The U.S. commercial real estate (CRE) sector has regained strength since the 2008–’09 financial crisis, when property prices and related investments had sunk to tremendous depths, and is well on the way toward recovery. Values for institutional-quality properties are up roughly 70 percent from their 2009 trough. In fact, they are 5 to 10 percent higher than their peak in 2007 (see chart 1).

Going forward, although further broad-based gains in CRE values will be more limited, we believe several factors point to a sustained and prolonged recovery. These include low supply growth, pent-up household formation demand, availability of capital across a variety of sources and strong demand from sovereign wealth funds and foreign investors. Additionally, whereas rising real interest rates are a potential headwind for CRE capitalization rates and values, any sustained rise in rates would likely be accompanied by an improving U.S. economy, which in turn could create incremental demand and rent growth for well-located properties over the long term.

Not all real estate is created equal, however. Investors with bottom-up fundamental research capabilities and industry knowledge can target subsectors that are likely to show superior long-term performance.

Bonds issued by real estate investment trusts are vehicles for credit investors to go into commercial property or its specific subsectors. REITs are unique within the corporate sector because calculating nearly real-time values for a company’s assets and liabilities is achievable with a reasonable amount of certainty; this is because of highly detailed disclosure best practices — in some cases down to the individual property level — as well as a generally active transaction market that provides reliable sales comparisons. Accordingly, performing reliable stress tests on REIT portfolios gives credit investors a valuable framework in assessing credit risk and the ultimate ability of a REIT to make timely payments of interest and principal at maturity.

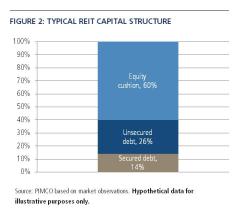

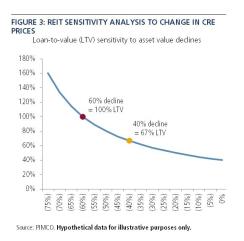

In the average REIT capital structure (see chart 2), CRE asset values would have to fall by more than 60 percent before the value of a REIT’s unsecured debt exceeds the value of its assets and recovery on the debt drops below par (see chart 3). To put this in context, institutional-quality real estate values fell by 40 percent from peak to trough during what was possibly the most severe financial crisis of the past few decades.

Accordingly, we believe REIT unsecured bonds can provide a significant cushion of equity to weather any downturn in the present cycle. Additionally, our research suggests nearly all the outstanding REIT unsecured bonds contain meaningful debt covenants, which help protect REIT investors from overleveraged balance sheets.

Specific covenants come in several forms. For example:

• Total debt to assets < 60 percent

• Secured debt to assets < 40 percent

• Interest coverage ratio > 1.5x

• Unencumbered assets to unsecured debt > 150 percent.

In our view, there are other positive attributes that make the probability of default low and, in the event of default, make REIT unsecured debt recovery value high. They include:

• Ownership of high-quality assets that have a much broader buyer base than lower-quality assets

• Effective cross-collateralization of those assets

• Ability to issue subordinate equity and preferred equity, as well as to sell or encumber assets in order to raise cash if needed

• Recent laddering and terming-out of debt maturity schedules.

In the more than two decades of the modern era of REITs, there has been only one default; in that case, the bonds did not have the standard REIT covenants, and ultimately there was complete recovery.

Whereas this strong track record lends support to REIT investing, we are always mindful of the cyclical nature of commercial real estate. PIMCO views the following subsectors as the most attractive over the long term and better able to withstand downturns. All of these sectors share the same themes, including high-barrier-to-entry geographic footprints, below-average capital expenditure requirements and solid generation of cash flow.

High-barrier apartments. Since the financial crisis, household formation growth has been well below the long-term average. In the present environment, we believe, the apartment rental market and the single-family housing market can coexist comfortably. Although the single-family housing market should continue to improve and home prices should continue to rise modestly on a national basis, we think demand for apartments will remain solid due to pent-up household formations and demand and a growing younger cohort that is now more averse to homeownership because of high student-debt levels, lack of down payments, strict mortgage underwriting standards and the desire for job mobility. Additionally, many of the jobs created in today’s economy are in areas in which single-family housing is unaffordable for the average person, making renting the only option.

Self-storage. The self-storage sector has a track record of posting consistent net operating income growth during periods of economic strength and weakness, thanks to demand created by life changes such as marriage, divorce and relocation. Self-storage also features barriers to new supply, given “not in my backyard” politics and limited availability of attractive sites near population centers. But most important, owning and operating self-storage facilities require very low capex, which generates significant and consistent cash flow.

High-productivity malls and outlets. As e-commerce retail sales continue to take market share from traditional retail sales, there is still a high threat to anchor box stores. Whereas replacing underperforming anchor boxes with other, presumably better-performing tenants could be a positive for lower-productivity malls over the long term — assuming the rest of the mall is still viable — store closures hurt near- to intermediate-term results. Power shopping centers — those anchored by stores like Best Buy, Bed Bath & Beyond, Barnes & Noble, OfficeMax and Staples — are more sensitive to the rise of e-commerce than are centers anchored by grocery chains because most products sold in power centers can be ordered online and shipped the same day. Winners in the shift toward e-commerce will likely be REITs that own well-located industrial and logistics facilities, as well as REITs that own retail centers in centralized locations that can act as showrooms, store pickup locations and distribution hubs.

Hotel C corporations. Hotel C corps such as Starwood, Marriott and Hilton have all shifted toward an asset-light operating model, in which an increasing percentage of ebitda (earnings before interest, taxes, depreciation and amortization) is generated from highly scalable management and franchise fees, which require very limited capex. Although hotel demand is still highly sensitive given daily leases, these companies generate significant free cash flow and carry very low levels of debt.

High-barrier office. New supply risk is more limited in high-barrier-to-entry markets such as New York and San Francisco, because of land constraints and lengthy permit processes. Additionally, demand from foreign investors for iconic buildings in marquee cities has been strong and focused on long-term capital appreciation and storing wealth outside of their home countries. This strong foreign bid may be somewhat more vulnerable to a rise in global real rates, however, given the more limited cushion between cap rates and interest rates on these assets.

We tend to avoid the following subsectors, as they generally do not possess favorable long-term investment dynamics:

Suburban office centers face significant supply risk. Re-leasing vacant space is extremely difficult and costly. Additionally, the allotment of work space per employee is a long-term secular risk that affects overall demand for office space.

Data centers have decent short-term demand, but long-term capex is high because of the risk of obsolescence, and new supply is looming in select markets.

Low-barrier industrial warehouses face both new supply and the risk of obsolescence. These types of assets also have a track record of generating below-average rent growth.

Hotel REITs are, for the time being, in the sweet spot of a multiyear recovery, but owning and maintaining physical hotel assets over the long term makes hotel REITs one of the most capital-intensive sectors because of daily turnover and what’s needed to maintain a brand. Long-term capital expenditures are typically two to three times the level of other property sectors.

Low-barrier strip malls face the highest long-term threat from the rise of e-commerce.

The outlook for REIT credit remains encouraging, specifically in companies with above-average exposure to high-quality assets in high-barrier-to-entry markets, relatively low capex requirements and management teams with records of solid capital allocation and healthy balance sheets. Firms that meet these criteria are likely to see a solid cash flow and sustain capital in the long term.

Ray Huang is a vice president and credit analyst at PIMCO’s Newport Beach headquarters, focusing on REITs and hotel companies.

Amit Arora is a senior vice president at PIMCO’s Newport Beach headquarters and a portfolio manager on the global corporate bond team.

See PIMCO’s disclaimer.