In the 1997 film Tomorrow Never Dies, James Bond drives a modified silver BMW that he controls from the backseat with a mobile phone during a parking lot chase sequence. The vehicle also has special tires: In the event of a puncture, they simply reinflate.

It may be a while before consumers get to enjoy some of the features in Bond’s supercar. Investors, however, can benefit from opportunities brought by technological advances today, long before they can hop into driverless cars.

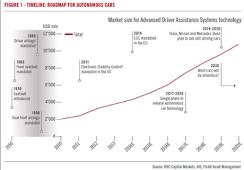

Growing concerns over road safety and security — among the public, governments and regulators — are helping speed technological advances in the auto sector and accelerate the development of driverless cars. The market for advanced auto security equipment is unlikely to remain a niche sector for long: It is expected to grow threefold, to $10 billion, by the end of this decade and become a rich hunting ground for investors.

Innovation has been a constant theme in transportation. Carmakers such as Mercedes-Benz and Volvo are already testing fully autonomous vehicles on public roads, whereas Google has unveiled a new prototype of its driverless car that has no steering wheel, mirrors or pedals.

Click image to enlarge.

Investments in innovation in the automobile industry have seen rapid technological advancements in the past few years. So far, the progress has been most evident in the so-called nice-to-have areas: a built-in tablet computer, Wi-Fi access and state-of-the-art music and sound systems. These are indeed the areas from which companies are already reaping rewards and generating revenue. They are, however, in contrast to need-to-have vehicle safety technology, which has made little progress since the introduction of seat belts and air bags decades ago.

The balance may be about to change, however. The growing desire to improve safety will speed up the development of vehicle technology over the coming decade. One of the promising areas of growth is active safety technology, or what the industry calls Advanced Driver Assistance Systems. ADAS technology, a market that is already worth $3.8 billion, is designed to help drivers avoid accidents, as opposed to passive safety elements such as seat belts and air bags, which simply reduce the effect of accidents. Cars fitted with ADAS are already available in the new generation of high-end vehicles that are coming onto the market. In October Tesla Motors unveiled a self-driving feature that can adjust a vehicle’s speed automatically after reading the limit shown on road signs. The new Mercedes S-Class includes a traffic jam assist, which allows the car to follow the one in front of it automatically at low speeds.

From an investment perspective, companies operating in this industry make for interesting opportunities. The wider automated and assisted driving technology is forecast to be worth roughly $25 billion by 2020 and $57 billion by 2025, compared with $6 billion today — a compound annual growth rate of 26 percent in the six years to 2020 and 17 percent during the following decade.

Another key driver of the market’s growth is regulation. For example, car manufacturers need to adopt one or more active safety systems on each vehicle model to receive a five-star rating from Europe’s New Car Assessment Programme (NCAP), an independent safety-scoring agency representing seven European governments. In 2014 Euro NCAP doubled the active safety weighting within its scorecard, to 20 percent. By 2017 the scoring system will become even more stringent: Active safety technology will become a default requirement for a four-star rating. In the U.S. the umbrella of the global NCAP will give vehicles augmented scores if they have lane-keeping assistance. Japan’s NCAP may award extra points to cars with lane-keeping assistance and night vision. Similar efforts are gathering pace in the developing world and will inevitably lead to even greater investment in engineering those systems.

Another plus for investors is that suppliers of ADAS technology are also in the midst of an industry consolidation. Privately held German car parts maker ZF Friedrichshafen agreed in September to acquire TRW Automotive Holdings Corp., a U.S. manufacturer of video cameras and radar systems, for $13.5 billion. In the same month, Japan’s Panasonic Corp. ?agreed to buy a 49 percent stake in Ficosa International, a family-owned Spanish car parts manufacturer, in a deal estimated to be as much as $275 million.

Another developing trend that goes hand in hand with demand for better safety is the increasing need for connectivity. Having a connected car does not just mean being able to send e-mail from your vehicle or search online for nearby restaurants. Such technology can also help drivers reroute to avoid congestion, or fix faults remotely over the Internet via a software upgrade. New York–based consulting firm McKinsey & Co. expects that the number of networked cars will rise 30 percent annually for the next several years. It also estimates that more than 20 percent of cars will be connected to the Internet by 2020, compared with 8 percent at present.

On this side too, it is the need-to-have technology — rather than the nice-to-have — that offers the most promising prospects for growth and opportunities for investors.

Yves Kramer is a fund manager at Pictet Security Fund at private bank Pictet & Cie in Geneva.

Get more on trading and technology.