexico, a fast-growing profit stream from China and the world’s leading premium beer portfolio.

There are many potentially lucrative trends unfolding, and we believe a targeted and differentiated stock-picking approach is the best way to capture them. Given the likely economic squalls ahead, successful emerging-markets investing will take a long-term view, skillful piloting and highly sensitive downside-risk radar. It will also take broadening horizons beyond the old, familiar places.

Sammy Suzuki is portfolio manager of strategic core equities at AB in New York.

See AllianceBernstein’s disclaimer.

Get more on emerging markets and on equities.