35

Janos Barberis

Chief Executive Officer

FinTech Hong Kong

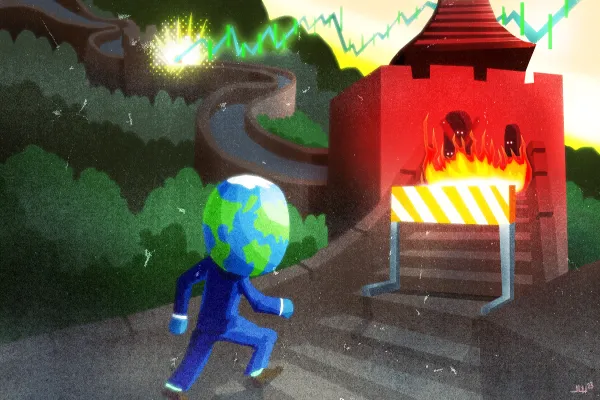

Undeniably a world financial capital, Hong Kong currently ranks behind only London and New York, and just ahead of Singapore, in consulting firm Z/Yen Group’s Global Financial Centres Index. Janos Barberis believes Hong Kong should have that kind of stature in fintech as well. Evangelizing on the territory’s behalf as founder and CEO of the FinTech Hong Kong ecosystem, he concedes that “the U.S. and EU are leading the race in terms of the amount of money invested.” However, the 27-year-old asserts, “Asia, and in particular China, offers market opportunities on a scale that is not remotely comparable to Europe or the U.S.” Where better than Hong Kong to see, as Barberis contends, that “China is already leading innovation in the fintech space, trialing technology and services at a pace that the West cannot match”? He arrived in Hong Kong from the U.K. in 2012 for the master’s in law program at the University of Hong Kong, where he wrote a thesis on how peer-to-peer lending would eventually displace China’s shadow banking sector. After a brief stint in London helping to obtain a license for “challenger bank” Lintel Financial Services, Barberis returned to launch the web-based “single point of access for Hong Kong’s fintech scene” in 2014. “Witnessing the fintech activity in London, I realized that Hong Kong had not only the same prerequisites to be a fintech hub, but, importantly, it has much more market opportunity regionally,” says Barberis, who is also co-editor of The FinTech Book, a globally crowdsourced compendium that will be released in January. As of mid-October the FinTech Hong Kong portal listed 619 members (categorized as influencers, mentors and enthusiasts), 51 start-ups and 52 events. In a sign of the venture's spreading influence, its web platform has been white-labeled for organizers of emerging ecosystems in Beijing, Dubai, London, Shanghai, Singapore and Toronto, and Barberis recently founded the SuperCharger, an accelerator program backed by Internet giant Baidu and the Hong Kong Stock Exchange.

The 2015 Fintech Finance 35

& James Robinson IV RRE Ventures

Evercore Partners

Bain Capital Ventures

Financial Technology Partners

General Atlantic |

Brad Bernstein FTV Capital

Anthemis Group

Goldman Sachs Group

Ribbit Capital

Nyca Partners |

Partnership Fund for New York City

Andreessen Horowitz

Digital Currency Group

Banco Bilbao Vizcaya Argentaria

Santander InnoVentures |

AXA Strategic Ventures

Citi Ventures

Credit Suisse NEXT Fund

SenaHill Partners

Bill & Melinda Gates Foundation |

Accion International

Marlin & Associates

CME Ventures

Illuminate Financial Management

Life.SREDA |

Innotribe SWIFT

Barclays

UBS

& Vincenzo La Ruffa Aquiline Capital Partners

REDI Holdings |

Startupbootcamp FinTech

Bloomberg Beta

Valar Ventures

Innovate Finance

FinTech Hong Kong |

| |