From disgruntled venture capitalists to Securities and Exchange Commission chairman Jay Clayton, market watchers have been complaining long and loud about the regulatory challenges of going public on U.S. stock exchanges. Emerging markets firms lately, not so much.

Five companies in South America, China, and Israel have tapped New York’s equities market this year through February 9, according to Renaissance Capital, which tracks initial public offerings and manages two exchange-traded funds that invest in them. That’s nearly a quarter of all new U.S. listings and compares to precisely zero done by companies from emerging markets the same period last year.

“Other marketplaces see the value of listing here,” says Kathleen Smith, a principal of Renaissance, dismissing the notion that excessive regulation is discouraging public offerings in the U.S. “The IPO market is open for business.”

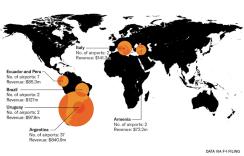

Three of this year’s IPOs come out of South America: PagSeguro Digital, a Brazilian internet payments company that raised $2.27 billion; Central Puerto, a big Argentine power generator that completed a $330 million offering; and Argentina’s Corporación América Airports — which operates airports across South America, from Brasilia to the Galapagos Islands of Ecuador, as well as in Armenia, Pisa, and Florence — raised $486 million.

Demand for emerging markets IPOs, especially South America, is driven by expectations for positive long-term economic growth. According to a report by Boeing Co. cited in Corporación América Airports’ prospectus, for example, airline passenger growth in Latin America is expected to increase at an annualized 6.2 percent rate from 2017 to 2037. That exceeds forecasted traffic growth of 5.9 percent for the Asia-Pacific region, 2.6 percent in North America, and 3.2 percent in Europe.

All told, Corporación América Airports, which has an executive office in Luxembourg, operates 52 airports in seven countries around the world, with the majority of those in Argentina and the balance in Peru, Uruguay, and elsewhere, the prospectus shows.

Argentina is perceived as a turnaround story. “It is aimed in the right political direction and has the chance to become a more normal place,” says Alejandro Bianchi, an investment manager with InvertirOnline.com, in an email. “That explains the demand and appetite for Argie risk right now.”

Meanwhile, companies in emerging markets are seeking to widen their investor pool outside their home base. “Local market liquidity and costs are a concern,” says Rachel Ziemba, a senior advisor at investment firm Alpha Z Advisors, in an email. “Many of these companies have international revenue bases and raising capital internationally is [part] of this goal.”

Other IPOs in the U.S. this year were done by China’s Huami, a maker of wearable exercise-monitoring devices that raised $110 million, and Sol-Gel Technologies, an Israeli dermatology company that issued $75 million of shares. The uptick in emerging market company listings shows confidence in the new issue market, which has raised more than $10 billion this year.

“If people are saying the IPO market is dead,” says Smith. “They are not looking at the IPO market.”