Illustration by Sam Island

On July 20, Tesla did something that no company had ever done before: It saw the volume of bets made by its “haters” — the term co-founder Elon Musk uses to describe investors who bet that the electric-car company’s stock will fall — cross $20 billion.

To this day, those bets are a painful reminder that the “haters” have been consistently wrong. The company’s shares sped to a new high on August 17 — rising 11 percent from the record set the previous day of trading — to close at about $1,836 each. Their climb continued Tuesday to an unprecedented $1,887.

“It’s a picture of the perseverance of the short-sellers that are left,” says Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, a financial-analysis company that shared data with Institutional Investor. The magnitude of losses short-sellers have endured is “just absurd,” he says, compared to bets against other companies, with Tesla “by far the longest unprofitable short I’ve ever seen.”

Yet Dusaniwsky saw no mad rush for the exits as Tesla’s shares skyrocketed almost 300 percent on the year to close at a then-record high of $1,643 on July 20. With the company’s market value soaring past price targets set by Wall Street analysts, he says, “it’s by far and away the largest short.”

Why?

It’s not short-sellers covering their positions that’s been driving up Tesla’s stock price, according to Mark Spiegel, who runs a small hedge fund that’s short the company. But he does have other suspicions.

“Some entity — I don’t know who — was executing a strategy of buying massive quantities of out-of-the-money call options,” forcing call-option sellers to buy enough stock to hedge their exposure, Spiegel, founder of hedge fund firm Stanphyl Capital Partners, suggested by phone. “This thing just kind of spiraled its way up.”

Another driver has been widespread enthusiasm among individual investors buying Tesla shares this year through trading apps like Robinhood, according to Spiegel. “There was this whole gambling mentality that took place,” he says, “partially because people got stuck at home” during the pandemic with stimulus checks to spend.

While huge losses have forced some investors to cover their bearish bets against the Musk-led carmaker, a dramatic short squeeze did not materialize in July, according to Dusaniwsky. He saw the percentage of shorted shares relative to Tesla’s publicly traded total hold about steady last month, even as the pain inflicted by its soaring stock price intensified.

In July, Tesla short-sellers racked up about $6 billion in mark-to-market losses — widening from about $3.7 billion in June — bringing them down about $21 billion for the year as recently as this month, S3 data show. “So very rarely is there a stock where you see these losses,” he says.

That helps explain the shrinking number of Tesla shorted shares this year, as some investors covered their bets.

Although Tesla’s rising stock price drove the short interest to an eye-popping dollar value, the number of shares wagered against the company actually fell, from about 20 percent of its publicly traded total at the beginning of January to about 7 percent by August 12. That level edged down from more than 8 percent of Tesla’s float on July 22, the day the Palo Alto, California-based carmaker announced better-than-expected earnings for the second quarter.

When short-sellers rush to exit their bets against a company to prevent deeper losses, their purchase of shares to cover their positions can propel its stock price sharply higher. That exacerbates the pain of those still short the company, potentially forcing them to cover their trades as well.

“The shorts are still being squeezed,” says Dusaniwsky. “Losses are mounting and shorts are still covering,” he says, despite seeing no massive acceleration of this activity as Tesla’s stock surged toward its July peak.

Among other things, Spiegel sees Tesla’s market share being eroded by the competition. But with Tesla being “a cult stock,” he says Robinhood investors probably won’t lose enthusiasm for it until they start seeing electric cars made by Volvo, BMW, Mercedes-Benz, or Audi on the road.

Until then, they seem all in for Tesla — and its controversial leader, Elon Reeve Musk.

On July 5, he tweeted that “limited edition” short shorts were being offered on Tesla’s website. The description for the now “sold out” apparel featured on Tesla’s online shop captures his glee sticking it to short-sellers who lost money as the company’s stock soared:

“Celebrate summer with Tesla Short Shorts. Run like the wind or entertain like Liberace with our red satin and gold trim design. Relax poolside or lounge indoors year-round with our limited-edition Tesla Short Shorts, featuring our signature Tesla logo in front with ‘S3XY’ across the back. Enjoy exceptional comfort from the closing bell.”

Tesla — whose electric cars include the models S, 3, X, and Y — went on to beat Wall Street expectations for its performance in the second quarter.

