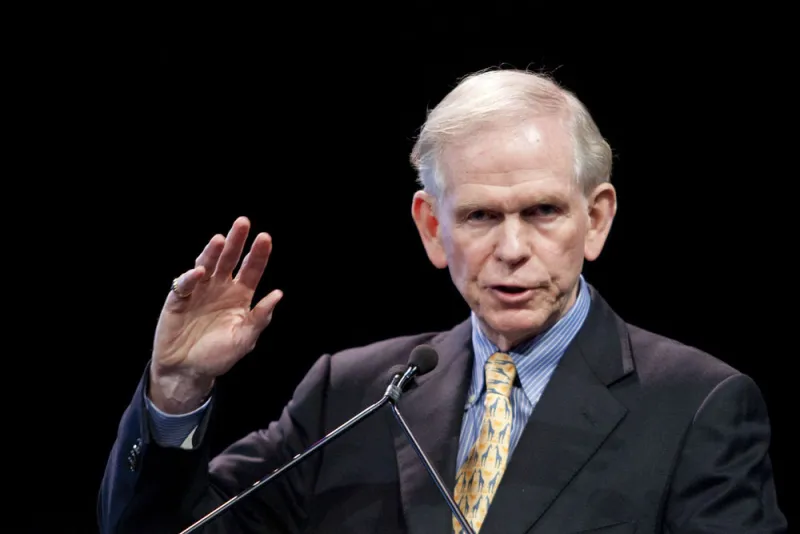

GMO co-founder Jeremy Grantham is throwing his weight behind venture capital investments, using a growing portion of his family fortune to tackle the existential threat posed by climate change.

Venture capital is the sole feature of American capitalism that is working exceptionally well, Grantham said on stage at the Investing for Impact conference hosted by The Economist in New York. “It is still alive and snappy.”

About 60 percent of his $1.1 billion fund, which includes the Grantham Foundation for the Protection of the Environment, is related to early stage venture capital or a “close cousin” of the strategy within private equity, Grantham told Institutional Investor on the sidelines of the event. Eighteen percent of the total fund is “green,” a portion that will increase to 35 percent in the next ten years as the percentage of VC assets also grows, he said.

During his remarks on stage, Grantham described “green” venture capital as the “the cutting edge of the cutting edge” and called out traditional asset managers and regulators for being too slow and ineffective at solving urgent problems tied to the environment.

“We expect to be kicking ass,” Grantham said of his personal fund’s VC strategies in green energy.

[II Deep Dive: Jeremy Grantham Says Investors Should Be ‘Intrigued’ by This Strategy]

Grantham, a legendary value investor who is based in Boston, said during the interview with II that the U.S. still excels at venture capital partly because the industry collaborates with prestigious universities such as Massachusetts Institute of Technology.

One of his most successful VC deals so far is in QuantumScape Corp., a maker of batteries used in electric cars. Grantham has quadrupled his money in the company, an investment he now values at $50 million and expects will continue to increase, he told II.

During his remarks on stage, Grantham railed against the oil and gas industry for its knowing contribution to the climate crisis. He claimed that experts at ExxonMobil understood decades ago they were adding dangerous amounts of carbon emissions to the atmosphere.

He warned that fossil fuels were contributing to the warming of the earth, with flooding being just one of the damaging consequences expected to increase over time. Grantham said part of the problem is that the oil and gas industry, with all its money and power, has wielded strong influence over lawmakers and regulators.

His concerns about the environment are about “survival,” and as part of that, he said his “objective is to make the oil industry pariahs.” While attitudes toward the environment are changing, Grantham said that giant index fund managers like BlackRock should improve their records on “green” proxy voting.

Beyond electric vehicles, Grantham is looking at innovative ways to suck carbon dioxide from the atmosphere. He said seaweed could help do that.