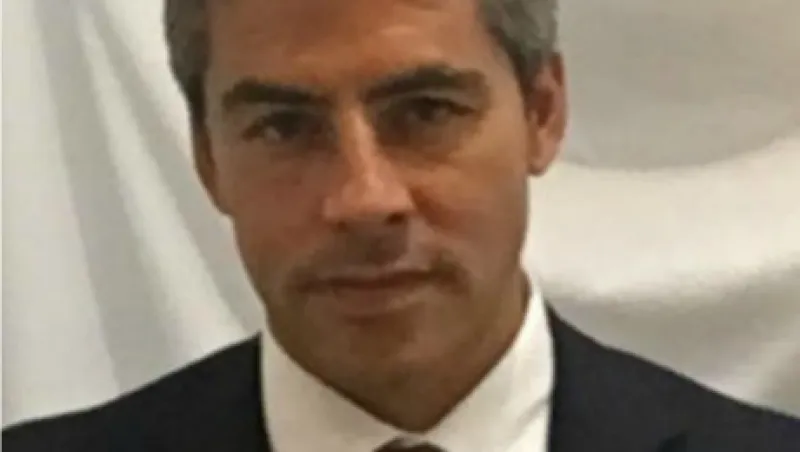

Talk about good timing. At a moment when institutional asset owners are increasingly aware of the need to invest sustainably, the head of hedge fund investments for APG Asset Management, the asset management division of $427 billion Dutch pension plan Stichting Pensioenfonds ABP, has left to start his own firm. Paulus Ingram is launching ARC Fiduciary, a sustainability alternative-investment manager, with a handful of his former APG Opportunity Fund colleagues.

At APG, Ingram, who began his career at New York–based hedge fund firm D.E. Shaw & Co. before moving into real estate and private equity, oversaw $25 billion in hedge fund investments from New York. “Working for APG has been a real honor and a privilege,” says the ARC Fiduciary co-founder, who joined the Dutch pension in 2010. APG’s hedge fund program is advised by New York–headquartered New Holland Capital. “The synergy between APG’s size, long-term fortitude and discretion and New Holland’s network and insights is very special,” Ingram says.

ARC is slated to launch in the last quarter of 2016. The Greenwich, Connecticut–based firm is a specialist investment adviser that sponsors fiduciary institutional products targeting financial outperformance and supporting the United Nations’ Sustainable Development Goals. Announced last September, the 17 goals set an agenda for sustainable development through 2030 that includes ending poverty, fighting inequality and injustice and tackling climate change. Reaching those targets will require massive injections of capital from the public and private sectors.

Ingram, who holds a BA in English literature and biology from Amherst College and a master’s in finance from the University of Amsterdam, says he and the rest of the ARC team believe that the global efforts under way to achieve the Sustainable Development Goals give asset owners a huge opportunity to generate the risk-adjusted returns they need to achieve their financial objectives and be on the forefront of the economic transition to a sustainable future. “We’ve been watching this space develop over the last decade and have made significant investments already,” he notes. “However, there is a shortage of institutional-quality product available to large asset owners with fiduciary obligations.”

This month a coalition of European asset managers, including APG, representing a total of €550 billion ($617 billion) in assets, pledged to use the U.N. goals as a framework to guide their investment decisions.

ARC is joining a rarefied group. Among the large institutional-quality firms that do exist are Generation Investment Management, the London-based asset manager founded in 2004 by former U.S. vice president Al Gore and ex–Goldman Sachs Asset Management chief executive David Blood; and Capricorn Investment Group, the New York– and Palo Alto, California–based investment office of onetime eBay executive Jeffrey Skoll.

ARC’s first fund focuses on climate change. The firm’s Energy Transition Opportunity Fund will pursue tactical investments in construction-ready U.S. energy infrastructure projects aiming to reduce carbon emissions by 50 to 70 percent. The fund, co-headed by Ingram and ARC CIO Dempsey Gable, will invest in solar, wind, hydro, more-efficient natural gas, and energy storage and efficiency projects that will help the world shift to a low-carbon economy over the coming decades.

At APG, Gable, a longtime energy investing expert, ran the $5.5 billion Opportunity Fund, which focused on asset-backed and nontypical investment opportunities. He previously built a $4.5 billion portfolio of energy assets at Commerzbank, Germany’s second-largest bank. Before heading hedge funds at APG, Ingram worked for Gable as a senior portfolio manager on the Opportunity Fund.

“Many of these assets are identical to the ones we invested in through the Opportunity Fund, and we plan to work hand in hand with developers we financed previously,” says Gable, who also stresses the need to consider sustainable investing from the perspective of a fiduciary asset owner. For an investment to be sustainable, he says, it must produce returns too. “We were trained that we want to do good in the world, but we’re investing somebody’s pension,” Gable observes. “It’s got to make money.”

Last year, in an initiative spearheaded by chair Corien Wortmann-Kool, ABP announced plans to drive more capital into sustainable-investment strategies. Through 2020, with the goal of cutting carbon dioxide–related investments by 25 percent, the fund will almost double its commitments to investments with Sustainable Development Goals, from €29 billion to €58 billion, and maximize its ownership role through engagement with corporations. “Chairwoman Wortmann-Kool’s farsighted 2015 public announcement was really a catalyst for us,” Gable says. He and Ingram now hope to be a part of making a low-carbon future possible for all institutional asset owners.

APG Asset Management says that Ingram’s responsibilities will be divided among the internal team while the firm considers his replacement.

Follow Imogen Rose Smith on Twitter at @imogennyc.

Get more on hedge funds.