“More importantly, despite a very disrupted quarter with the Covid-19 pandemic, TSLA hit the mark on GAAP profitability,” Bank of America research analysts wrote in a July 22 note. That’s “generally perceived as the remaining hurdle for potential inclusion in the S&P 500 index,” they said, meaning the company, which trades under the ticker TSLA, could soon benefit from an even higher stock price.

Becoming part of the S&P 500 would give a boost to Tesla’s shares — at least initially, says Dusaniwsky, explaining that passive funds would seek to buy and hold the carmaker along with other large companies in the U.S. stock index.

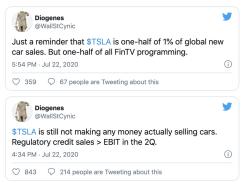

But Spiegel, whose Stanphyl has “a substantial position” betting against Tesla, doesn’t expect that bump would last. And he wasn’t impressed by the company’s second-quarter profit, taking issue with the regulatory credits behind it.

“It was only able to post a GAAP profit last quarter by using over $400 million of emission credits, which are going away for them completely at some point next year,” he says.

Tesla did not respond to an email seeking comment on the wagering against it and what’s driving its stock price this year.

Spiegel says he upped his bet against the electric carmaker when the stock appeared to be “breaking down” after its earnings call. In his view, Tesla’s results were “so manipulated,” with its stratospheric stock price unhinged from its actual performance.

Meanwhile, Wall Street banks are now wildly divided on the future of the stock.

Bank of America analysts had also warned Tesla’s stock price of around $1,600 was detached from fundamentals — before this month changing course to more than double their price target due to the company’s ease in raising equity to fund accelerated growth.

On July 22, they said Tesla’s better-than-expected earnings were “more than reflected” in the roughly 300 percent runup in its year-to-date stock price at the time. Then, just a few weeks later, they upgraded their investment rating on the company to neutral from underperform, and lifted their share price objective to $1,750 from $800.

“Musk’s leadership, a compelling brand, and improved execution are driving an ever-increasing stock price,” they wrote in an August 14 research report. “This is direct evidence that the company has unfettered access to low-cost capital.”

They called that a “key advantage” that should accelerate the electric-vehicle maker’s growth to almost 50 percent annually over the next five years. While remaining skeptical Tesla will be “the dominant EV automaker in the long run,” they said “if a big global footprint can be built with no-cost capital, the ‘growth’ story would carry the day for the stock.”

Bank of America’s valuation for Tesla is far above the $300-a-share price target that Barclays maintained for the company after its second-quarter earnings. Barclays also kept its underweight rating on the rising stock, even as its equity analysts conceded in their July 23 research note that they were “not clear on when momentum breaks.”

Seeing nothing to prevent the shares from moving higher, Barclays analysts had earlier urged their “bearish friends” in a July 6 note to stay “in the shelter of their caves.”

Tesla, with a massive market value of more than $350 billion, surged again this month after announcing a five-for-one stock split. “Trading will begin on a stock split-adjusted basis on August 31,” Tesla said August 11. The next day, its shares jumped 13 percent on the news, deepening losses for short-sellers.

But the bears — including well-known hedge fund managers David Einhorn of Greenlight Capital and Jim Chanos of Kynikos Associates — have shown they’re willing to hang on for years to their high-conviction bets against Tesla. Chanos uses his Twitter account, @WallStCynic, to express skepticism about Tesla’s future, including on the day of its earnings:

“Most big Tesla shorts aren’t losing sleep or missing meals because of their positions,” says Dusaniwsky. “They still think this will eventually go their way.”

Musk has poked at them, including in 2018, when he made good on a delivery of short shorts to Einhorn. In response, Einhorn tweeted in August of that year a photo of the gift and wrote: “He is a man of his word! They did come with some manufacturing defects. #tesla.”

At the time, Tesla was trading around $355 a share. Now the stock is more than quintuple that level.

“People who are long [Tesla] have all kinds of nonsensical dreams that are disproven by the facts,” says Spiegel, who sees them inexplicably drawn in by Musk. “I know that eventually enough people will leave the cult,” the hedge fund manager says, “and the stock will collapse.”

“And then it will be just a few hardcore cultists left watching it go all the way down,” he says.