Investors, economists and financial market participants like indicators they can quantify: inflation, growth, earnings, unemployment and so on. But often the most important factors in future development are unquantifiable and unpredictable. Technology is at the top of that list.

Much of the growth in corporate earnings and economic output since the Industrial Revolution can be explained by advances in technology and knowledge. Humans have streamlined the process of converting scientific knowledge into commercial enterprises that improve the human condition. This development has led to the greatest era of human prosperity in recorded history. Many economists consider technology and knowledge collectively as the fourth factor of production, after land, labor and capital.

The growth and development in emerging markets can largely be explained by the diffusion of technological know-how from the West to the rest. There are tangible examples of the economic power of technological advancement and distribution throughout the emerging world, from the spread of mobile telephones in Africa to the development of innovation hubs in China and to the creation of a deep service and technology economy in India.

It is clear that technological progress has a highly disruptive impact on economy and society, which shouldn’t be surprising. From the use of Twitter to gather support for protests in Ukraine and throughout the Middle East to outsourcing jobs to robots, the spread of technology is affecting how companies evolve and how countries manage their international standing.

Many investors and those in the financial press have viewed the impact of technology through the sector itself. Much of the focus has been on where technology companies are in their innovation cycle and the anticipated profitability of advances. Such speculation has only been further encouraged by the spread of social media and lofty valuations of the sector’s top companies. The news of WhatsApp selling for $19 billion gets a lot more attention than, for example, the development of new nanotechnology, which involves engineering matter at the molecular, atomic or subatomic level.

To frame this conversation in terms of investing, I see five key dynamics of technology in the global economy around which portfolio managers need to develop their thinking not only to ensure they participate in the next wave of wealth creation but also to protect capital loss from sectors and regions that will not be able to take advantage of the technology.

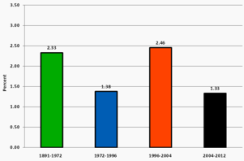

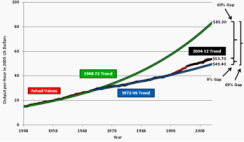

First, we must better understand the interaction between technological advances and productivity. Despite significant improvements in technology, productivity growth in the U.S. has been below its historical levels over the past ten years. Many economists — such as Northwestern University’s Robert Gordon — use this observation as a potential indicator for a long period of economic stagnation going forward. As charts 1 and 2 show, a slowdown in U.S. productivity growth has had significant impact on GDP per capita during the past 50 years. Why is productivity, as defined by dollar output per hour worked in the U.S., slowing down? This is a debate often heard in academia among economists such as Gordon, Paul Krugman, Larry Summers and Tyler Cowen.

Source: Robert Gordon

Source: Robert Gordon

Second, investors should spend more time thinking about why some countries and companies adopt certain technologies faster than others. The work of academics such as Diego Comin, a professor at Harvard Business School (presently on leave), is very instructive. He has analyzed some of the key factors to technological adaptation and has created maps illustrating the progress of technology diffusion. Investors should consider how this variable affects their asset allocation between countries and sectors.

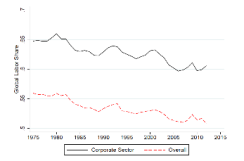

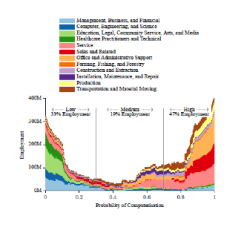

Third, investors need to better understand the capital-labor substitution dynamics that are at work around the world. Though some may dismiss this point as the rantings of some sort of 21st century Luddite, globalization, coupled with labor-replacing technologies in manufacturing and services, is poised to make finding jobs much harder for much of the world’s population going forward. Some scholars predict that in the next two decades, as many as 47 percent of U.S. jobs could be automated. On a similar note, it has been well documented that labor’s share of global growth has been declining as the return on capital exceeds the return on labor. In addition to the social and human impact of this dynamic, investors may need to reexamine what indicators they use to understand the health of an economy. Does unemployment illustrate the health of an economy? Does government spending need to increase as the demands of social safety nets around the world increase?

Source: Loukas Karabarbounis and Brent Neiman. "The Global Decline in Market Share."

Source: Carl Frey and Michael Osborne. "The Future of Employment: How Susceptible Are Jobs to Computerization."

Fourth, investors need to think about the transition costs to be passed on to companies and countries during some of these disruptions. The McKinsey Global Institute, the business and economics research arm of New York–headquartered consultancy firm McKinsey & Co., forecasts that disruptive technologies could have a $33 trillion impact on the global economy by 2025. What are the trade-offs of these developments, and how do investors protect themselves from any losses from creative destruction? For example, how will the world transform into a low-carbon energy system? The spread of solar, wind, nuclear and other forms of alternative energies will impact the growth of resource-rich countries, as well as major oil and gas businesses. In the short term, what are the transition costs for banks and retailers as more and more global consumption moves online, and who benefits?

The fifth and final point addresses the financial community, which will need to wrap its mind around the use and misuse of data and the oft-discussed concept of big data in particular. As British travel writer and essayist Pico Iyer recently recounted in the New York Times, humanity now produces as much data in two days as it did in all of history until 2003. The amount of data is doubling every two years. As a quantitative industry — dealing with numbers and data — investment professionals will need to develop a responsible and thoughtful approach to data and its explanatory power on the future.

Needless to say, the questions of technology’s impact on markets, businesses, economies and societies have very few known answers at this point. But investors who want to participate in the next era of wealth creation would be well advised to understand these dynamics and make sure their portfolios are positioned as thoughtfully as possible.

Aniket Shah is an investment specialist with the Investec Investment Institute, part of Investec Asset Management.

See Investec's legal disclaimer.

Get more on trading and technology.