Call it the changing of the guard. In 2011, a year when a majority of hedge fund managers lost money, 15 of the 25 managers who top AR's annual ranking of the biggest earners failed to make the previous year’s list. In fact, eight individuals are making their debut on the 11-year-old ranking, which first appeared in the pages of Institutional Investor.

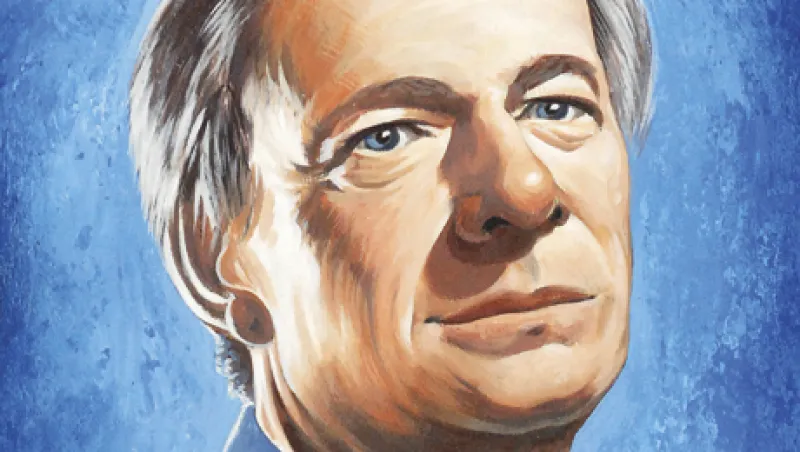

Sure, the top five earners are well-known names to readers familiar with the Rich List: Bridgewater Associates' Ray Dalio ($3.9 billion), Icahn Capital Management’s Carl Icahn ($2.5 billion), Renaissance Capital’s James Simons ($2.1 billion), Citadel’s Kenneth Griffin ($700 million) and SAC Capital’s Steven Cohen ($585 million).

Yet all but five of the rest of the top earners are making their debut or reappearing after a one- or two-year absence. Managers such as Centaurus Energy’s John Arnold, Bridgewater’s Greg Jensen and Robert Prince, Tiger Global’s Chase Coleman, Viking Capital’s O. Andreas Halvorsen and ValueAct’s Jeff Ubben — whose strategies are all very different — figure to become the next fixtures in the top 25 ranking as their respective firms continue to grow in size.

At the same time, a number of hedge fund managers who have historically dominated the list have retired, including Soros Fund Management’s George Soros, his one-time sidekick Stanley Druckenmiller of Duquesne Capital, Caxton Associates' Bruce Kovner and Highbridge Capital Management’s Henry Swieca.

By providing a rare peek at the wealth earned by the individuals who operate within this secretive universe, the list documents the level of success they have achieved.

While the 25 highest earners made a combined $14.4 billion last year, the lowest sum in three years, they earned more than $136 billion from 2001 through 2011, an average of nearly $500 million per person per year, which includes their share of the fees as well as gains on their considerable amount of capital in the funds (not counting losing years).

As a result, hedge fund managers have become modern day Rockefellers, Carnegies and Vanderbilts. And like their predecessors, they have had a major influence on society in everything from real estate to charities. Not only have they helped drive up the value of luxury Manhattan apartments, Fairfield, Connecticut homes, Hampton summer houses, many kinds of art and even major league sports franchises, they have also donated hundreds of millions of dollars to build wings of hospitals and museums and to fund college programs, buildings and sports arenas. They have shelled out billions of dollars to help the poor and medically unfortunate, including those suffering from Parkinson’s disease and autism. Hedge funds have also quietly funded scores of lesser-known charities.

Seven hedge fund managers who have appeared on the Rich List have taken Bill Gates’ Giving Pledge to donate a majority of their wealth.

Many Rich List regulars also are big givers to political candidates and political action committees as well as major fundraisers for individual candidates on both sides of the political aisle.

The top earners list has also attracted the attention of legislators on Capitol Hill. When five hedge fund managers were called in 2008 to testify at hearings before the House Committee on Oversight and Government Reform to discuss the role of hedge funds in the 2008 financial crisis, the individuals all happened to have topped the Rich List the prior year, having earned more than $1 billion apiece — George Soros, Philip Falcone, Kenneth Griffin, John Paulson and James Simons.

Perhaps most remarkably, hedge fund managers earned these amounts during the hardest period to make money on Wall Street in several generations — from 2001 through 2011 — when the Dow Industrials rose a total of just 13 percent, the Nasdaq Composite climbed a mere 7 percent and the Standard & Poor’s 500 lost nearly 5 percent. In three of the 11 years, the average hedge fund lost money, according to Hedge Fund Research.

After all, the era saw two recessions (including a major financial crisis), the biggest terrorist attacks on U.S. territory, two wars, the rise of the Chinese economy and the near-collapse of the Euro.

Yet through it all several managers displayed remarkable consistency. Although Renaissance Technologies’ James Simons was the only one to qualify for the list all 11 years, three others — SAC Capital’s Steven Cohen, Citadel’s Kenneth Griffin and Millennium Management’s Israel Englander — qualified ten times.

The decade has also seen the birth of new stars, like John Paulson, who after toiling in virtual obscurity for more than a decade earned $3.7 billion in 2007 betting against the subprime housing market. Although huge losses last year prevented him from qualifying for the Rich List, he is likely to return to the ranking in the future.

At the same time, several other managers experienced meteoric rises and falls. For example, Atticus Capital’s Timothy Barakett, the former Harvard hockey star who from 2005 through 2007 made about $1.6 billion, closed down his firm in 2009 after his main fund, Atticus Global lost 27 percent the prior year and investors tripped over one another heading for the exits. His one-time European whiz, David Slager, who made nearly $1 billion from 2005 through 2007, earlier this year closed down his small firm, Attara Capital, which had trouble raising capital. And Harbinger Capital’s Phil Falcone, who gained widespread notoriety in 2007 when he made $1.7 billion shorting the troubled housing market, has seen his assets under management shrink by nearly 80 percent from its high after suffering performance troubles and legal inquiries into various activities.

Now the question is whether the eight newcomers to the ranking will build their own multibillion-dollar fortunes or flame out in a year or two.