Currently ranked: 22

Previously ranked: 19

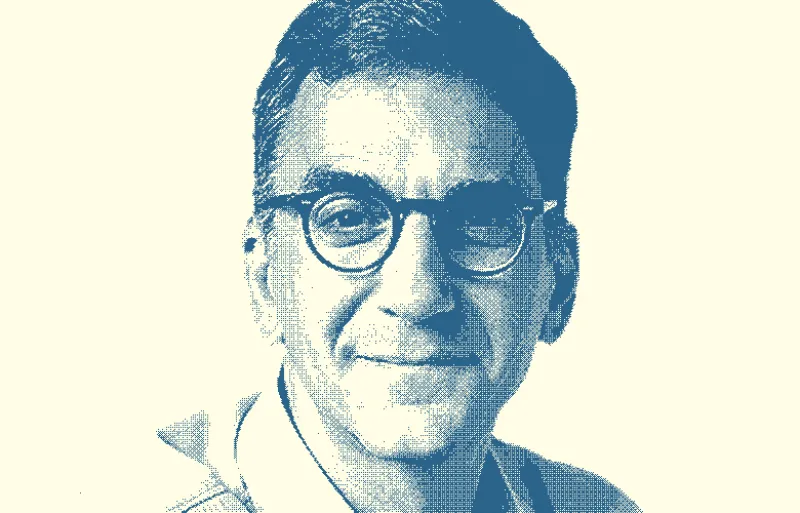

For all the attention to income inequality and initiatives to promote financial inclusion, “three billion people are left out of, or poorly served by, the global financial system,” says Michael Schlein, president and CEO of Accion. The Cambridge, Massachusetts–based nonprofit has been forming and nurturing microfinance institutions in emerging markets since 1961, and it is mobilizing more capital for financial inclusion by pushing fintech levers. It has a think tank, the Center for Financial Inclusion, and runs two investment vehicles: the Accion Frontier Inclusion Fund and Accion Venture Lab.

The Frontier Inclusion Fund, managed by Quona Capital and with Accion as sponsor, anchor investor, and general partner, announced its final close in March. The fund was oversubscribed, with $141 million committed by a long list of banks and institutions, including the Axa Impact Fund, the Dalio Foundation, International Finance Corp., JPMorgan Chase & Co., and TIAA Investments. Combining social impact and financial returns “shows the importance of harnessing the capital markets to solve society’s most challenging problems,” says Schlein, who had been a senior Citigroup executive, a Securities and Exchange Commission chief of staff, and a New York City official before taking the helm at Accion in 2009. The fund’s investments include AllLife (the portfolio’s first insuretech company) in South Africa, Coins (which handles mobile payments on a blockchain platform) in the Philippines, CreditMantri (which offers alternative-data-based credit advisory) in India, and Konfio (which provides working capital for microbusinesses) in Mexico.

Seed-stage investor Accion Venture Lab, having deployed more than $10 million in start-ups since 2012, is demonstrating “the viability of achieving both profit and purpose” in promoting “high-quality financial services for underserved customers,” Schlein says. In February 2017 the lab sold its stake in Mexican mobile payments company Clip, now part of General Atlantic’s growth equity portfolio. The Accion fund co-led Clip’s first institutional investment round in 2013.

See the full Fintech Finance 40 here.