John Paulson’s New York-based Paulson & Co. has acquired a stake in Swiss pesticide maker Syngenta and may press for the company’s board to accept a $45 million takeover bid from U.S. seed company Monsanto, according to a Reuters report. For its part, Syngenta has said Monsanto’s offer is too low, as is the $2 billion Monsanto has offered to pay if the deal is not approved by regulators. Syngenta was formed in 2000 from a merger of the agricultural businesses of Novartis and AstraZenica. Paulson is of course best known for his hugely successful bet on subprime in 2007, but he initially focused mostly on merger arbitrage, still a big area of investment for the firm.

___

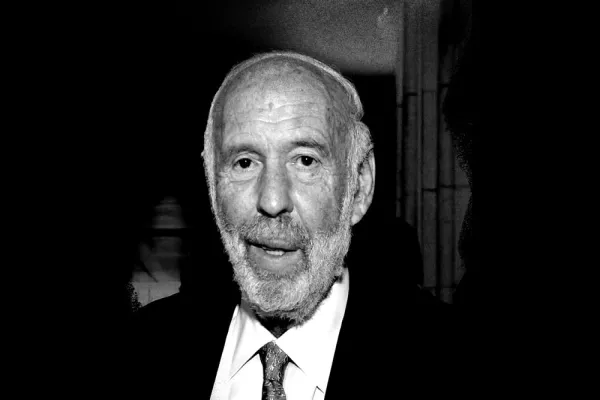

New York-based Visium Asset Management, the $7 billion multistrategy hedge fund firm founded by Jacob Gottlieb, is the latest hedge fund getting into more illiquid investment strategies. The firm is looking to raise $500 million for Visium Healthcare Partners, a private equity firm that will invest in biopharmaceutical and medical technology companies, according to a Bloomberg report. The University of Michigan is contemplating a $50 million investment in the fund, which will be managed by Avinash Amin and Ken Macleod, according to the report. Visium also manages five hedge funds and a mutual fund.

___

A long-short China hedge fund that had suspended redemptions and halted trading is back to business as usual. Singapore-based APS Asset Management halted trading in the fund last week because of turmoil in the Chinese stock market but is once again investing and meeting redemption requests now, according to a Reuters report. “Having carefully considered the financial position of the fund, the composition, value and liquidity of the fund’s investments and general market conditions, the directors consider the lifting of the suspension to be in the fund’s best interests,” APS said in a statement, according to the report.

___

Yet another data tracker reports that hedge funds had a lousy month in June. London-based Preqin said its hedge fund index lost 0.75 percent for the month, its first monthly loss for the year, though it is still up 4.5 percent in the first half. CTAs fell 2.66 percent for the month, while UCITS funds fell 1.76 percent, according to Preqin. Relative value funds, the only positive strategy last month, returned a slim 0.17 percent gain in June, and have only lost money two out of the past 18 months, according to Preqin.