Currently ranked: 25

Previously ranked: PNR

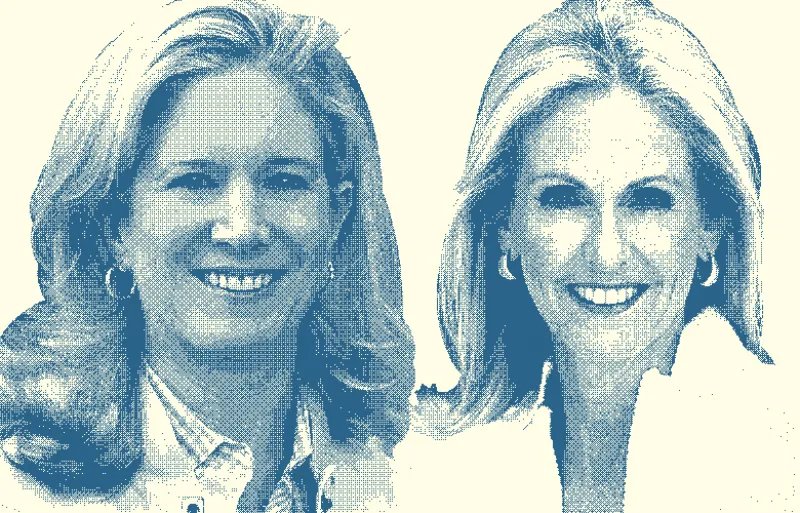

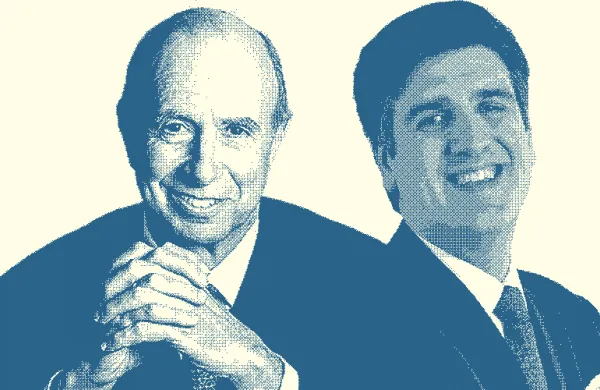

Spun out of Oak Investment Partners to take aim at venture and growth equity opportunities in health care information and fintech, Oak HC/FT got off to a fast start in June 2014, with a $500 million fund. Fortune magazine noted that two of the three founders — Patricia Kemp, Annie Lamont, and Andrew Adams — were women, and it deemed Oak HC/FT “the largest fund ever raised by a female-majority VC firm.” The fact that the Greenwich, Connecticut, firm was able to launch a second, $600 million fund in April 2017 confirmed its momentum and staying power — not that there should have been much doubt given the players and their histories as investors and practitioners.

The now 22-employee firm has 15 active investments, including blockchain-focused incubator Digital Currency Group, payment fraud prevention company Feedzai, employee health and benefits administration firm Maestro Health, and insuretech disrupters Insureon and Trov.

Both health care and fintech are “regulated industries that are ripe for disruption, and a big part of the health care system has to do with payments,” says managing partner Lamont. An example of the convergence between health care and financial services is automated human resources platform Benefitfocus, a portfolio company that went public in 2013.

Oak HC/FT in March led a $20 million, series C financing for Urjanet, a provider of utility data for energy management and bill processing, and Kemp joined its board. A former senior executive of marketing firm Cendant, Kemp was hired in 2002 by Lamont as an Oak Investment Partners venture partner. Lamont had joined Oak Investment Partners in 1982, after working as a research associate at high-tech banking boutique Hambrecht & Quist. She served as general partner from 1986 to 2006.

Renowned for her health care industry work — serving on several company boards and in March receiving the National Venture Capital Association’s Excellence in Healthcare Innovation award — Lamont is equally at home in financial services. She recalls taking an interest in 1999 in Flooz, a “virtual online currency” that was some years ahead of its time. “That got me interested, and we established a fintech practice before just about anybody else,” she says.