Currently ranked: 32

Previously ranked: 34

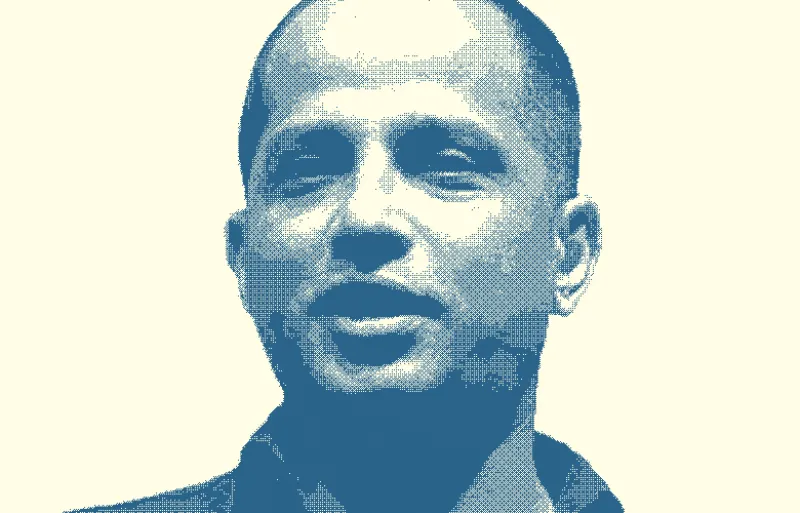

So intent is Singapore on maintaining its leadership as a hub for financial technology innovation that the Monetary Authority of Singapore, the city-state’s central bank, appointed ex–Citibank executive Sopnendu Mohanty as chief fintech officer in 2015. As if to confirm the effectiveness of the campaign to foster a world-beating R&D ecosystem — backed by a five-year, S$225 million ($166 million) MAS grant — Singapore tops the fintech hub survey of the Institute of Financial Services Zug, among others. More than 13,000 people from 60 countries flocked to the 2016 Singapore FinTech Festival, a joint effort of MAS and the Association of Banks in Singapore, and attendance topped 25,000 for the 2017 edition, held in mid-November.

Singapore’s fintech status creates a halo effect. In September, Mohanty co-signed a cooperation agreement with Malaysia, which he described as “another step toward strengthening cross-border efforts to promote innovation in our neighboring jurisdictions. I foresee it creating new opportunities for fintech firms in Singapore and Malaysia looking to venture into each other’s markets.” Other bilateral agreements have been signed over the past year and a half with regulatory bodies in the U.K., Australia, Switzerland, South Korea, France, Japan, Denmark, and Thailand.

In a recent “Money20/20” video interview, Mohanty said that regulatory support for fintech is growing, and that the next step in technology will be artificial intelligence and machine learning “to create new insights, opportunities, and products” out of the explosion of data. A remaining hurdle is “access to capital,” he noted, because there is hesitation to invest in “ideas that are not tested.”

See the full Fintech Finance 40 here.