At least one former investor in the blown-up OptionSeller.com died awaiting restitution, and lawyers worry that the legal battles will outlive more clients.

Retirees lost everything (and then some) that they’d invested with James Cordier — the pyrotechnician behind commodity-trading advisor OptionSeller, which flamed out in late 2018.

Cordier was popular with old folks.

“l have asked that the elderly clients in their 80s and 90s have accelerated processing,” said attorney John Chapman in an interview. “They don’t have five or six years to wait. One client has already passed away.” Chapman’s firm represents about 110 ex-investors in one of several protracted legal campaigns against Cordier, his company, and broker-dealer INTL FCStone.

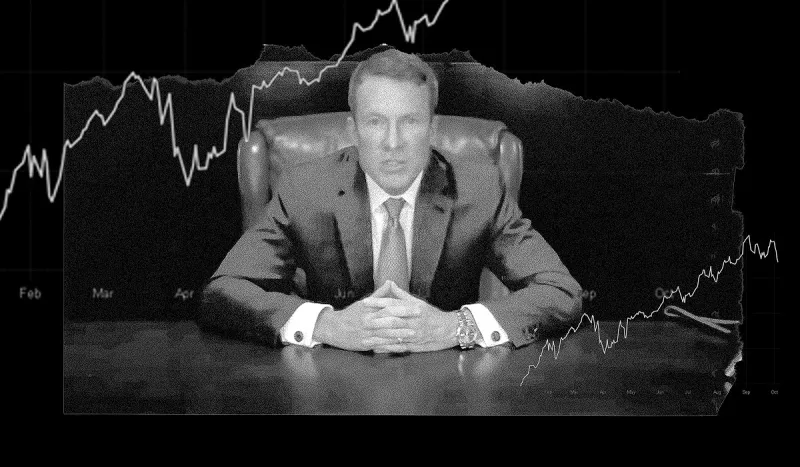

Cordier became infamous in finance circles from his viral and cringe-worthy apology video, which has been viewed more than half a million times. In the video, he sits at a boardroom table in a suit and tie, wearing cufflinks and a Rolex-resembling watch.

“Needless to say, the events of this past week have been incredibly devastating for our clients,” Cordier told the camera, crying. “To my client in Marseille, my wife and I were certainly looking forward to joining you in the French Riviera. It sounded so beautiful.”

OptionSellers.com managed money for 290 individuals and specialized in its namesake technique of selling options to produce income. The firm lost all of its capital in volatile energy markets and left many clients on the hook to settle trade balances, according to legal filings.

[II Deep dive: He Blew Up His Fund. Now He’s a Laughingstock.]

Many clients sued more than a year ago, and are pursuing broker FCStone for millions via arbitration through the National Futures Association. FCStone, in turn, has shot back with its own claims, Chapman said.

“Not only did everybody lose 100 percent of their investment, they were also hit with margin debt calls equal to about a third of their investment,” the lawyer said by phone early last week. “FCStone has additionally been demanding that clients also pay interest on that money. Clients are taking out second mortgages just to put potatoes on the table. And now FCStone is demanding victims pay the attorneys’ fees” if the investors lose. “It’s pretty scorched earth.”

Destitute investors are going after Cordier’s broker. OptionsSeller didn’t carry insurance and losses exceed $100 million, according to Chapman.

FCStone claims that it only served as a clearing firm, whereas several investor cases argue that OptionSeller acted as its agent and FCStone should be on the hook for restitution and damages.

“Clearing firms perform limited administrative functions,” FCStone said in a statement to Institutional Investor. “When extreme volatility in November 2018 caused OptionSellers’ customers to suffer losses that exceeded their margin deposits, certain of OptionSellers’ customers refused to meet their obligations and brought their own claims or counterclaims against FCStone.” The firm believes that the claims are not founded.

Cordier’s attorneys did not return messages asking for comment.

But the infamous video star has surprisingly faded to the background of the “scorched earth” situation his trading wrought. Investors do have outstanding legal claims against him, but the focus of litigation appears to be on FCStone — a multinational corporation with a big balance sheet and legal firepower to match.

“Cordier is still living large down in the Tampa area. He did not declare bankruptcy,” Chapman said.

As for his ex-clients, “These people work all their lives to make a nice middle-class life, and then the bottom drops out and they drop out of the middle class. They don’t even understand why it happened,” Chapman said.

“They rely on these jackasses who said they know what they’re doing,” the lawyer went on. “It’s very sad.”