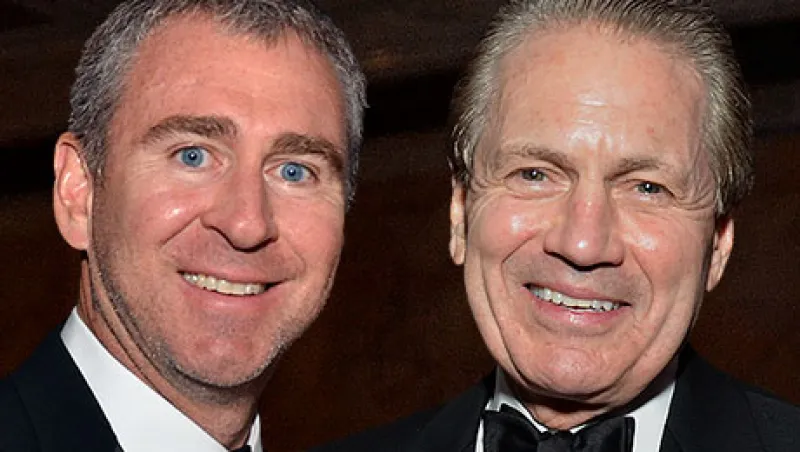

Many seek to make their mark in hedge funds. But few have the collective impact of Institutional Investor’s lifetime achievement honorees, Kenneth Griffin and J. Tomilson Hill.

After trading from his Harvard University dorm as a 19-year-old sophomore, Griffin became one of the youngest people to start his own firm when at 22 he founded Citadel in 1990. Formed with $4.6 million in capital, and the backing of legendary hedge fund investor Frank Meyer, Citadel has become one of the largest and most successful managers with more than $26 billion of assets. The firm’s flagship multi-strategy hedge funds, Wellington and Kensington Global Strategies, have annualized returns of 19 percent since inception.

Griffin, a pioneer in the fields of credit derivatives and trading technology, has long focused on building out Citadel’s business beyond its highly successful Wellington and Kensington funds. In 2002, he formed Citadel Securities, an award-winning market-making business that’s separate from his hedge fund firm. Meanwhile, Chief Executive Officer Griffin has continued to start new funds and diversify business lines at Citadel. Still only 48, he’s already built the hedge fund firm with a depth and breadth that make it unique in the industry.

In contrast to Griffin, who, before founding Citadel, managed a fund exclusively for Meyer’s Glenwood Capital Investments, Hill had a much more traditional banking career before entering the hedge fund industry. A graduate of Harvard College and Harvard Business School, he started out at First Boston, where he became a co-founder of the investment bank’s mergers and acquisitions department. Hill, 68, joined Blackstone in 1993 and is now vice chairman of the private equity firm. In 2000, he was tapped to start Blackstone Alternative Asset Management, or BAAM, the firm’s fund-of-hedge-funds business. BAAM is now the world’s largest allocator to hedge funds with $71 billion of assets under management, up from $1.3 billion at inception.

Hill’s achievement at BAAM, of which he is president and CEO, has been all the more impressive amid the tectonic shifts that have led the fund-of-hedge-funds industry to shrink in the past decade. HFR data show that net assets in the industry have fallen to just over $630 billion, from a high of nearly $800 billion in 2007. Key to Hill and BAAM’s success has been an ability to innovate and use the firm’s considerable size to its benefit.

Both Griffin and Hill are committed philanthropists, art collectors and patrons of the arts. Griffin serves on charitable boards including the board of directors of the Chicago Public Education Fund, and the board of trustees for the Art Institute of Chicago, the Museum of Contemporary Art Chicago, the Whitney Museum of American Art, and the University of Chicago. He has given away more than $500 million, including a $150 million gift to his alma mater to support financial aid for students. Hill is a member of the Council of Foreign Relations, where he serves on the board of directors and is chairman emeritus of the investment committee. He has served on boards of many other charitable institutions, including the Metropolitan Museum of Art, and Our Lady Queen of Angels School in Spanish Harlem. Hill is also on the investor committee of the Smithsonian Institution.

Griffin, the hedge-fund manager lifetime achievement honoree, and Hill, the hedge-fund allocator lifetime achievement honoree, will be honored at II magazine’s 15th Annual Hedge Fund Industry Awards dinner at the Mandarin Oriental hotel in New York Wednesday, June 21. For more about the dinner, as well as a full list of hedge fund investment manager finalists -- winners to be announced at the event -- visit the Institutional Investor 2017 Hedge Fund Industry Awards web page.