Sitting in hard plastic chairs at long tables facing the front of a stereotypical university lecture room were some of the biggest players in Canadian asset management.

Representatives of Canada’s largest pension investors — including the Canada Pension Plan Investment Board, Caisse de dépôt et placement du Québec, the Public Sector Pension Investment Board, and the Ontario Teachers’ Pension Plan Board — had gathered to address the solvency crisis that plagues pension funds in Canada and beyond.

Or rather, they’d gathered to watch and critique as some of the world’s brightest young finance students pitched their solutions to the pension problem.

The McGill International Portfolio Challenge, a first-of-its-kind academic case competition centered on how to meet the obligations of an underfunded pension plan, invited undergraduate and graduate students from around the globe to design and present hypothetical portfolios they believed could achieve solvency without taking undue risk or relying too heavily on contributions.

Canadian pension funds, along with actuarial and asset management firms including Mercer and BlackRock, sponsored the competition, sending close to 30 investment professionals to serve as the judges responsible for choosing the winning team.

Sebastien Betermier, a finance professor at McGill University’s Desautels Faculty of Management and an adviser to the Portfolio Challenge’s student organizers, says the contest originated when students became frustrated with a lack of case competitions targeting the challenges of asset management. They approached Betermier and other advisers to pitch the idea of starting their own — a brand new case competition that would ultimately address the financial needs of an underfunded private sector defined benefit plan.

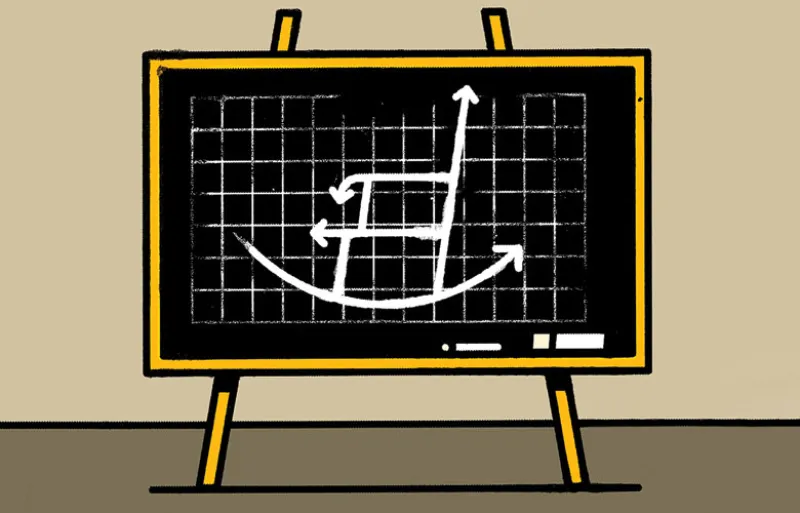

“I liked the concept quite a bit because the state of pensions is a bit like global warming,” Betermier says. “It’s really complex and it’s not fun to talk about, so we tend to postpone the debate. Even though it’s a long-term crisis that might affect us in ten years, we tend to avoid thinking about it until it’s too late.”

The idea quickly caught on with members of the Canadian asset management industry, generating enough sponsorships to offer a cash prize of C$25,000 — a little less than $20,000 in U.S. dollars — to the winning team, plus an additional C$25,000 in runner-up prizes. Portfolio Challenge adviser Clifton Isings, himself in charge of investing the Canadian National Railway’s pension fund, points to the outpouring of sponsorship dollars as evidence of the importance of the problem being addressed.

“It is a huge world problem,” he says. “Here’s a chance to learn from different approaches and different perspectives.”

For the inaugural case competition, students were tasked with funding the closed pension plan of an imaginary Canadian lumber corporation — an C$857 million fund facing a shortfall of C$264 million. In the hypothetical scenario the company was to make a C$50 million contribution to its pension in 2018, under an agreement that the investment committee would restructure the portfolio to minimize future contributions while still meeting payout obligations.

Details of the case were based loosely on McGill’s own defined benefit plan, managed by CIO and treasurer Sophie Leblanc. Leblanc says she helped student organizers get the mock pension’s liability right and provided them with McGill’s own statement of investment policy and actuarial report. The final case, which she reviewed ahead of its release to Portfolio Challenge participants, was a realistic representation of a pension, Leblanc says — with a few tricks thrown in.

On the day of the competition, held at the Desautels building in downtown Montreal, 25 teams of up to four students arrived to present their portfolio designs. Each team was given ten minutes to make its presentation, followed by 15 minutes of Q&A with a panel of judges. Five teams advanced to the finals, where they would be judged by a panel including investors from CPPIB and CIBC Asset Management.

The proposed strategies ranged from pure asset–liability matching to derivative overlays and included asset allocations that ran the gamut from mostly bonds to mostly equities. Most portfolio designs included an environmental, social, and governance investing component, and many targeted sizable allocations to real assets.

Gary Grad, who serves as investment chief at CIBC, says that he and his fellow judges ultimately picked the most innovative portfolio: a combination of cash flow–matching bonds and equity futures with a collar of options to limit volatility.

“Although it was risky and would be a hard sell to the company, it was the most creative,” he says.

Kiril Gatev, a graduate student at HEC Montréal business school and a member of the winning team, says he and his teammates went with the options collar because they wanted to limit the pension fund’s potential losses. They designed the strategy so that any loss greater than 10 percent would be absorbed by the fund’s options.

“It’s not a common strategy, but the whole idea is risk management,” Gatev explains. “Pensions, asset management — this is what I want to do, and I know it’s the same for my colleagues.”